Montgomery Maryland Stock Option Grants and Exercises and Fiscal Year-End Values In Montgomery, Maryland, stock option grants and exercises play a significant role in the financial landscape of both individuals and corporations. Stock options are a form of compensation that grants employees the right to purchase company stocks at a predetermined price within a specified period. This incentive is often used to reward deserving employees, align their interests with the company's performance, and foster long-term commitment. There are several types of stock option grants commonly offered in Montgomery, Maryland: 1. Incentive Stock Options (SOS): SOS are typically granted to key employees and provide favorable tax treatment. These options must comply with strict requirements set forth by the Internal Revenue Service (IRS), and any resultant gains are subject to long-term capital gains tax rates. 2. Non-Qualified Stock Options (Nests): Nests are more flexible and can be granted to employees at any level. Unlike SOS, Nests do not receive special tax treatment. Upon exercise, ordinary income tax is paid on the difference between the grant price and the current market price. 3. Restricted Stock Units (RSS): RSS are a form of equity compensation that entitles employees to receive company shares at a future date, subject to certain conditions. RSS typically vest over time, incentivizing employees to stay with the company. Upon vesting, RSS are considered ordinary income, and taxes must be paid accordingly. In Montgomery, Maryland, stock option exercises involve employees deciding to exercise their vested stock options, purchasing company shares at the agreed-upon price. Following the exercise, employees have the option to retain the shares or sell them in the open market. The decision depends on individual financial goals, market conditions, and personal circumstances. Fiscal year-end values play a vital role in determining the financial performance and overall valuation of a company. For companies offering stock options in Montgomery, Maryland, fiscal year-end values are essential for calculating the value of outstanding stock options, potential dilution, and overall equity ownership. Moreover, fiscal year-end values play a significant role in financial reporting, including income statements, balance sheets, and cash flow statements. Publicly traded companies must disclose the value of outstanding stock options in their financial statements, providing transparency to investors and stakeholders. In conclusion, Montgomery, Maryland, offers various types of stock option grants, including incentive stock options (SOS), non-qualified stock options (Nests), and restricted stock units (RSS). These grants provide employees with the opportunity to purchase company stocks at predetermined prices. Once vested, employees may exercise their stock options, potentially leading to financial gains. Fiscal year-end values are critical for calculating the value of outstanding stock options and evaluating a company's financial performance.

Montgomery Maryland Stock Option Grants and Exercises and Fiscal Year-End Values

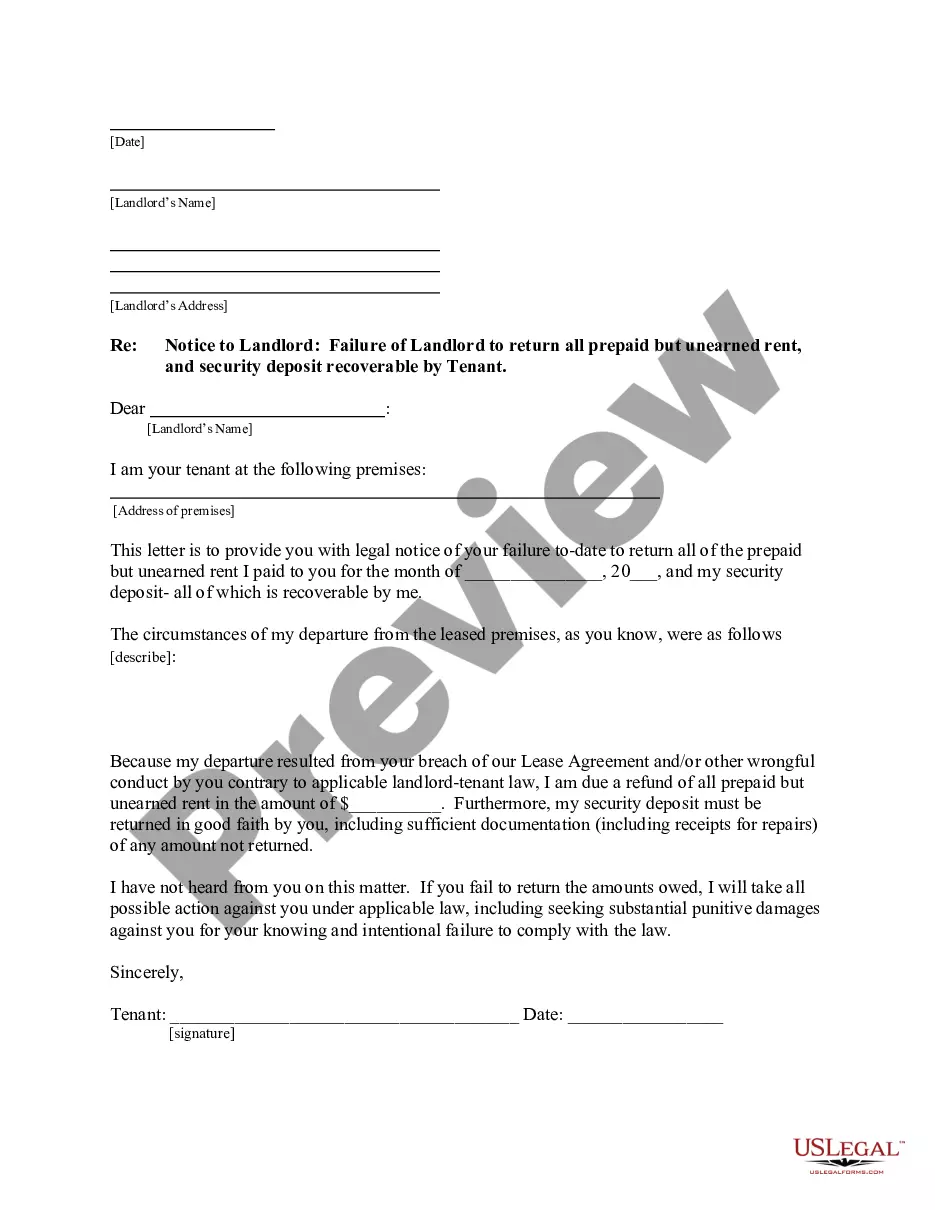

Description

How to fill out Montgomery Maryland Stock Option Grants And Exercises And Fiscal Year-End Values?

How much time does it usually take you to draft a legal document? Since every state has its laws and regulations for every life scenario, locating a Montgomery Stock Option Grants and Exercises and Fiscal Year-End Values suiting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, gathered by states and areas of use. Aside from the Montgomery Stock Option Grants and Exercises and Fiscal Year-End Values, here you can get any specific document to run your business or individual affairs, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can pick the document in your profile at any time later on. Otherwise, if you are new to the website, there will be some extra actions to complete before you obtain your Montgomery Stock Option Grants and Exercises and Fiscal Year-End Values:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another document using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Montgomery Stock Option Grants and Exercises and Fiscal Year-End Values.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!