The Dallas Texas Supplemental Employee Stock Ownership Plan (ESOP) offered by SIX Corporations is a comprehensive employee benefit program designed to provide additional financial security and incentives for the company's workforce in the Dallas, Texas region. This plan serves as a supplementary component to SIX Corporations broader ESOP, ensuring that employees in Dallas, Texas have specific benefits tailored to their geographical location. The Dallas Texas Supplemental ESOP operates under the same principles as the main SIX Corporation ESOP, aiming to promote a sense of ownership and reward employees for their dedication and contribution to the company's success. This unique employee ownership plan encourages long-term participation and fosters a strong bond between the employees and the organization. This supplemental plan offers several key advantages to employees based in Dallas, Texas, including increased retirement security, tax benefits, and the potential for wealth accumulation. Participants in the Dallas Supplemental ESOP can benefit from the plan's tax-deferred contributions, allowing them to save more for their retirement while reducing their current tax liability. Moreover, employees who actively participate in the Dallas Texas Supplemental ESOP become eligible for stock ownership in SIX Corporations. This additional ownership opportunity grants them a stake in the company's success and aligns their interests with the overall growth and profitability of SIX Corporations. The Dallas Texas Supplemental ESOP further provides diverse options for employees to accumulate more shares in SIX Corporations. These options may include profit-sharing contributions, payroll deductions, or the allocation of stock bonuses based on performance evaluations. By participating in the plan, Dallas-based employees can reap significant financial rewards both during their employment period and after retirement. As for the different types of Dallas Texas Supplemental Sops within SIX Corporations, they often vary based on employee rank, tenure, and performance. For instance, senior executives or high-performing employees may have access to enhanced benefits or higher contribution rates compared to entry-level positions. Additionally, the plan may have specific provisions that enable employees to purchase discounted company stock or offer other investment opportunities linked to SIX Corporations. In summary, the Dallas Texas Supplemental Employee Stock Ownership Plan of SIX Corporation caters to employees working in the Dallas area, providing a range of benefits, including tax advantages, additional stock ownership, and long-term wealth accumulation. By participating in this plan, SIX Corporations aims to foster a sense of ownership and boost employee loyalty, ultimately contributing to the overall success of the company and its employees in Dallas, Texas.

