A San Diego California Tax Sharing Agreement is a legal document that outlines the distribution of tax revenues among different jurisdictions within the San Diego County. It is designed to provide a fair and equitable system for the allocation of tax revenue, ensuring that each jurisdiction receives its proper share based on specific criteria. The main purpose of a Tax Sharing Agreement is to establish a cooperative relationship among different entities, such as cities, towns, and counties, to collectively manage and distribute tax revenues generated within the region. By entering into this agreement, the participating jurisdictions ensure that they can collaboratively address the challenges and opportunities that arise from economic development and taxation. There are different types of San Diego California Tax Sharing Agreements, including: 1. Countywide Tax Sharing Agreement: This type of agreement involves all entities within San Diego County. It establishes a comprehensive framework for revenue sharing, considering factors like population, economic activity, and infrastructure needs. This agreement aims to foster regional cooperation and coordination among the local governments. 2. City-specific Tax Sharing Agreement: This type of agreement applies only to cities within San Diego County. It focuses on revenue sharing between cities, especially in cases where certain cities might have more economic development or higher tax revenue generation. It helps ensure a fair distribution of resources and supports economic growth across the region. 3. Special District Tax Sharing Agreement: In some cases, specific districts within San Diego County might enter into a specialized tax-sharing agreement. These districts can include school districts, water districts, transportation districts, or other governmental bodies responsible for specific services or infrastructure. Such an agreement enables resource pooling and joint planning efforts to meet the needs of the district effectively. Overall, a San Diego California Tax Sharing Agreement provides a framework for revenue allocation and fosters cooperation among jurisdictions. It helps ensure that each participating entity receives its fair share of tax revenue, promoting equitable development and regional growth.

