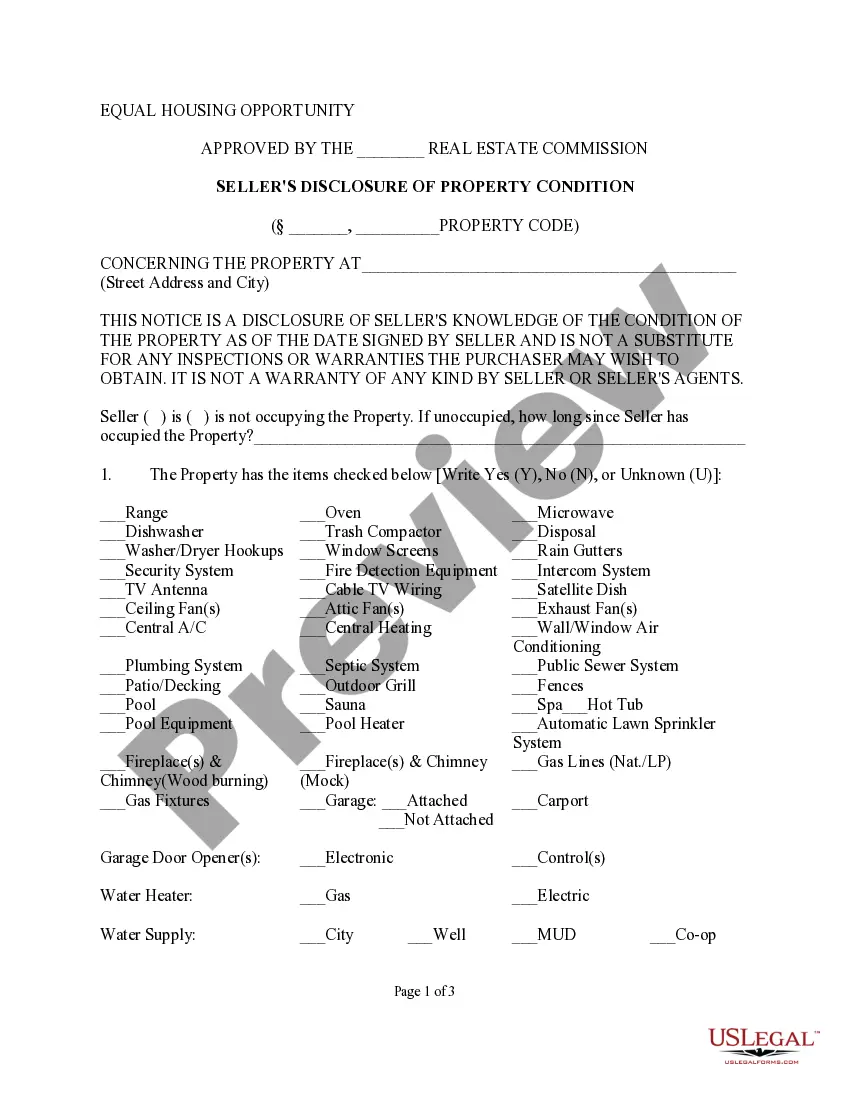

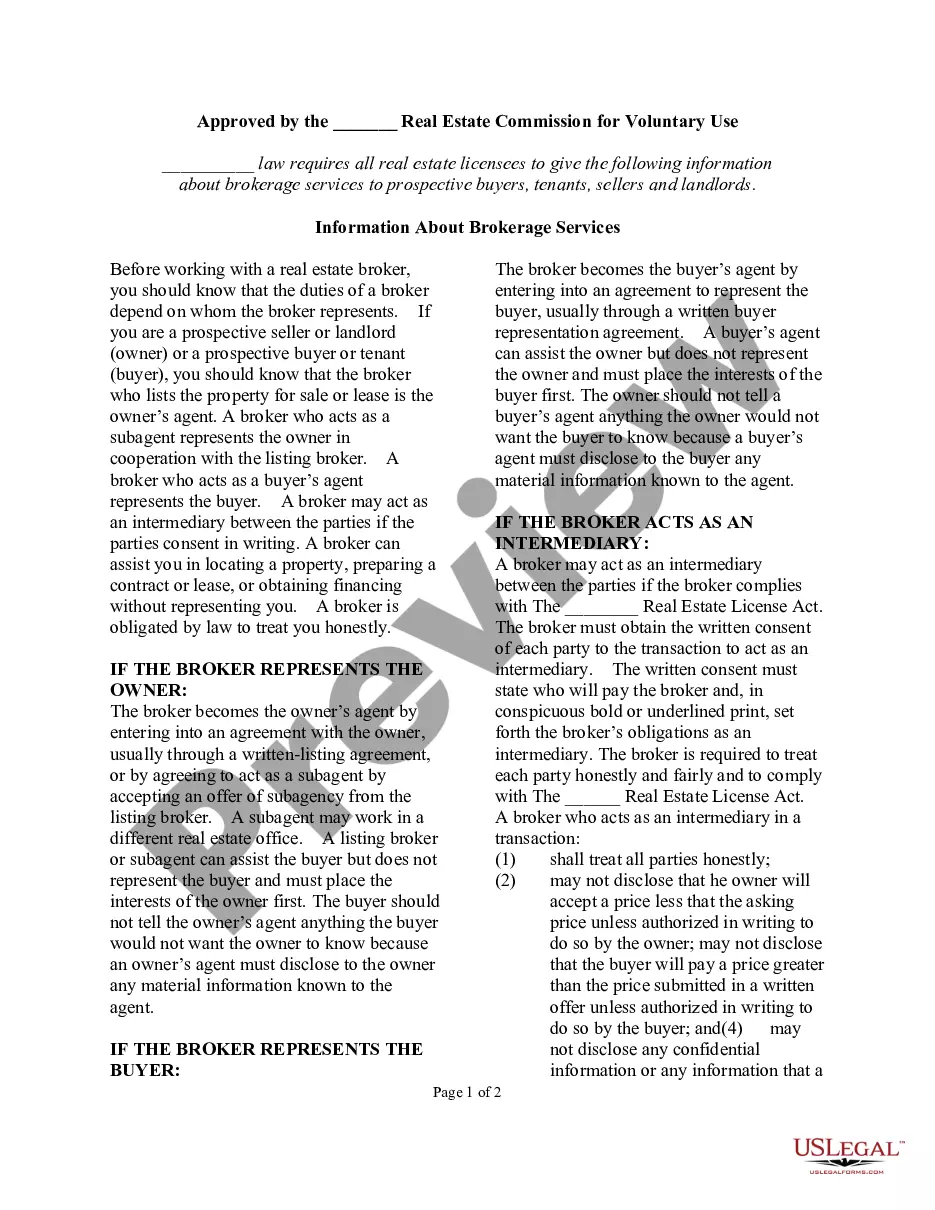

San Diego California Stock Option Grants and Exercises and Fiscal Year-End Values refer to the processes and financial aspects related to stock option grants and exercises in San Diego, California. These activities play a crucial role in the compensation packages offered by companies to their employees, providing them with the opportunity to purchase company stock at a predetermined price. Below are various types of stock option grants and exercises along with their fiscal year-end values: 1. Non-Qualified Stock Options (NO): Non-qualified stock options are a common type of stock option grant offered to employees. These options come with a predetermined exercise price and are subject to ordinary income tax upon exercise. Companies in San Diego often provide Nests as part of their employee compensation packages. 2. Incentive Stock Options (ISO): Incentive stock options are another type of stock option grant available to employees. SOS may offer certain tax advantages, such as preferential tax treatment upon exercise and capital gains tax upon sale. These grants are subject to specific requirements set by the Internal Revenue Service (IRS). 3. Restricted Stock Units (RSS): RSS are a form of compensation granted to employees in the form of company stock. Unlike traditional stock options, RSS do not have an exercise price. Instead, RSS represent a promise to deliver company shares in the future, typically granted with vesting conditions. The fiscal year-end value of RSS is based on the stock price on the last day of the fiscal year. 4. Employee Stock Purchase Plans (ESPN): ESPN are programs designed to allow employees to purchase company stock at a discount. Employees contribute a percentage of their salary into the ESPN, and at the end of a predetermined period known as the offering period, they can purchase company stock at a discounted price. The fiscal year-end value of ESPN is determined by the market price of the company stock on the last day of the fiscal year. 5. Stock Option Exercises: Stock option exercises refer to the process of utilizing stock options to purchase company shares. Upon exercising their options, employees pay the exercise price and acquire the shares. The fiscal year-end value of exercised stock options is determined by the market price of the company stock on the exercise date. The calculation of fiscal year-end values for stock option grants and exercises is crucial for accounting and financial reporting purposes. It helps companies evaluate the overall compensation expenses, potential tax implications, and the impact on their financial statements. By understanding the different types of stock option grants and exercises available in San Diego, companies can effectively design compensation packages to attract and retain talented employees while adhering to legal and regulatory requirements.

