Franklin Ohio Stock Option Grants and Exercises and Fiscal Year-End Values are financial instruments and processes that play a crucial role in stock compensation plans for employees in the city of Franklin, Ohio. These grants and exercises, along with fiscal year-end values, are key components in determining the worth and benefit of stock options for both employers and employees. Stock option grants in Franklin, Ohio refer to the specific number of shares of company stock given to an employee as part of their overall compensation package. These grants are typically subject to certain conditions and vesting schedules, which determine when the employee can exercise the options and acquire the stock. Stock options can serve as a valuable tool to attract and retain talented employees, align their interests with the company's performance, and provide them with potential financial rewards. Exercising stock options in Franklin, Ohio occurs when an employee decides to convert their stock options into actual shares of company stock. This process usually entails a purchase of the shares at a predetermined exercise price, which is typically lower than the current market price of the stock. By exercising the options, employees become shareholders and may benefit from any future increase in the company's stock price. Fiscal year-end values associated with Franklin Ohio Stock Option Grants and Exercises refer to the determination of the worth of stock options at the end of a fiscal year. This valuation is essential for financial reporting purposes and assists in evaluating the overall financial health of the company. Accurate fiscal year-end values enable companies to disclose the value of stock options granted to employees, potential dilution effects on existing shareholders, and the impact of stock-based compensation on the company's financial statements. Different types of Franklin Ohio Stock Option Grants may include: 1. Incentive Stock Option (ISO): This type of stock option grant meets specific criteria outlined by the Internal Revenue Service (IRS). SOS offer tax advantages to employees by potentially qualifying for favorable long-term capital gains tax treatment upon their sale. 2. Non-Qualified Stock Option (NO): Nests do not meet the criteria set by the IRS for favorable tax treatment. These options are more flexible in terms of plan design and vesting schedules, but they typically result in ordinary income tax for employees upon exercise. 3. Restricted Stock Units (RSS): Although not precisely stock options, RSS are often considered in the same category. RSS represents a promise to deliver company stock at a future date, subject to vesting conditions. RSS are gaining popularity as they align employee incentives with company performance while reducing the complexity associated with traditional stock options. In conclusion, Franklin Ohio Stock Option Grants and Exercises, along with their fiscal year-end values, are critical aspects of stock compensation plans in the city. Understanding the different types of stock option grants and their associated exercises is crucial for employers and employees alike in managing and assessing the potential financial benefits and impact on their overall compensation.

Franklin Ohio Stock Option Grants and Exercises and Fiscal Year-End Values

Description

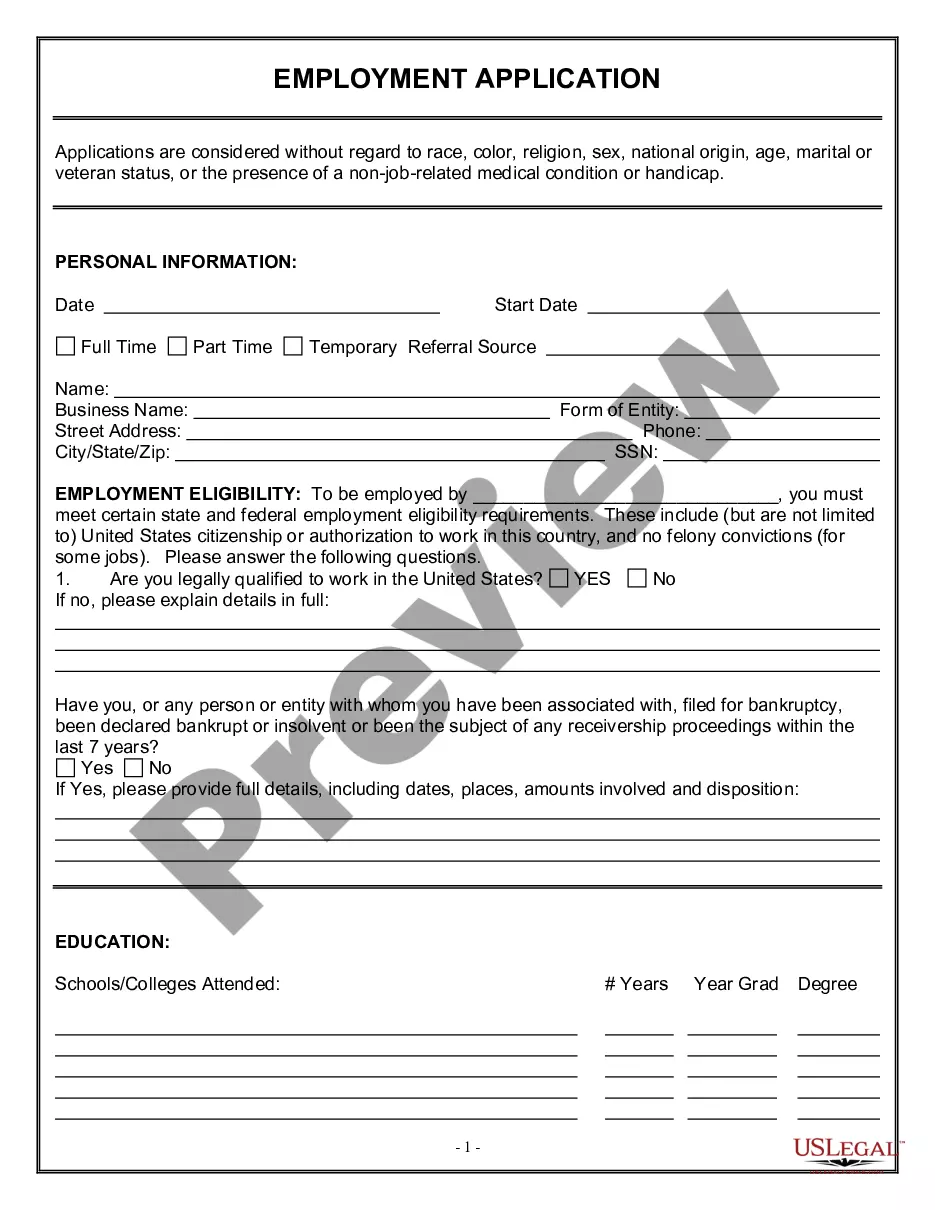

How to fill out Franklin Ohio Stock Option Grants And Exercises And Fiscal Year-End Values?

If you need to get a reliable legal form provider to find the Franklin Stock Option Grants and Exercises and Fiscal Year-End Values, consider US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, number of learning materials, and dedicated support make it easy to locate and complete various documents.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

You can simply select to search or browse Franklin Stock Option Grants and Exercises and Fiscal Year-End Values, either by a keyword or by the state/county the form is intended for. After locating required template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Franklin Stock Option Grants and Exercises and Fiscal Year-End Values template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Register an account and choose a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes this experience less costly and more reasonably priced. Set up your first company, organize your advance care planning, draft a real estate agreement, or execute the Franklin Stock Option Grants and Exercises and Fiscal Year-End Values - all from the comfort of your sofa.

Sign up for US Legal Forms now!