Suffolk New York Tax Sharing Agreement is a legal agreement between local municipalities and the county of Suffolk, New York, which outlines the distribution and allocation of tax revenue generated within the county. This agreement ensures a fair and equitable distribution of tax revenue among the various towns, villages, and cities within Suffolk County. The main purpose of the Suffolk New York Tax Sharing Agreement is to create a system where municipalities can benefit from the tax revenue generated by certain taxable activities within their jurisdiction. Through this agreement, the revenue generated from property taxes, sales taxes, and other taxable sources is shared among the different local governments in Suffolk County. There are different types of tax sharing agreements in Suffolk County, including: 1. Property Tax Sharing Agreement: This type of agreement determines the distribution of revenue generated from property taxes within the county. It outlines the percentage of property tax revenue that each municipality will receive based on factors such as the assessed property values and the specific needs of each municipality. 2. Sales Tax Sharing Agreement: This agreement governs the distribution of revenue generated from sales taxes collected within Suffolk County. It determines the percentage of sales tax revenue that each municipality will receive, considering factors such as population, economic activity, and the provision of municipal services. 3. Hotel/Motel Tax Sharing Agreement: This agreement involves the distribution of revenue generated from hotel and motel taxes within the county. It outlines the share of these tax revenues that will be allocated to each municipality, taking into account factors such as the number of hotels/motels, tourism activity, and the infrastructure demands created by tourism. 4. Business Tax Sharing Agreement: This type of agreement deals with the distribution of revenue generated from business-related taxes, such as commercial property taxes and business-related fees. It ensures that the municipalities hosting businesses receive a fair portion of the tax revenue generated by these entities. The specific terms and conditions of the Suffolk New York Tax Sharing Agreement may vary depending on the unique circumstances and needs of the municipalities involved. These agreements aim to foster cooperation and collaboration among local governments by providing them with a fair share of the tax revenue generated within Suffolk County, ultimately promoting the region's overall economic growth and development.

Suffolk New York Tax Sharing Agreement

Description

How to fill out Suffolk New York Tax Sharing Agreement?

Drafting paperwork for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create Suffolk Tax Sharing Agreement without expert help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Suffolk Tax Sharing Agreement on your own, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to save the needed form.

In case you still don't have a subscription, follow the step-by-step guide below to get the Suffolk Tax Sharing Agreement:

