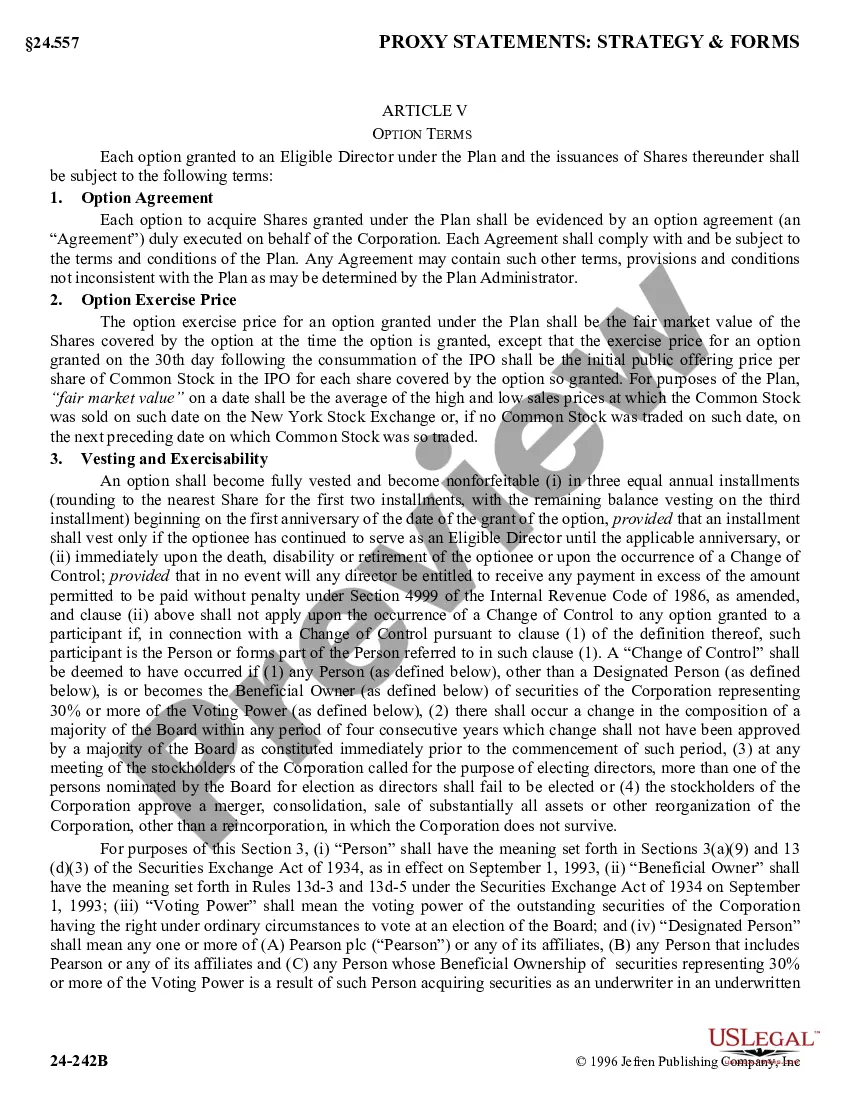

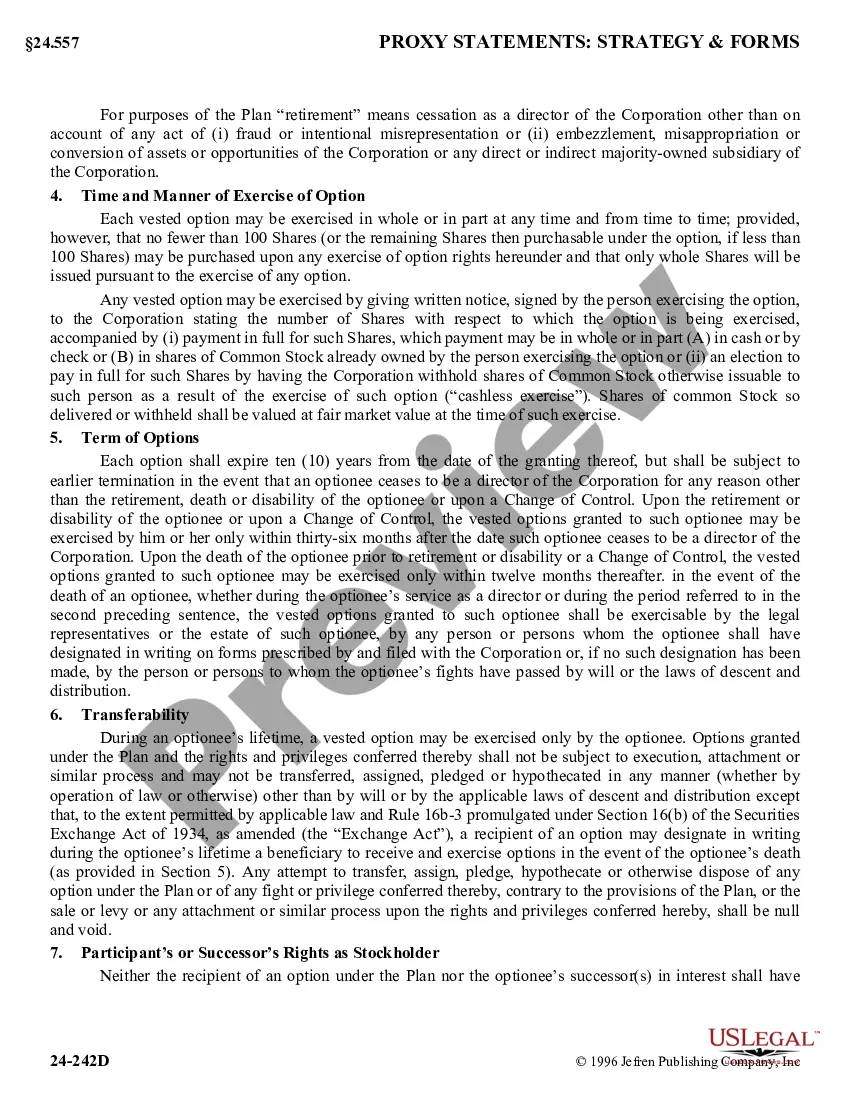

The Fairfax Virginia Stock Option Plan for Nonemployee Directors of Cameo International, Inc. is a comprehensive compensation program designed to incentivize and reward nonemployee directors of the company. It provides an opportunity for eligible directors to receive stock options in addition to their regular compensation. Under this plan, nonemployee directors are granted the right to purchase a specific number of shares of Cameo International, Inc. stock at a fixed price, known as the exercise price. These stock options are typically granted as part of the director's compensation package and serve as a means to align the director's interests with those of the company's shareholders. The Fairfax Virginia Stock Option Plan for Nonemployee Directors offers several benefits to eligible participants. Firstly, it helps attract and retain highly qualified directors who play a crucial role in providing oversight, guidance, and strategic decision-making for the company. By offering stock options, the plan encourages directors to have a vested interest in the company's long-term success and profitability. Furthermore, the stock options granted through this plan provide directors with the potential for significant financial gain if the company's stock price increases over time. This can result in substantial wealth accumulation for directors, enhancing their overall compensation package. It is important to note that variations or amendments may exist within the Fairfax Virginia Stock Option Plan for Nonemployee Directors. These variations could include different vesting schedules, exercise periods, or eligibility requirements based on the director's tenure or the company's performance. Such variations aim to tailor the plan to suit the specific needs and objectives of the company. Overall, the Fairfax Virginia Stock Option Plan for Nonemployee Directors of Cameo International, Inc. represents a valuable component of the compensation package for nonemployee directors. It aligns the interests of the directors with those of the company's shareholders, encourages long-term commitment, and provides an avenue for potential financial gain through stock ownership.

Fairfax Virginia Stock Option Plan for Nonemployee Directors of Camco International, Inc.

Description

How to fill out Fairfax Virginia Stock Option Plan For Nonemployee Directors Of Camco International, Inc.?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business objective utilized in your county, including the Fairfax Stock Option Plan for Nonemployee Directors of Camco International, Inc..

