The Middlesex Massachusetts Supplemental Employee Stock Ownership Plan (ESOP) is a retirement benefit program specifically designed for employees of SIX Corporation residing in Middlesex County, Massachusetts. As a whole, the ESOP serves as an additional retirement savings option for eligible employees of the company. The Middlesex Massachusetts ESOP is part of a broader employee ownership program established by SIX Corporations, a leading global supplier of highly engineered products and technologies. Through this plan, the corporation aims to promote employee ownership, engage employees in the company's success, and provide an avenue for long-term wealth creation. This ESOP is tailored specifically for employees based in Middlesex County, Massachusetts. It ensures that these employees can actively participate in the company's growth and have a vested interest in its performance. By offering company stock as a retirement investment option, eligible employees can accumulate wealth over time and benefit from any appreciation in SIX Corporations stock value. The Middlesex Massachusetts ESOP operates by allocating a portion of eligible employees' compensation to be invested in SIX Corporation stock. This allocation is determined based on various factors, such as the employee's tenure, salary, and contributions to the retirement plan. Over time, as the employee continues to work for SIX Corporations, their stake in the company grows, providing a potential source of retirement income. SIX Corporations may offer different types or variations of the Middlesex Massachusetts ESOP, tailored to specific employee groups or roles within the company. These variations may include additional or modified features based on the needs and objectives of those individuals or the specific requirements of Middlesex County regulations. In summary, the Middlesex Massachusetts Supplemental Employee Stock Ownership Plan of SIX Corporations allows eligible employees in Middlesex County to participate in the company's success by owning a stake in the company through their retirement savings. This plan aims to create an additional avenue for long-term wealth accumulation and provide employees with a vested interest in SIX Corporations performance and growth over time.

Middlesex Massachusetts Supplemental Employee Stock Ownership Plan of SPX Corporation

Description

How to fill out Middlesex Massachusetts Supplemental Employee Stock Ownership Plan Of SPX Corporation?

