The Cook Illinois Supplemental Employee Stock Ownership Plan (ESOP) is a unique offering provided by SIX Corporations, a leading diversified industrial company. Aimed at rewarding dedicated employees and fostering a sense of ownership, this employee benefit program is designed to supplement the primary ESOP offered by the company. The Cook Illinois Supplemental ESOP specifically caters to employees of Cook Illinois, a subsidiary of SIX Corporations. Cook Illinois is a renowned provider of student transportation solutions, specializing in offering safe and reliable transportation for educational institutions across the United States. The plan allows eligible employees to obtain an additional stake in the company through the purchase of company stock. By participating in the ESOP, employees become shareholders, enhancing their personal financial growth and incentivizing long-term commitment to the company's success. This unique stock ownership program provides various benefits to employees. Firstly, it allows participants to accumulate shares of SIX Corporations stock over time, thereby creating a retirement asset that could potentially grow in value. Employees are given the opportunity to purchase company shares at a discounted price, bringing affordability and accessibility to investing in SIX Corporations. Another key advantage of the Cook Illinois Supplemental ESOP is that it is structured as a tax-advantaged retirement plan. As employees contribute a portion of their pre-tax earnings towards purchasing company stock, they have the potential to accumulate substantial wealth while enjoying tax advantages. Depending on the individual's tax situation, contributions to the ESOP can be deducted from their taxable income, reducing their overall tax liability. Additionally, the plan provides flexibility in terms of the employee's control over their investments. Participants can choose from a range of investment options offered within the ESOP, allowing them to tailor their investment strategies according to their financial goals and risk tolerance. It is worth noting that it is unclear if there are different types of Cook Illinois Supplemental Sops within SIX Corporations. Therefore, without further information, it is assumed that the Cook Illinois Supplemental ESOP is a single plan catering exclusively to Cook Illinois employees.

Cook Illinois Supplemental Employee Stock Ownership Plan of SPX Corporation

Description

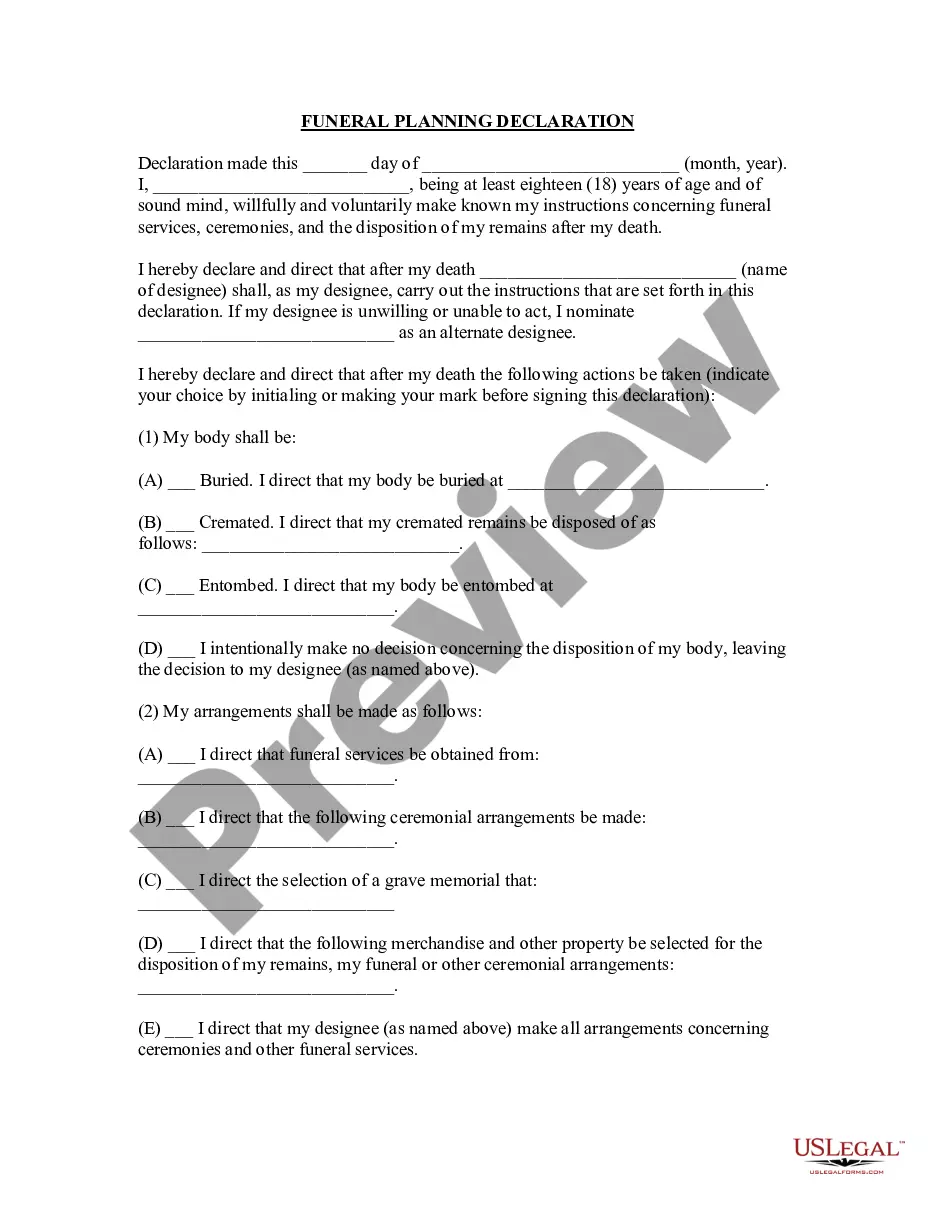

How to fill out Cook Illinois Supplemental Employee Stock Ownership Plan Of SPX Corporation?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Cook Supplemental Employee Stock Ownership Plan of SPX Corporation, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains available in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Cook Supplemental Employee Stock Ownership Plan of SPX Corporation from the My Forms tab.

For new users, it's necessary to make several more steps to get the Cook Supplemental Employee Stock Ownership Plan of SPX Corporation:

- Analyze the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Key Takeaways. Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

Steps to Setting Up an ESOP (1) Determine Whether Other Owners Are Amenable.(2) Conduct a Feasibility Study.(3) Conduct a Valuation.(4) Hire an ESOP Attorney.(5) Obtain Funding for the Plan.(6) Establish a Process to Operate the Plan.

Setting Up Your Employee Stock Option Plan Your company's mission and values should be a major factor in your stock option's plan design. Determine how much of the company you plan to share with early employees and employees that will join your company later. Regular stock grants are sold in shares of 100.

Steps to Setting Up an ESOP (1) Determine Whether Other Owners Are Amenable.(2) Conduct a Feasibility Study.(3) Conduct a Valuation.(4) Hire an ESOP Attorney.(5) Obtain Funding for the Plan.(6) Establish a Process to Operate the Plan.

More In Retirement Plans An employee stock ownership plan (ESOP) is an IRC section 401(a) qualified defined contribution plan that is a stock bonus plan or a stock bonus/money purchase plan.

Definition: An employee stock ownership plan (ESOP) is a type of employee benefit plan which is intended to encourage employees to acquire stocks or ownership in the company.

An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.

Overview of Three Types of ESOPs Nonleveraged ESOP. This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the sponsoring employer's stock.Leveraged Buyout ESOP.Issuance ESOP.

An ESOP, which stands for employee stock ownership plan, is a qualified retirement plan (similar to a 401(k) plan) set up as a trust fund, where current and future employees receive beneficial ownership in the company over time.