A Los Angeles California Tax Sharing Agreement is a formal agreement between different jurisdictions within the county of Los Angeles, California, that outlines how tax revenue should be shared among them. It is designed to ensure a fair and equitable distribution of tax proceeds, fostering cooperation and coordination among various local government entities. These agreements are particularly important within Los Angeles County, which is home to numerous cities, towns, and unincorporated areas, each with its own local government and tax-generating activities. The main purpose of tax-sharing agreements is to prevent competition and disputes over tax revenue and to promote collaboration for the overall economic growth and well-being of the county. The Los Angeles California Tax Sharing Agreement typically covers various types of taxes, including sales tax, property tax, business tax, and transient occupancy tax (also known as hotel tax). The specific provisions and formulas for sharing tax revenue vary depending on the type of agreement and the participating jurisdictions. One type of Tax Sharing Agreement in Los Angeles County is the Sales Tax Sharing Agreement. This agreement establishes how sales tax revenue generated within a certain area should be shared among the various cities and unincorporated areas in the county. The revenue sharing formula may be based on factors such as population, retail sales volume, or a combination of both. Another type of agreement is the Property Tax Sharing Agreement. Property tax is a significant revenue source for local governments, and this agreement defines how the property tax revenue collected from a particular area should be distributed among the jurisdictions within Los Angeles County. The distribution may take into consideration factors such as assessed property values, property classifications, or other agreed-upon criteria. Additionally, Los Angeles California Tax Sharing Agreements may cover specific taxes related to certain industries or activities. For example, a hotel tax sharing agreement may govern how the transient occupancy tax collected from hotels located in different cities or areas should be allocated among them. Overall, Los Angeles California Tax Sharing Agreements provide a framework for cooperation and revenue sharing among the diverse local jurisdictions within the county. By establishing clear guidelines and ensuring fairness in tax distribution, these agreements contribute to the sustainable development and economic prosperity of the entire region.

Los Angeles California Tax Sharing Agreement

Description

How to fill out Los Angeles California Tax Sharing Agreement?

Drafting paperwork for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to create Los Angeles Tax Sharing Agreement without expert help.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Los Angeles Tax Sharing Agreement on your own, using the US Legal Forms web library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Los Angeles Tax Sharing Agreement:

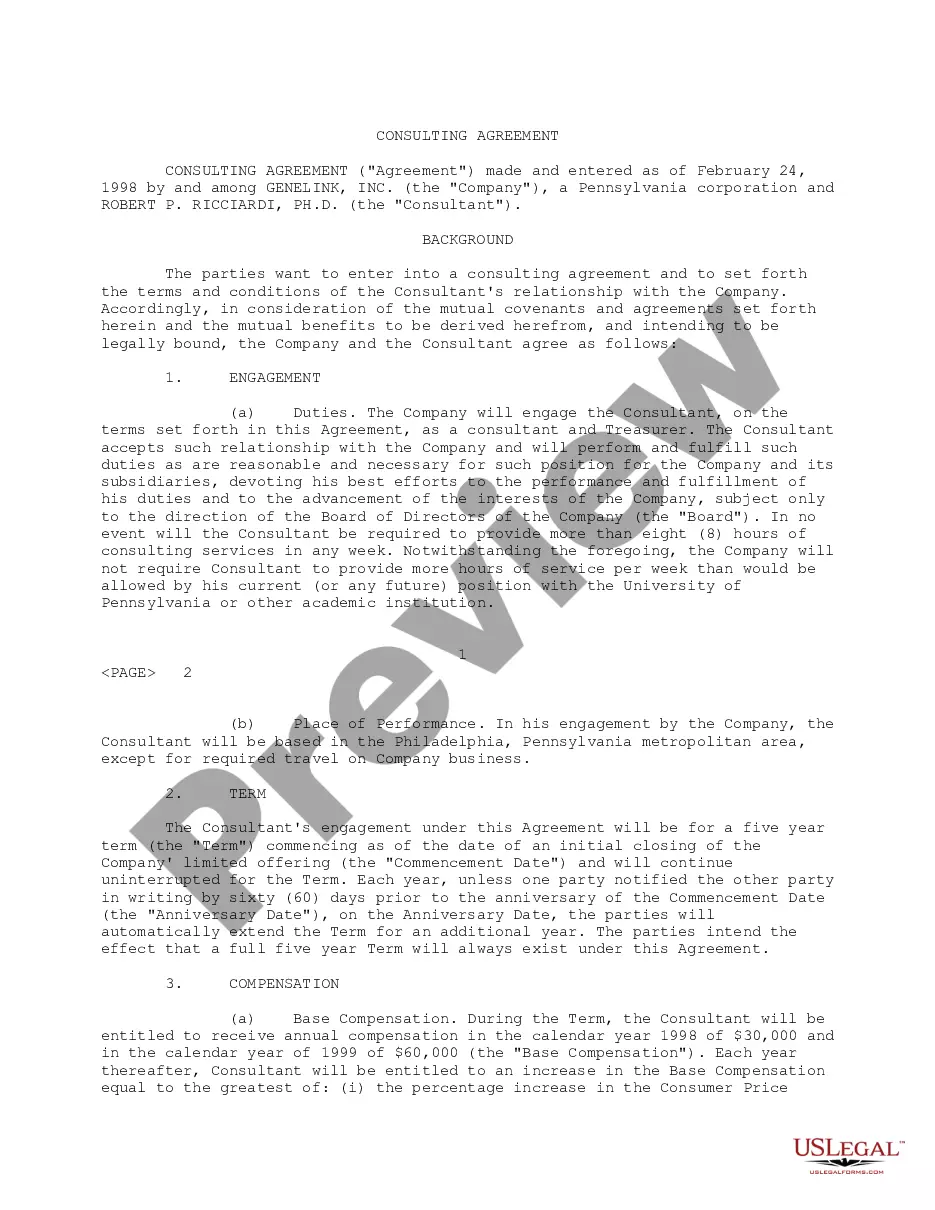

- Examine the page you've opened and check if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any scenario with just a few clicks!