Dallas Texas Supplemental Employee Stock Ownership Plan of SPX Corporation

Description

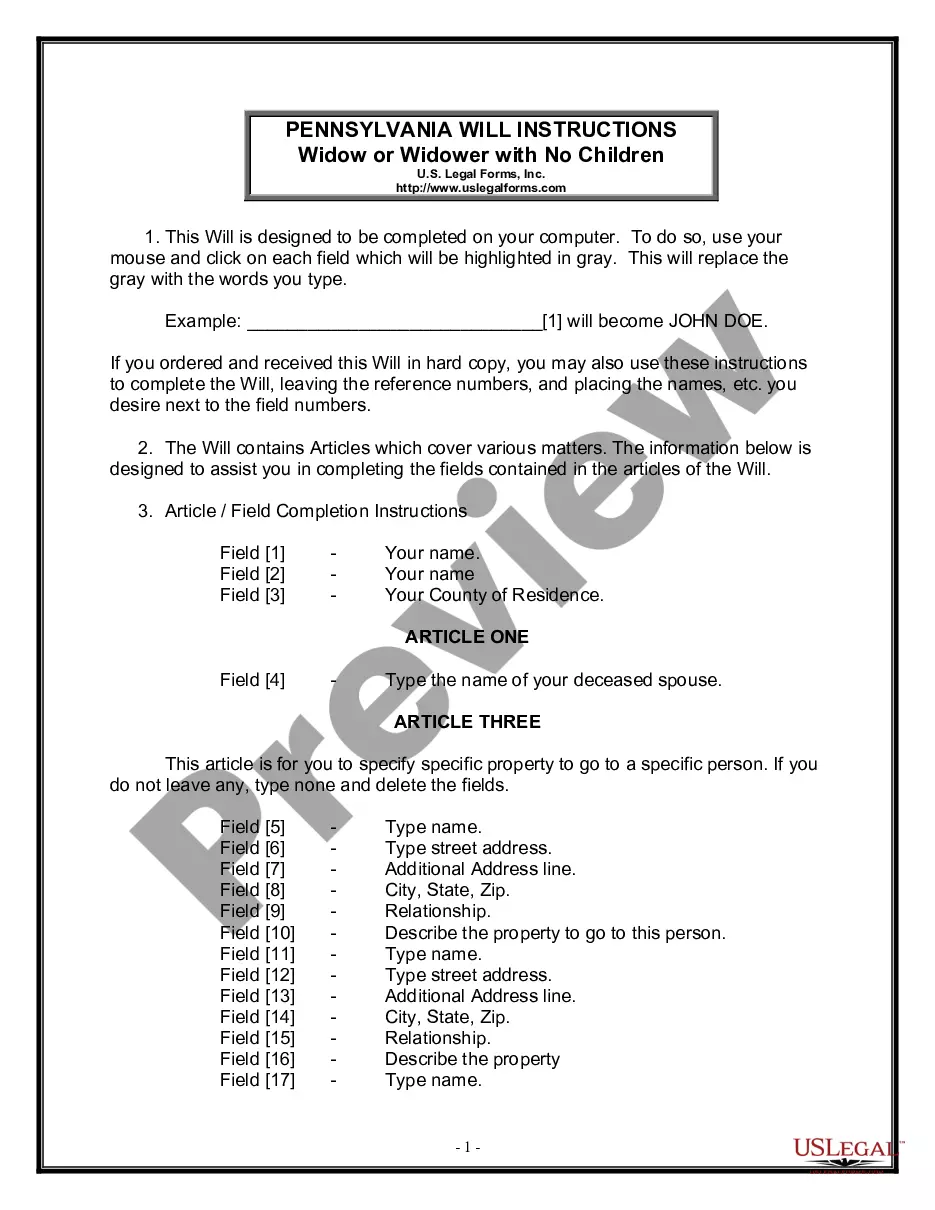

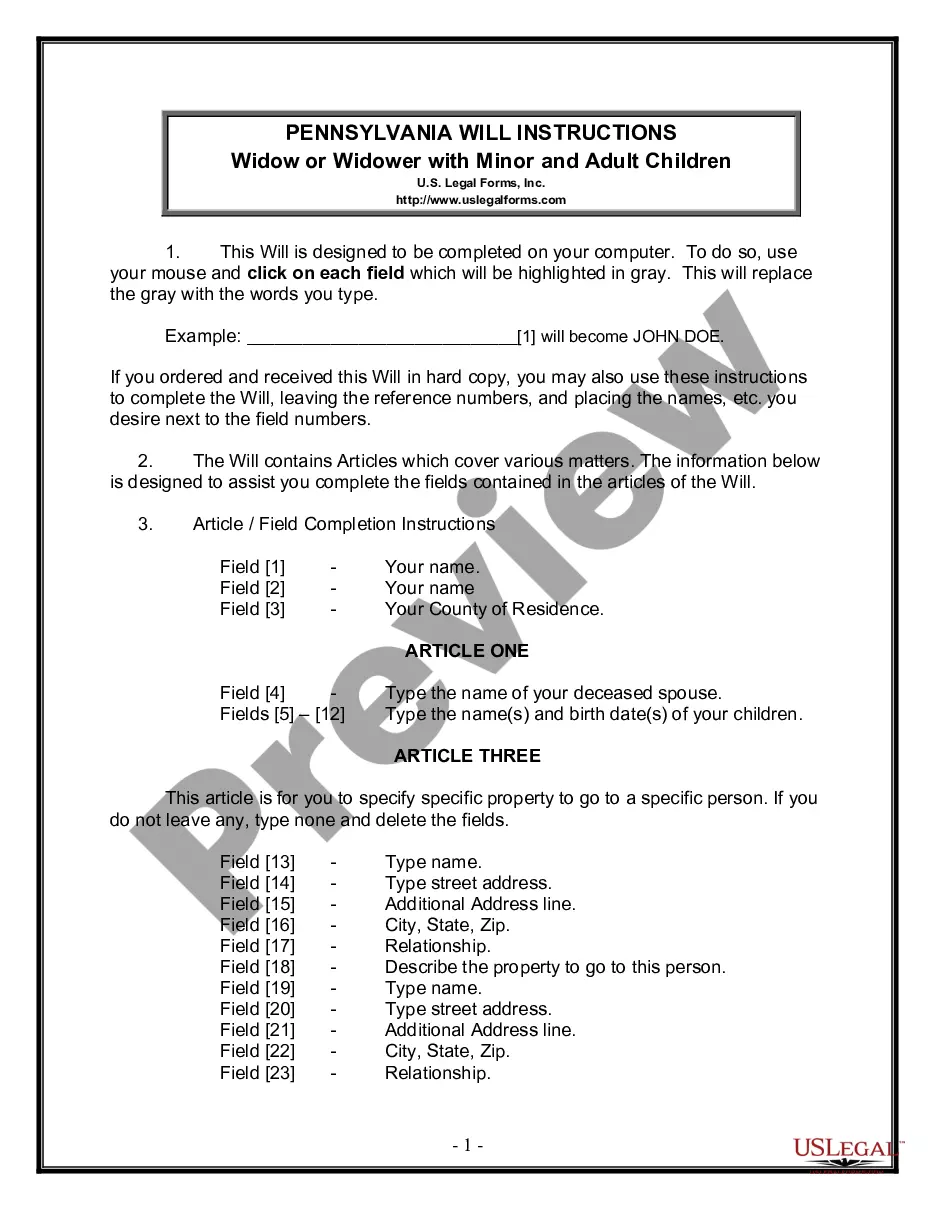

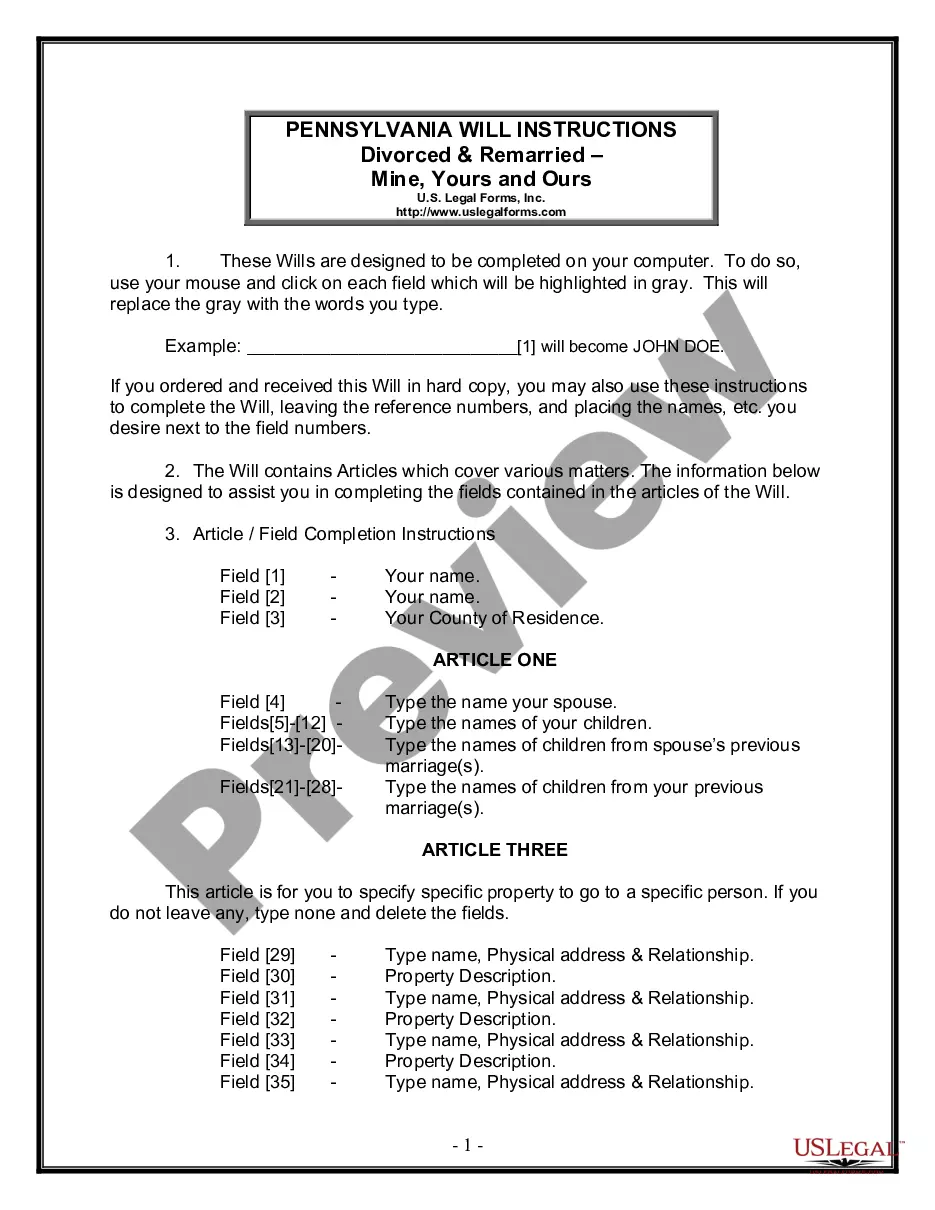

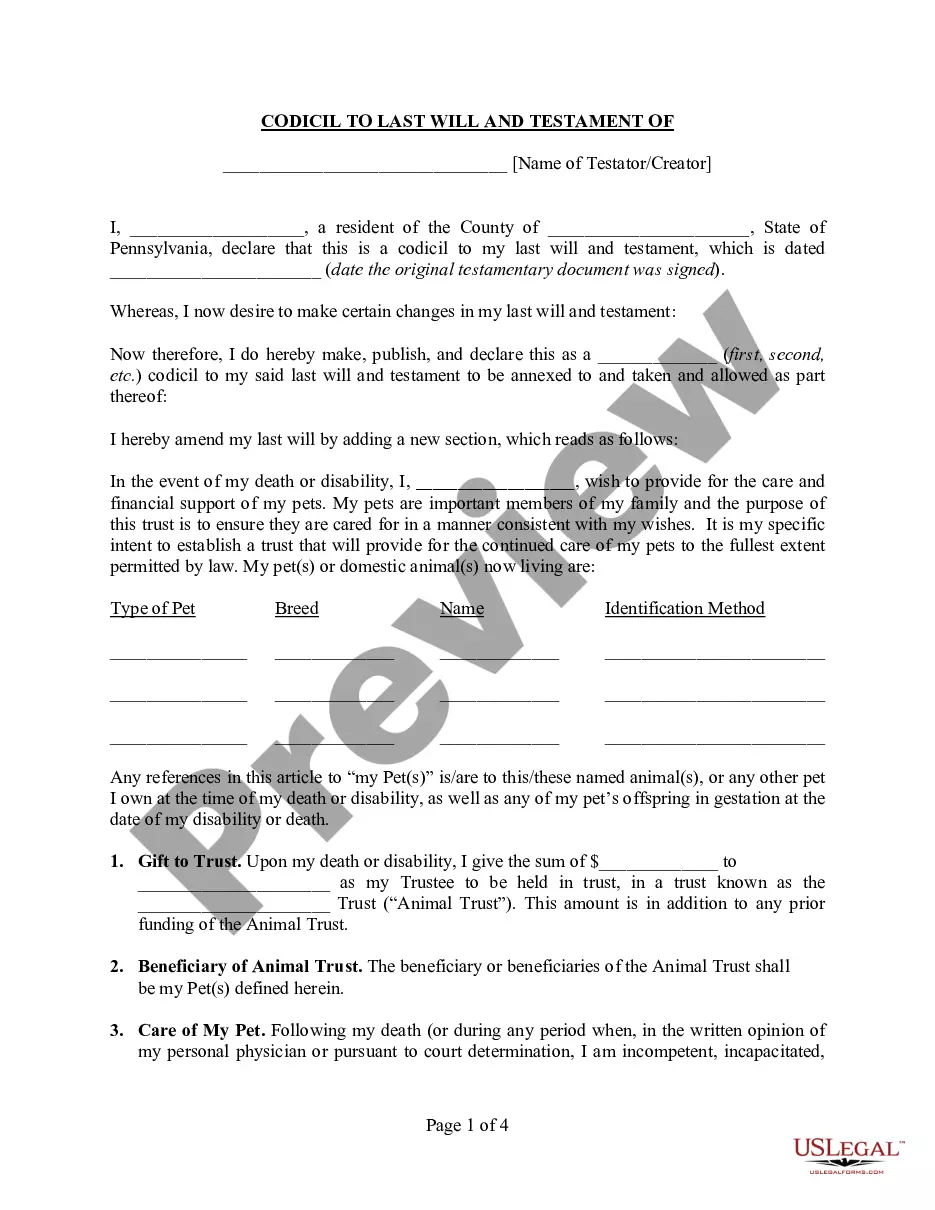

How to fill out Dallas Texas Supplemental Employee Stock Ownership Plan Of SPX Corporation?

Preparing paperwork for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it tense and time-consuming to create Dallas Supplemental Employee Stock Ownership Plan of SPX Corporation without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid Dallas Supplemental Employee Stock Ownership Plan of SPX Corporation on your own, using the US Legal Forms online library. It is the most extensive online collection of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Dallas Supplemental Employee Stock Ownership Plan of SPX Corporation:

- Look through the page you've opened and check if it has the document you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a few clicks!