The Nassau New York Supplemental Employee Stock Ownership Plan (ESOP) of SIX Corporations is a unique program designed to provide additional benefits to employees based in Nassau County, New York. An ESOP is a type of employee benefit plan that enables workers to own shares of the company's stock. SIX Corporations, a leading global supplier of highly specialized, engineered solutions, has established this plan to enhance its employees' long-term financial security and align their interests with those of the company. The Nassau New York Supplemental ESOP is an extension of SIX Corporations broader ESOP, tailoring the plan to meet the specific needs of its Nassau County employees. This supplementary plan may offer additional features and benefits beyond the regular ESOP, ensuring a more comprehensive and tailored approach to employee ownership. By allowing eligible employees to own a stake in the company, the Nassau New York Supplemental ESOP fosters a sense of ownership and accountability. This program empowers employees by providing them with a direct stake in the organization's success, strengthening their commitment and motivation. Through stock ownership, employees can benefit from the company's growth and rising stock value, which can create wealth and financial security over time. Furthermore, the Nassau New York Supplemental ESOP may offer unique features such as a higher level of participation, increased vesting options, or a more generous contribution matching system. These additional benefits could serve as a powerful incentive for employees to save for retirement, providing them with an opportunity to accumulate wealth through company stock while enjoying potential tax advantages. As with any ESOP, the Nassau New York Supplemental ESOP is subject to specific guidelines and regulations set forth by relevant governing bodies, such as the Securities and Exchange Commission (SEC) and the Employee Retirement Income Security Act (ERICA). It is essential for employees to familiarize themselves with the eligibility criteria, contribution rules, vesting schedules, and distribution options of the plan. To maximize the benefits offered by the Nassau New York Supplemental ESOP, employees should proactively educate themselves on the dynamics of the stock market, diversification strategies, and long-term investment planning. This will enable them to make informed decisions regarding their stock ownership in SIX Corporations, ensuring they can harness the full potential of the plan's benefits. In summary, the Nassau New York Supplemental Employee Stock Ownership Plan of SIX Corporations is a specialized program designed to extend the advantages of employee stock ownership to the company's workforce based in Nassau County, New York. Through this plan, employees can become shareholders, aligning their interests with the success of the organization while potentially accumulating significant long-term financial rewards.

Nassau New York Supplemental Employee Stock Ownership Plan of SPX Corporation

Description

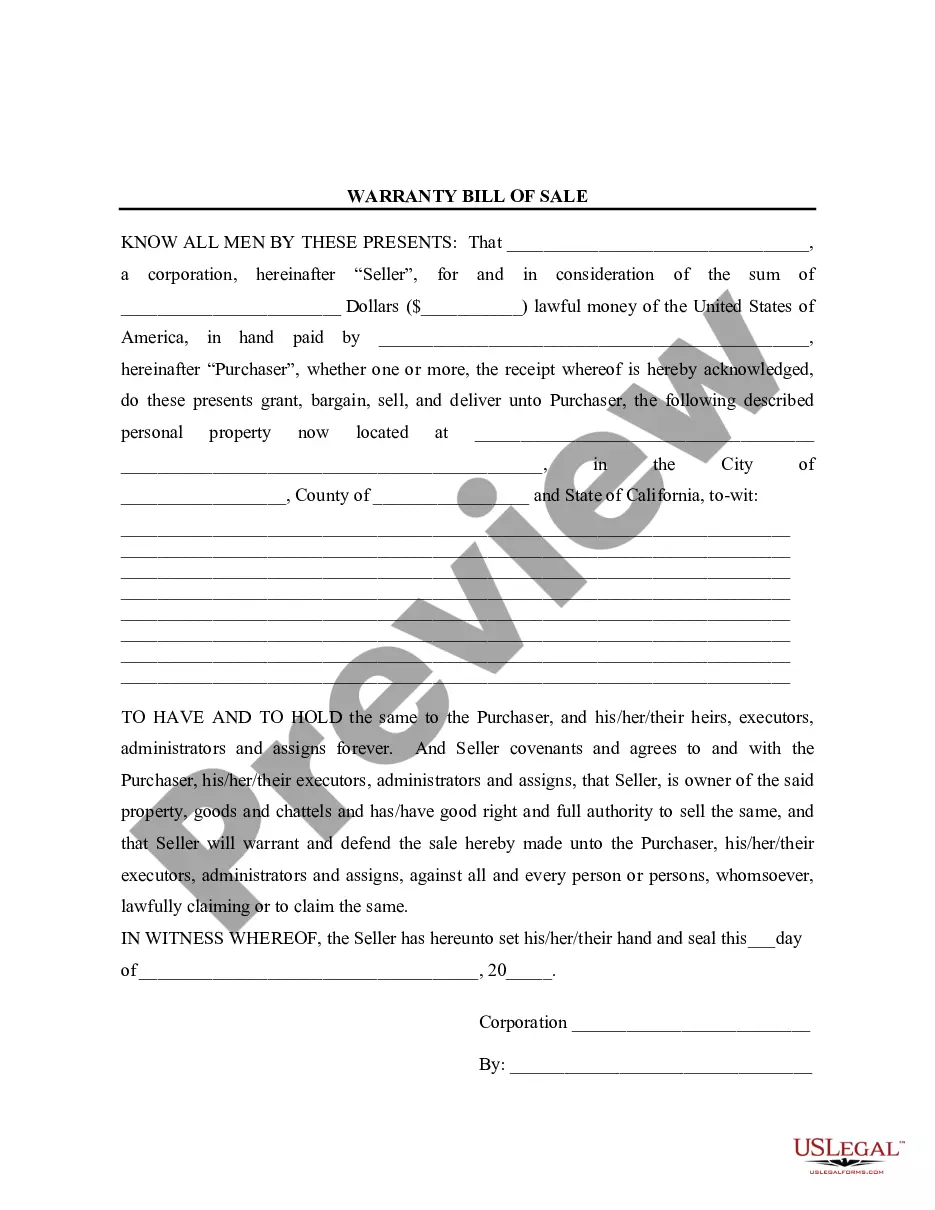

How to fill out Nassau New York Supplemental Employee Stock Ownership Plan Of SPX Corporation?

Dealing with legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Nassau Supplemental Employee Stock Ownership Plan of SPX Corporation, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to choose from in different categories ranging from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any tasks related to document execution straightforward.

Here's how to locate and download Nassau Supplemental Employee Stock Ownership Plan of SPX Corporation.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the template of your choosing is specific to your state/county/area since state regulations can impact the validity of some documents.

- Check the similar forms or start the search over to find the right document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and buy Nassau Supplemental Employee Stock Ownership Plan of SPX Corporation.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Nassau Supplemental Employee Stock Ownership Plan of SPX Corporation, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you have to deal with an exceptionally complicated case, we advise getting an attorney to review your document before executing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!