San Diego California Tax Sharing Agreement

Description

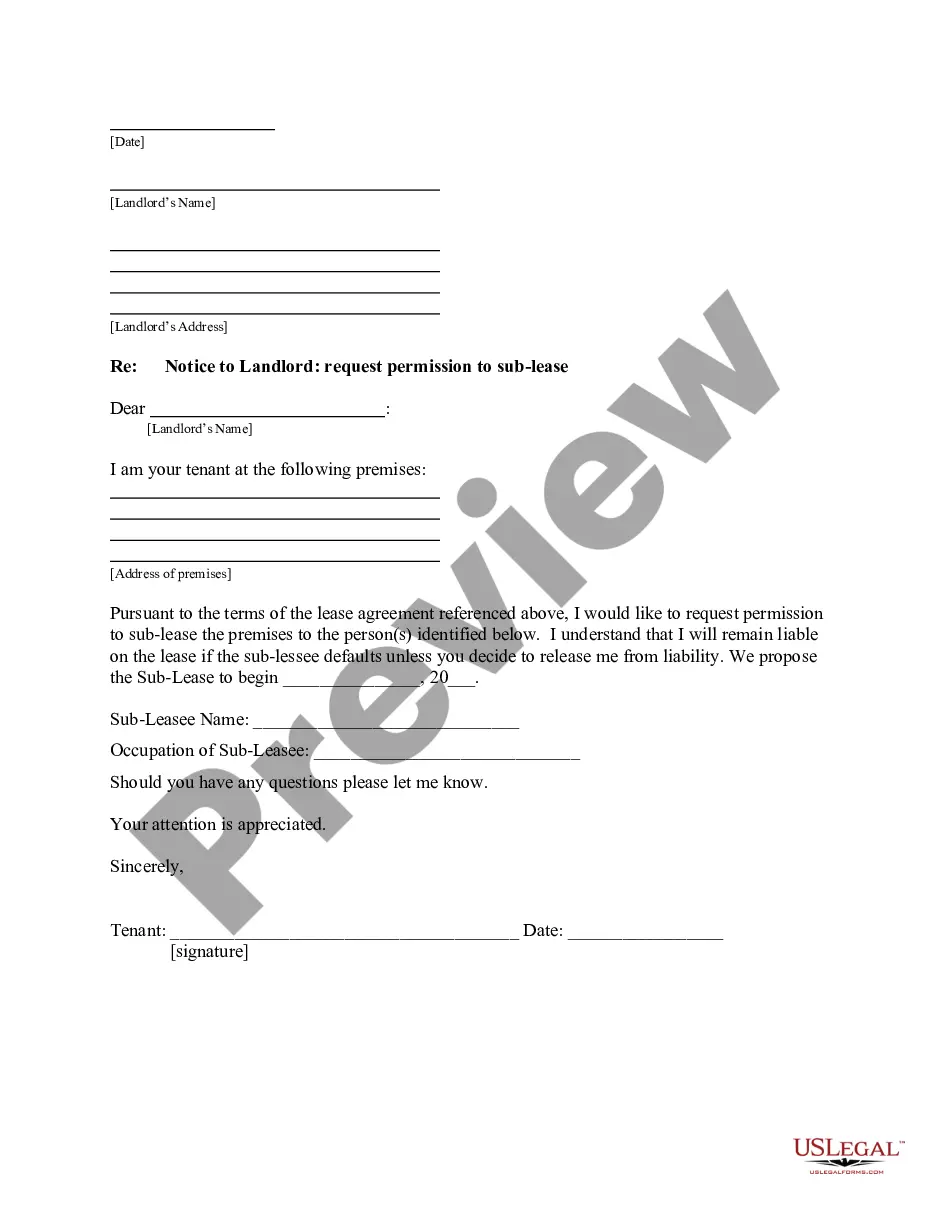

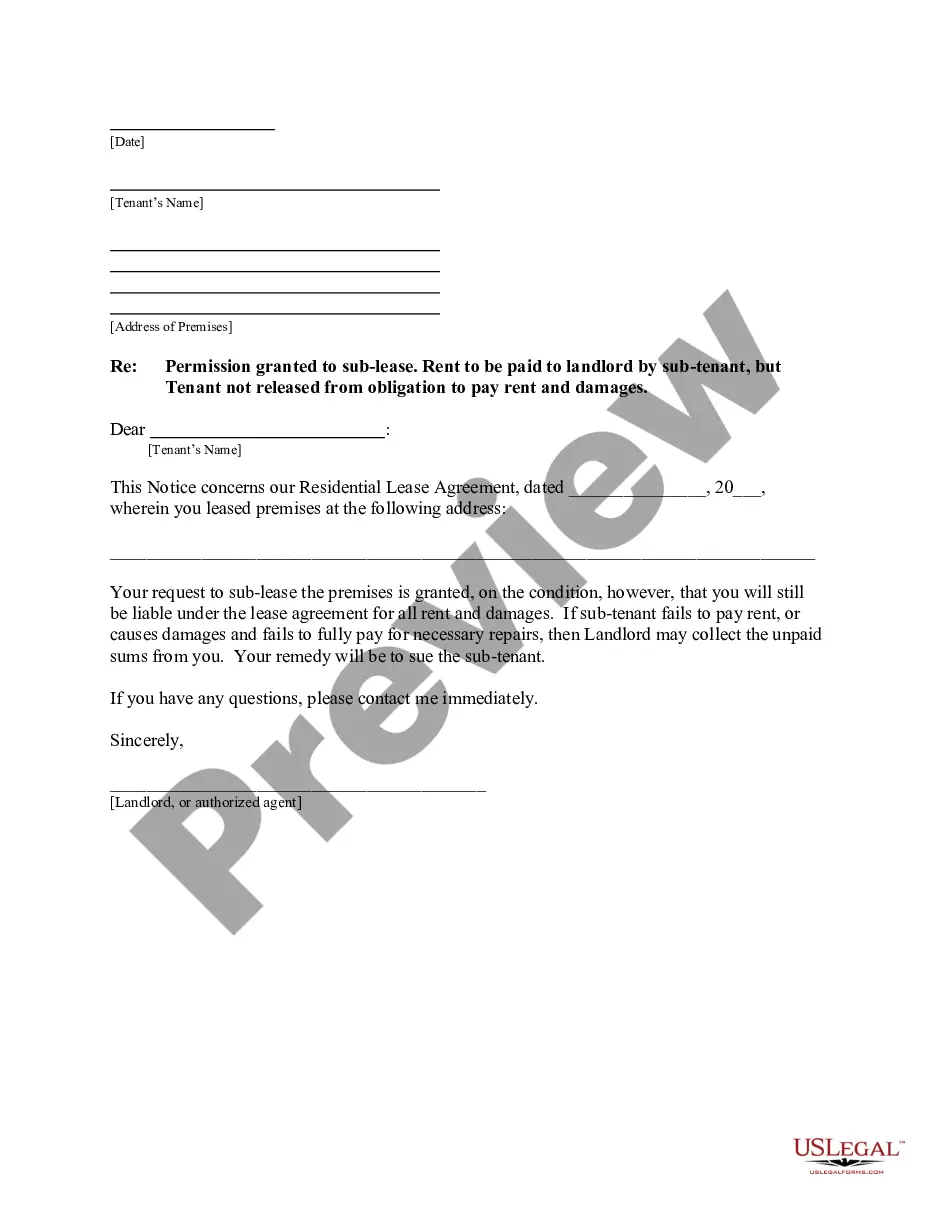

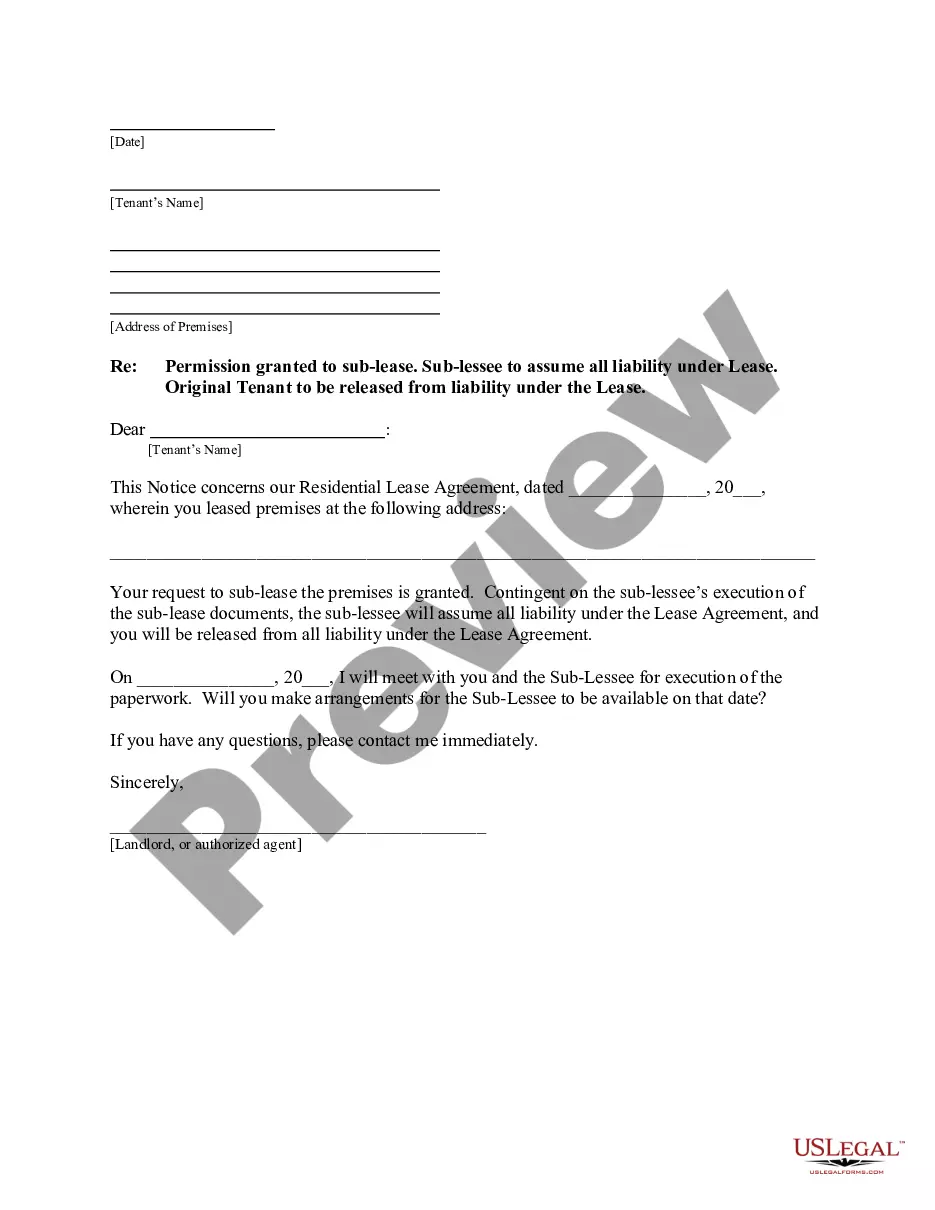

How to fill out San Diego California Tax Sharing Agreement?

Creating paperwork, like San Diego Tax Sharing Agreement, to manage your legal affairs is a difficult and time-consumming process. Many circumstances require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal issues into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents crafted for a variety of cases and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the San Diego Tax Sharing Agreement form. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new customers is just as easy! Here’s what you need to do before downloading San Diego Tax Sharing Agreement:

- Make sure that your form is compliant with your state/county since the regulations for writing legal paperwork may vary from one state another.

- Find out more about the form by previewing it or going through a brief intro. If the San Diego Tax Sharing Agreement isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin using our service and get the document.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment details.

- Your template is all set. You can try and download it.

It’s an easy task to find and buy the appropriate template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!