Locating samples on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Fairfax Stock Option Plan for Nonemployee Directors of Camco International, Inc. will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the Fairfax Stock Option Plan for Nonemployee Directors of Camco International, Inc.:

- Make sure you have opened the correct page with your regional form.

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Fairfax Stock Option Plan for Nonemployee Directors of Camco International, Inc. on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

A stock option is a contract that gives its owner the right, but not the obligation, to buy or sell shares of a corporation's stock at a predetermined price by a specified date. Private company stock options are call options, giving the holder the right to purchase shares of the company's stock at a specified price.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Private company stock options are call options, giving the holder the right to purchase shares of the company's stock at a specified price. This right to purchase or exercise stock options is often subject to a vesting schedule that defines when the options can be exercised.

Stock options are a form of compensation. Companies can grant them to employees, contractors, consultants and investors.

It gives investors who purchase the private shares an ownership stake in the company. In exchange for obtaining money to grow your business, you give up sole ownership. Later, you may decide to pay the investors back and take back equity, or you may keep them on as part-owners until you sell your company.

Under the said Rules, ESOPs can be issued only to the employees of an unlisted private limited company.

Yes, companies can absolutely offer stock options to their contractors, but contractors need to consider how the vesting, taxation, financial planning, and investment management related to the stock options fit into their personal financial plan.

Investing in private companies is a long-term endeavor. Most people who buy shares in private businesses do so with the hope that the company will eventually go public. If a business goes through an IPO, you can easily sell your shares on the stock market.

A private company is a firm held under private ownership. Private companies may issue stock and have shareholders, but their shares do not trade on public exchanges and are not issued through an initial public offering (IPO).

Companies issue options typically for one or more of the following reasons: Options can be used to attract and retain talented employees. Options can help motivate more dedication from employees. Options can be a cost-effective employee benefit plan, in lieu of additional cash compensation.