San Diego California Stock Option Grants and Exercises and Fiscal Year-End Values

Description

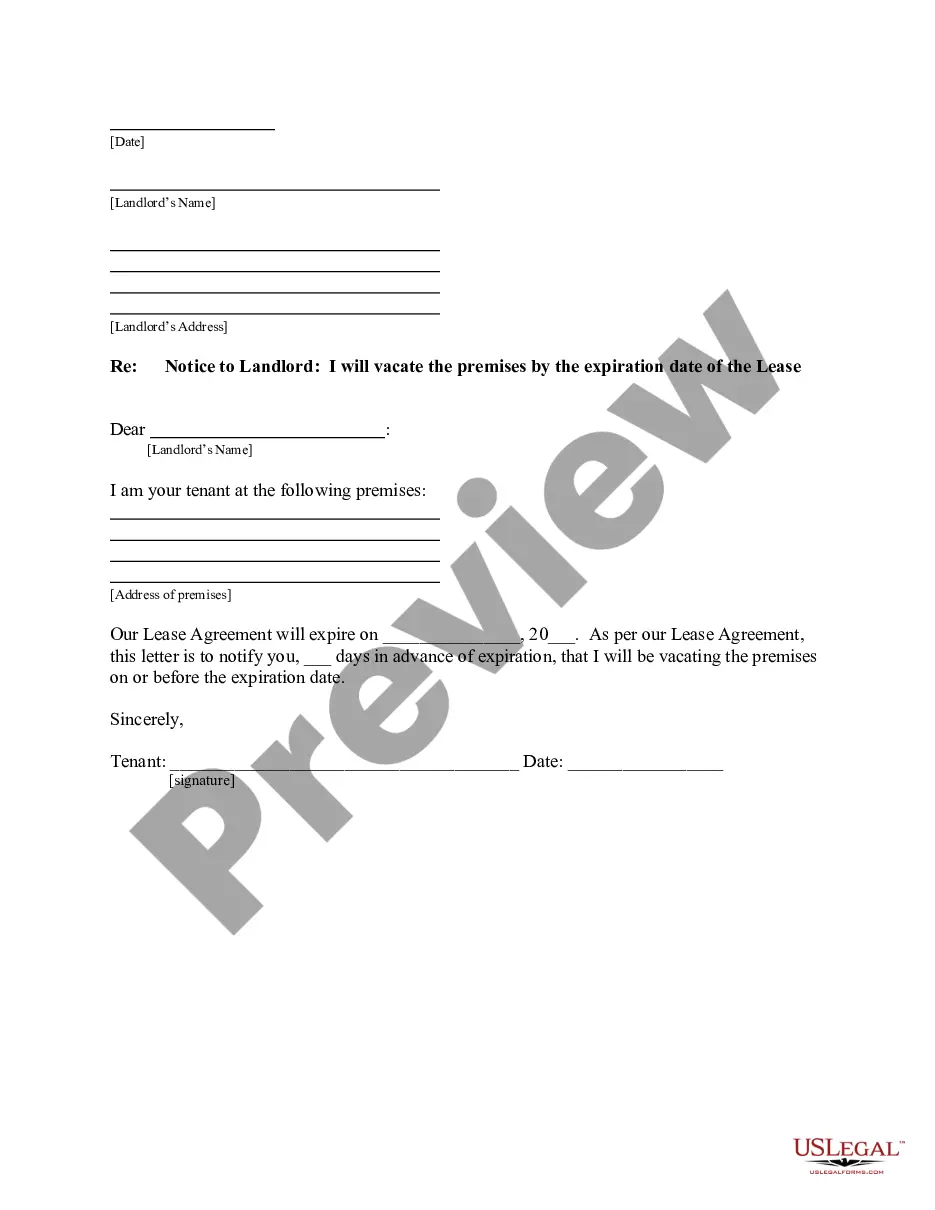

How to fill out San Diego California Stock Option Grants And Exercises And Fiscal Year-End Values?

Do you need to quickly create a legally-binding San Diego Stock Option Grants and Exercises and Fiscal Year-End Values or maybe any other document to take control of your own or business affairs? You can select one of the two options: contact a professional to write a legal paper for you or draft it entirely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you receive neatly written legal paperwork without having to pay sky-high prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-specific document templates, including San Diego Stock Option Grants and Exercises and Fiscal Year-End Values and form packages. We offer documents for an array of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, double-check if the San Diego Stock Option Grants and Exercises and Fiscal Year-End Values is adapted to your state's or county's laws.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the template isn’t what you were hoping to find by using the search bar in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the San Diego Stock Option Grants and Exercises and Fiscal Year-End Values template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the documents we provide are reviewed by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!