Middlesex Massachusetts Stock Option Grants and Exercises and Fiscal Year-End Values refer to the specific mechanisms through which individuals in Middlesex County, Massachusetts can receive stock option grants and exercise their stock options, as well as the determination of the fiscal year-end values associated with these activities. Stock option grants are provided by companies as a form of compensation to employees, allowing them to purchase company stock at a predetermined price, known as the exercise price or strike price, within a specified time frame. This provides employees with an opportunity to become partial owners of the company and benefit from potential future stock price appreciation. The process of exercising stock options involves the employees purchasing the designated number of shares from the company at the predetermined exercise price. This action is typically facilitated through a brokerage account or an employer stock plan. Upon exercise, employees can choose to hold the shares or sell them on the open market. Fiscal year-end values, on the other hand, represent the valuation of the company's stock options and the associated financial impact on the employees during the fiscal year-end reporting period. These values are important for various financial purposes, such as determining the company's overall performance, calculating employee compensation and taxation, and assessing the value of stock option programs. In Middlesex Massachusetts, there may be different types of stock option grants and exercises, including: 1. Nonqualified Stock Options (SOS): These stock options do not qualify for special tax treatment and are often granted to employees at a lower exercise price. 2. Incentive Stock Options (SOS): SOS are granted with certain tax advantages, allowing employees to potentially receive preferential tax treatment upon exercise and sale of the shares. 3. Restricted Stock Units (RSS): RSS are a type of stock-based compensation where employees receive company shares once certain vesting conditions are met. RSS are not technically options, but they are often considered alongside stock option programs. 4. Cashless Exercise: A stock option exercise method that allows employees to exercise their options without using personal funds by simultaneously selling enough shares to cover the exercise cost and any associated taxes. These Middlesex Massachusetts Stock Option Grants and Exercises and Fiscal Year-End Values play a crucial role in attracting and retaining talent, motivating employees, and aligning their interests with the overall success of the company. It is essential for both companies and employees to understand the specific terms and conditions of their stock option plans and stay informed about the fiscal year-end values to make informed financial decisions.

Middlesex Massachusetts Stock Option Grants and Exercises and Fiscal Year-End Values

Description

How to fill out Middlesex Massachusetts Stock Option Grants And Exercises And Fiscal Year-End Values?

