The Oakland Michigan Tax Sharing Agreement is a comprehensive and collaborative approach to regional tax revenue allocation and sharing in Oakland County, Michigan. Under this agreement, different municipalities within the county agree to pool a portion of their local tax revenues for joint projects, public services, and infrastructure developments that benefit the entire region. The purpose of the Oakland Michigan Tax Sharing Agreement is to promote fairness, equity, and economic growth among the participating municipalities. It ensures that resources are allocated more efficiently, preventing unnecessary duplication, and addressing regional challenges effectively. The agreement fosters intergovernmental cooperation, enabling local governments to work together towards common goals and objectives. There are several types of Oakland Michigan Tax Sharing Agreements: 1. Revenue Sharing Agreement: This type of agreement involves municipalities contributing a specified percentage or amount of their local tax revenues to a common pool. The funds from this pool are then distributed among the participating municipalities based on predetermined factors such as population, property values, or the amount of revenue generated. 2. Infrastructure Development Agreement: This agreement focuses on funding and development of regional infrastructure projects, including transportation systems, utility networks, and public facilities. Participating municipalities contribute a portion of their tax revenues towards the construction, maintenance, and improvement of these shared infrastructure assets. 3. Service Sharing Agreement: This type of agreement involves the pooling of tax revenues to fund and provide joint public services. These services may include public safety, emergency response, healthcare facilities, recreational facilities, or educational programs. Participating municipalities contribute a percentage or amount of their local tax revenues to support these essential services. 4. Economic Development Agreement: This agreement aims to promote economic growth and attract business investments to the region. Participating municipalities contribute a portion of their tax revenues to a common fund that is utilized for marketing, business development, infrastructure enhancements, and other initiatives to stimulate economic activity in the area. In summary, the Oakland Michigan Tax Sharing Agreement is a collaborative effort among municipalities in Oakland County to share and allocate tax revenues for the benefit of the entire region. By pooling resources and promoting regional cooperation, this agreement aims to foster economic growth, deliver efficient public services, invest in infrastructure development, and create a more equitable distribution of resources among participating municipalities.

Oakland Michigan Tax Sharing Agreement

Description

How to fill out Oakland Michigan Tax Sharing Agreement?

Preparing paperwork for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Oakland Tax Sharing Agreement without professional assistance.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Oakland Tax Sharing Agreement by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

If you still don't have a subscription, adhere to the step-by-step guide below to get the Oakland Tax Sharing Agreement:

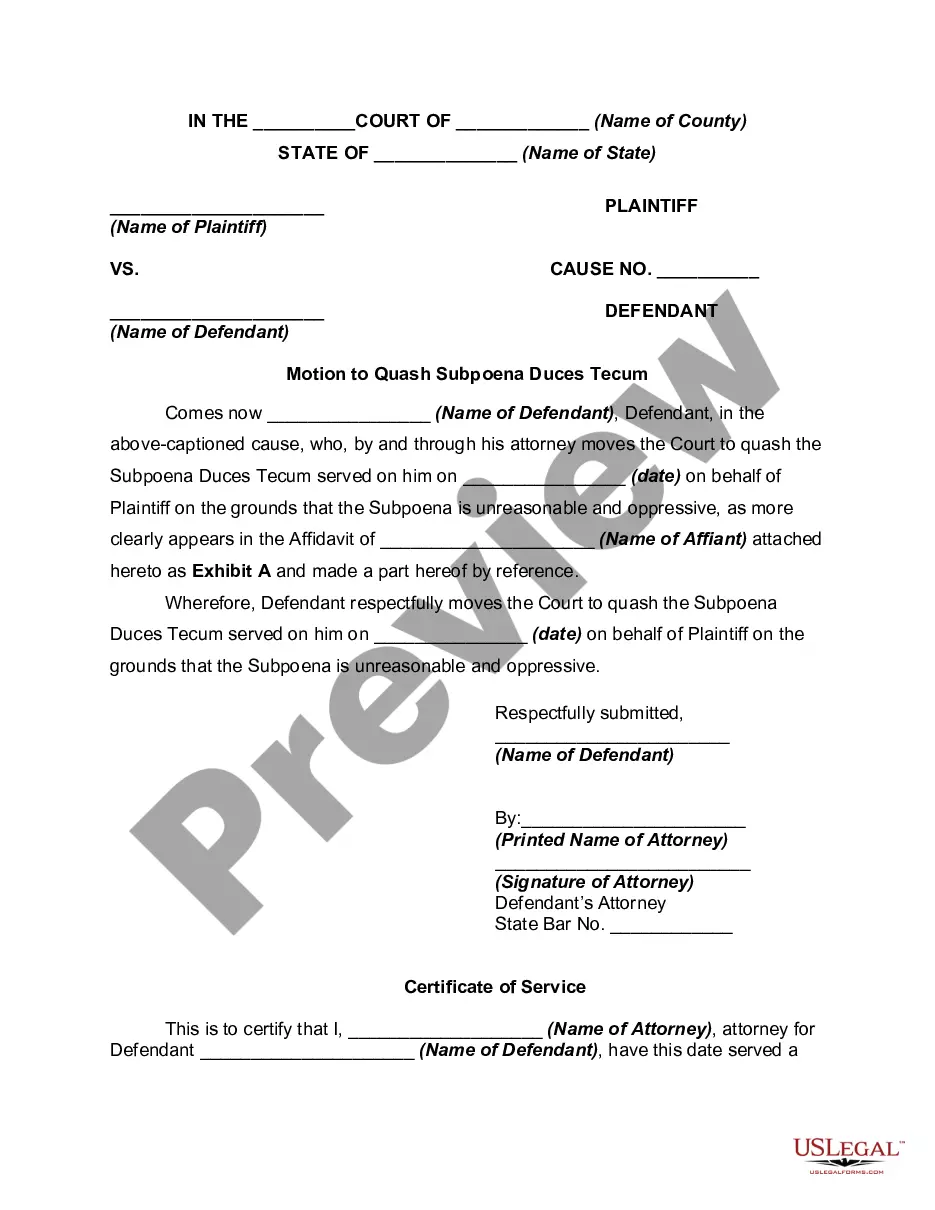

- Look through the page you've opened and verify if it has the sample you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal forms for any situation with just a few clicks!