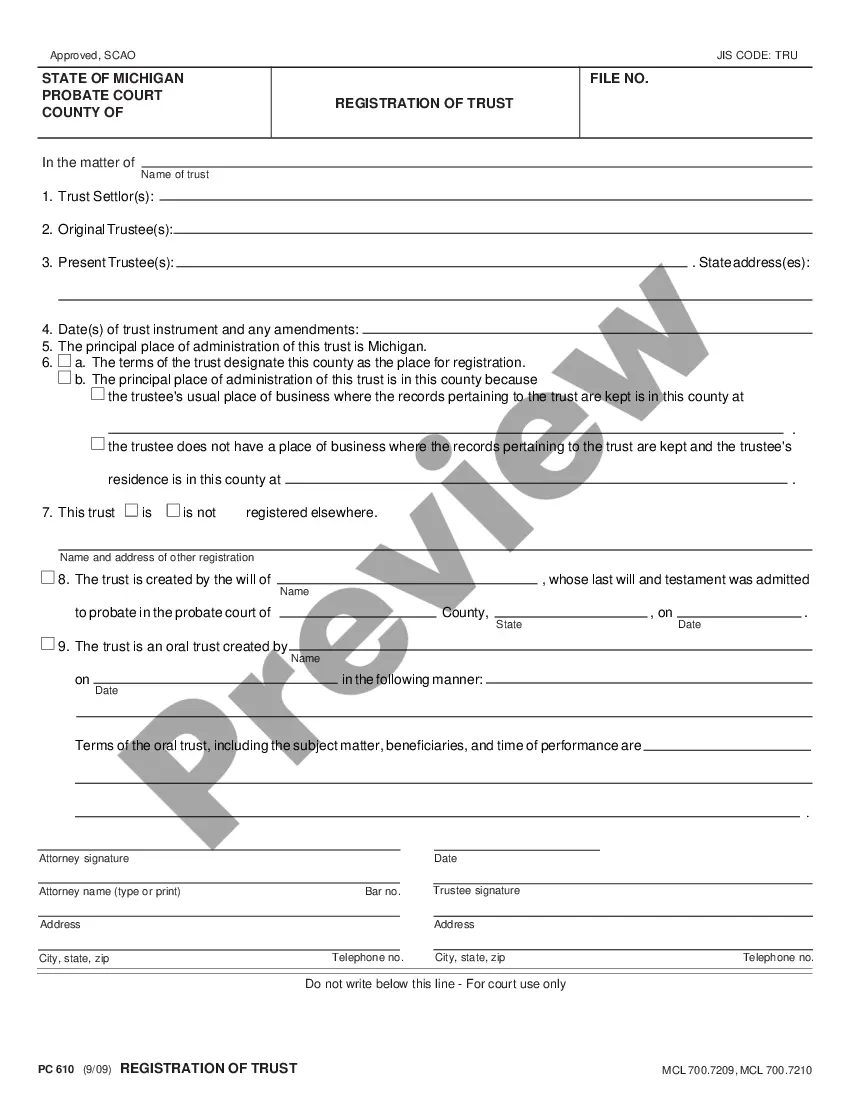

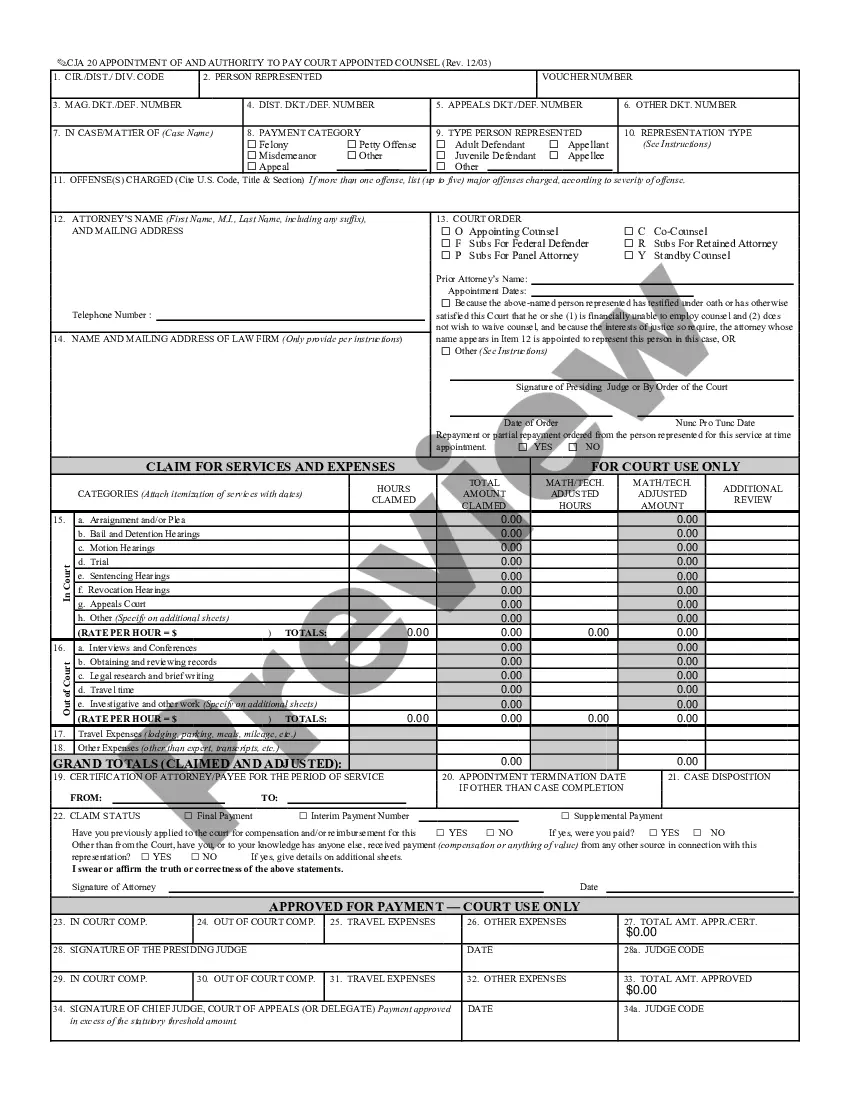

- Look through the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, use the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any situation with just a few clicks!

Form popularity

FAQ

It is used to describe the instances when one member of the related group can expect to owe or to receive economic consequences for its tax items that are generated and used in consolidated or combined returns.

If the parent corporation submits an unsigned Form 1122, it must retain the original, signed form in its records.

The allocation of a charge to tax between different sources of income.

Allocation and Distribution of Tax Refunds In order to ensure that members receive compensation for the use of their attributes, a tax allocation agreement should specify how tax refunds are allocated and distributed among group members.

Counties in the metropolitan commuter transportation district (MCTD) also collect a sales tax of 0.375%. This applies to all taxable sales within the counties of Bronx, Kings (Brooklyn), New York (Manhattan), Queens, Richmond (Staten Island), Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, Westchester.

Tax Sharing Arrangement means any written or unwritten agreement or arrangement for the allocation or payment of Tax liabilities or payment for Tax benefits with respect to a consolidated, combined or unitary Tax Return which includes the Company.

Although a tax sharing agreement is not required by law, Treasury Regulation Section 1.1552-1 does require that the tax liability of the consolidated group be allocated among the consolidated group members to determine the earnings and profits (E&P) of each member. A group member's allocated taxes reduce its E&P.

You can file sales tax returns and make your payment electronically by creating a Business Online Services account. Simply create your account, report your tax information online, and make a payment directly from your bank account. Most vendors are required to use Sales Tax Web File.

A tax sharing agreement (TSA) is a contract created to clarify the economic expectations among members of a related group of corporations included in consolidated or combined reporting tax returns.

Key Takeaways. Comprehensive tax allocation is an analysis that companies use to identify discrepancies between their accounting for business purposes and their accounting for tax purposes. Most of the discrepancies result from differences between the periods used for financial reporting and tax filing.