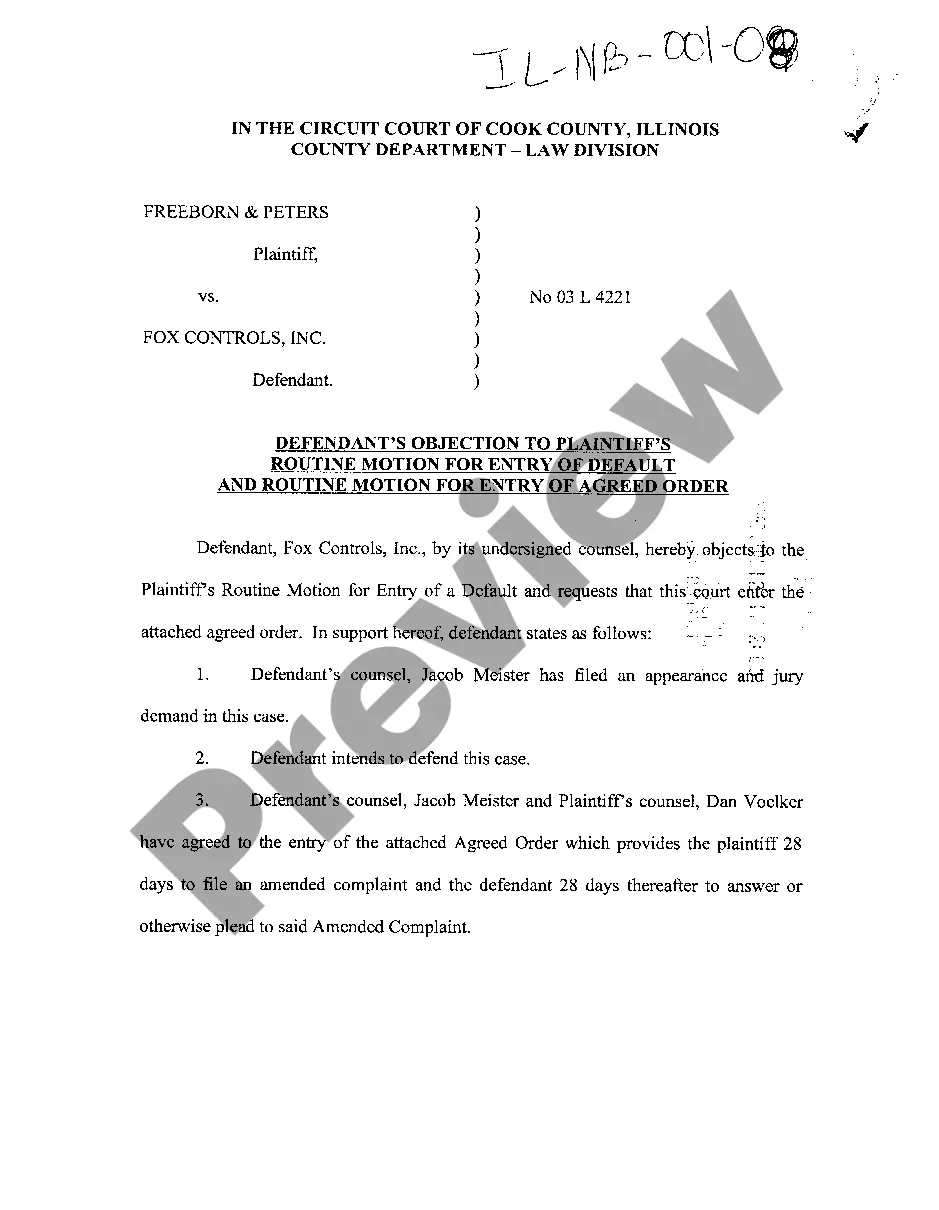

Draftwing documents, like Middlesex Stock Option Grants and Exercises and Fiscal Year-End Values, to manage your legal matters is a tough and time-consumming process. Many situations require an attorney’s involvement, which also makes this task not really affordable. However, you can take your legal matters into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents crafted for various cases and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Middlesex Stock Option Grants and Exercises and Fiscal Year-End Values form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly straightforward! Here’s what you need to do before downloading Middlesex Stock Option Grants and Exercises and Fiscal Year-End Values:

- Make sure that your template is compliant with your state/county since the regulations for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Middlesex Stock Option Grants and Exercises and Fiscal Year-End Values isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our service and get the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to locate and purchase the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!

Form popularity

FAQ

Exercising a stock option means purchasing the shares of stock per the stock option agreement. The benefit of the option to the option holder comes when the grant price is lower than the market value of the stock at the time the option is exercised.

You have taxable income or deductible loss when you sell the stock you bought by exercising the option. You generally treat this amount as a capital gain or loss. However, if you don't meet special holding period requirements, you'll have to treat income from the sale as ordinary income.

Open market options When you buy an open-market option, you're not responsible for reporting any information on your tax return. However, when you sell an optionor the stock you acquired by exercising the optionyou must report the profit or loss on Schedule D of your Form 1040.

Stock Options It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation. Box 3: Social Security wages (up to the income ceiling)

You'll pay capital gains tax on any increase between the stock price when you sell and the stock price when you exercised. In this example, you'd pay capital gains tax on $5 per share (the $10 sale price minus $5, which was the price of the stock when you exercised).

How to determine the exercise price for an option grant The value of tangible and intangible assets. The present value of anticipated future cash-flows. The market value of equity in similar companies. Recent arm's-length transactions. Control premiums or discounts for lack of marketability.

Assuming you stay employed at the company, you can exercise your options at any point in time upon vesting until the expiry date typically, this will span up to 10 years.

Rather than recording the expense as the current stock price, the business must calculate the fair market value of the stock option. The accountant will then book accounting entries to record compensation expense, the exercise of stock options and the expiration of stock options.

With nonqualified stock options, for employees the spread at exercise is reported to the IRS on Form W-2 For nonemployees, it is reported on Form 1099-MISC (starting with the 2020 tax year, it will be reported on Form 1099-NEC ). It is included in your income for the year of exercise.