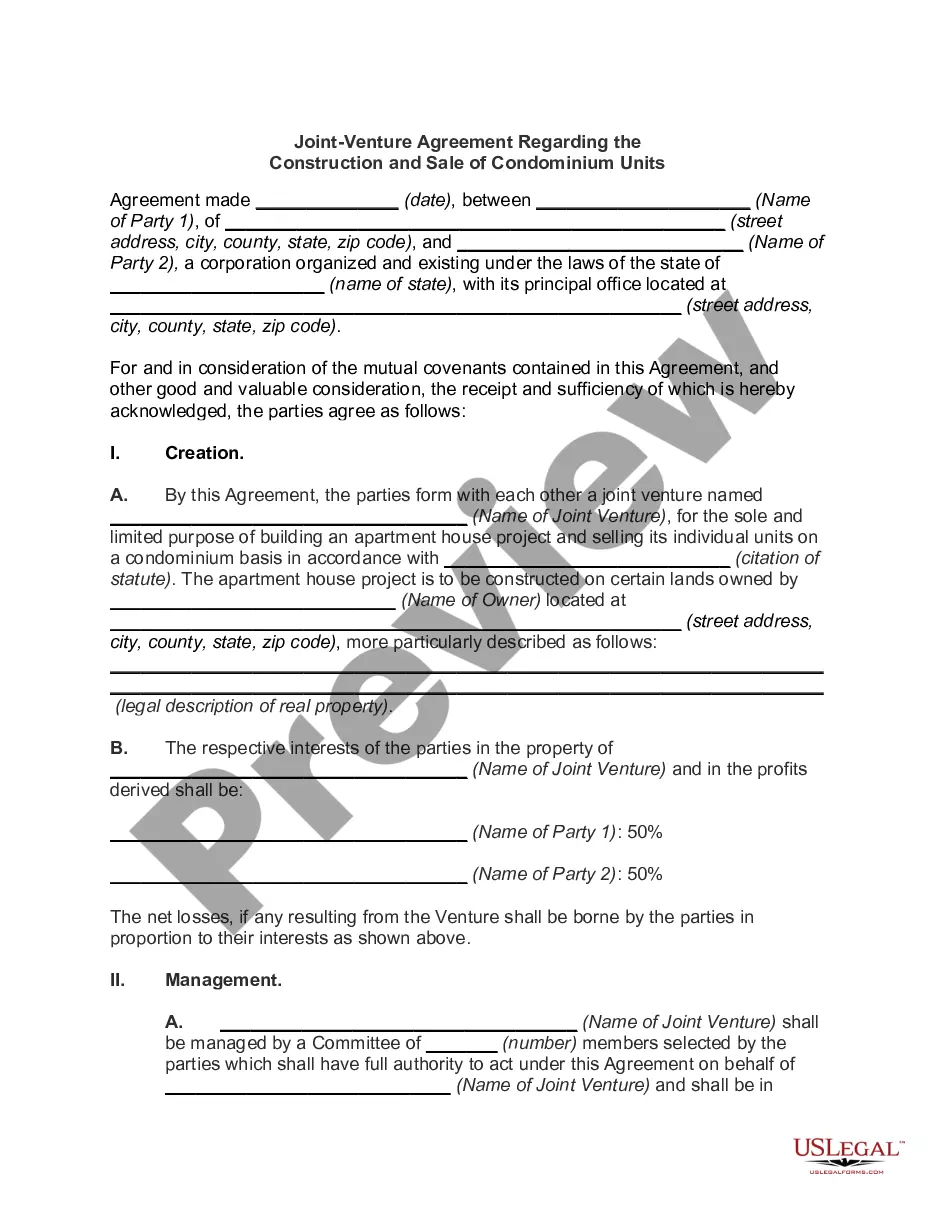

Creating legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from scratch, including Middlesex Supplemental Employee Stock Ownership Plan of SPX Corporation, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized based on their valid state, making the searching experience less challenging. You can also find detailed materials and tutorials on the website to make any tasks related to paperwork completion straightforward.

Here's how to locate and download Middlesex Supplemental Employee Stock Ownership Plan of SPX Corporation.

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the validity of some documents.

- Check the similar document templates or start the search over to find the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the option, then a suitable payment gateway, and purchase Middlesex Supplemental Employee Stock Ownership Plan of SPX Corporation.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Middlesex Supplemental Employee Stock Ownership Plan of SPX Corporation, log in to your account, and download it. Needless to say, our website can’t take the place of an attorney completely. If you need to deal with an exceptionally difficult case, we recommend using the services of a lawyer to examine your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!

Form popularity

FAQ

How Do I Enter Employee Stock Purchase Plan (ESPP) Sales inYouTube Start of suggested clip End of suggested clip With your return open in turbotax search for 1099-b. And select the jump to link have your 1099-bMoreWith your return open in turbotax search for 1099-b. And select the jump to link have your 1099-b form 3922 for the shares you sold and w-2 or year-end pay stub available for reference.

When you sell ESPP shares, your employer reports your ESPP income as wages in box 1 of your Form W-2. ESPPs have no withholding for income tax, and Social Security and Medicare taxes do not apply. Whether you had a qualified or disqualified disposition determines how much of the income is on your W-2.

You should report a long-term gain on Schedule D of Form 1040. A short-term gain will typically appear in box 1 of your W-2 as ordinary income, and you should file it as wages on Form 1040.

You must report this amount as compensation income on line 7 of your 2021 Form 1040. You must show the sale of the stock on your 2021 Schedule D. It's considered long-term because more than one year passed from the date acquired (January 2, 2020) to the date of sale (January 20, 2021).

IRS Form 3922 Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c) is for informational purposes only and is not entered into your return. You will need this information when you sell the stock, so the form should be kept for your records.

How Do I Enter Employee Stock Purchase Plan (ESPP) Sales inYouTube Start of suggested clip End of suggested clip With your return open in turbotax search for 1099-b. And select the jump to link have your 1099-bMoreWith your return open in turbotax search for 1099-b. And select the jump to link have your 1099-b form 3922 for the shares you sold and w-2 or year-end pay stub available for reference.

With ESPPs, the purchase discount for tax purposes is reported to the IRS on Form W-2 and is included in your income in the year of sale. Thus, when you sell the shares, do not make the purchase price your cost basis without following other steps when you complete Form 8949 to report the sale.

For stock plan participants with retail account transactions, Schwab will provide cost basis for covered and non-covered securities, as available, on a Form 1099 Composite statement. For ESPP participants, Schwab provides cost basis information on Substitute Form 1099-B.

With ESPPs, the purchase discount for tax purposes is reported to the IRS on Form W-2 and is included in your income in the year of sale.