Cuyahoga Ohio Employee Stock Ownership Plan (ESOP) is a retirement benefit program offered by Aura Systems, Inc., a company based in Cuyahoga, Ohio. It provides eligible employees with an opportunity to own shares of the company's stock, thereby allowing them to accumulate wealth and actively participate in the company's growth and success. The Cuyahoga Ohio ESOP is designed to promote employee ownership, foster a sense of ownership culture, and provide long-term financial security to the employees. As an ESOP, the Cuyahoga Ohio Employee Stock Ownership Plan operates as a qualified retirement plan, governed by the Employee Retirement Income Security Act (ERICA) regulations. It functions as a trust, holding shares of Aura Systems, Inc. on behalf of the participating employees. These shares are allocated to the individual employee accounts based on a predetermined formula, which often considers factors like length of service, compensation, and position within the company. The Cuyahoga Ohio ESOP offers numerous advantages to employees. By becoming shareholders through the ESOP, employees can enjoy tax benefits, as contributions made to Sops by employers are generally tax-deductible. Additionally, the plan allows employees to accumulate ownership in the company without investing their personal funds, making it a powerful wealth-building tool. One notable benefit of the Cuyahoga Ohio ESOP is that it aligns the interests of employees with those of the company. When employees own shares, they have a vested interest in the company's success and its long-term profitability. This ownership culture often leads to increased employee engagement, productivity, and loyalty. In terms of distributions, employees who participate in the Cuyahoga Ohio ESOP become eligible to receive a portion of their vested account balance upon retirement, disability, death, or termination of employment. The funds can be distributed in various ways, including lump-sum payments, periodic installments, or rolled over into an Individual Retirement Account (IRA). It is important to note that while the specifics of the Cuyahoga Ohio ESOP for Aura Systems, Inc. may vary, as there can be multiple variations of Sops, the core objectives and benefits remain constant. These variations might include differences in the vesting schedule, contribution levels, and distribution options. In summary, the Cuyahoga Ohio Employee Stock Ownership Plan of Aura Systems, Inc. offers employees an opportunity to become part owners of the company, providing them with financial benefits, promoting a culture of ownership, and fostering strong employee-company alignment.

Cuyahoga Ohio Employee Stock Ownership Plan of Aura Systems, Inc.

Description

How to fill out Cuyahoga Ohio Employee Stock Ownership Plan Of Aura Systems, Inc.?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Cuyahoga Employee Stock Ownership Plan of Aura Systems, Inc., it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Therefore, if you need the recent version of the Cuyahoga Employee Stock Ownership Plan of Aura Systems, Inc., you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Employee Stock Ownership Plan of Aura Systems, Inc.:

- Look through the page and verify there is a sample for your area.

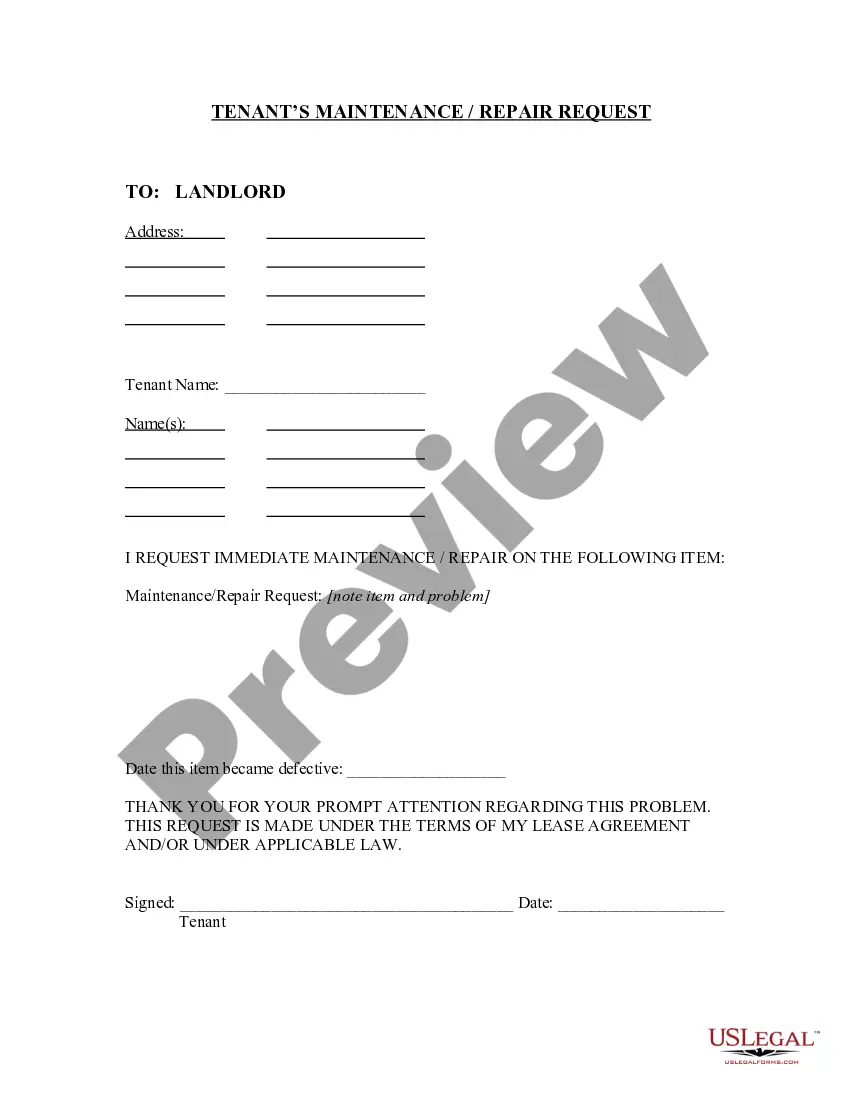

- Check the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Cuyahoga Employee Stock Ownership Plan of Aura Systems, Inc. and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!