Tarrant Texas Supplemental Employee Stock Ownership Plan of SPX Corporation

Description

How to fill out Tarrant Texas Supplemental Employee Stock Ownership Plan Of SPX Corporation?

How much time does it normally take you to create a legal document? Since every state has its laws and regulations for every life situation, locating a Tarrant Supplemental Employee Stock Ownership Plan of SPX Corporation suiting all local requirements can be exhausting, and ordering it from a professional attorney is often costly. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Tarrant Supplemental Employee Stock Ownership Plan of SPX Corporation, here you can get any specific document to run your business or personal affairs, complying with your regional requirements. Experts verify all samples for their validity, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Tarrant Supplemental Employee Stock Ownership Plan of SPX Corporation:

- Check the content of the page you’re on.

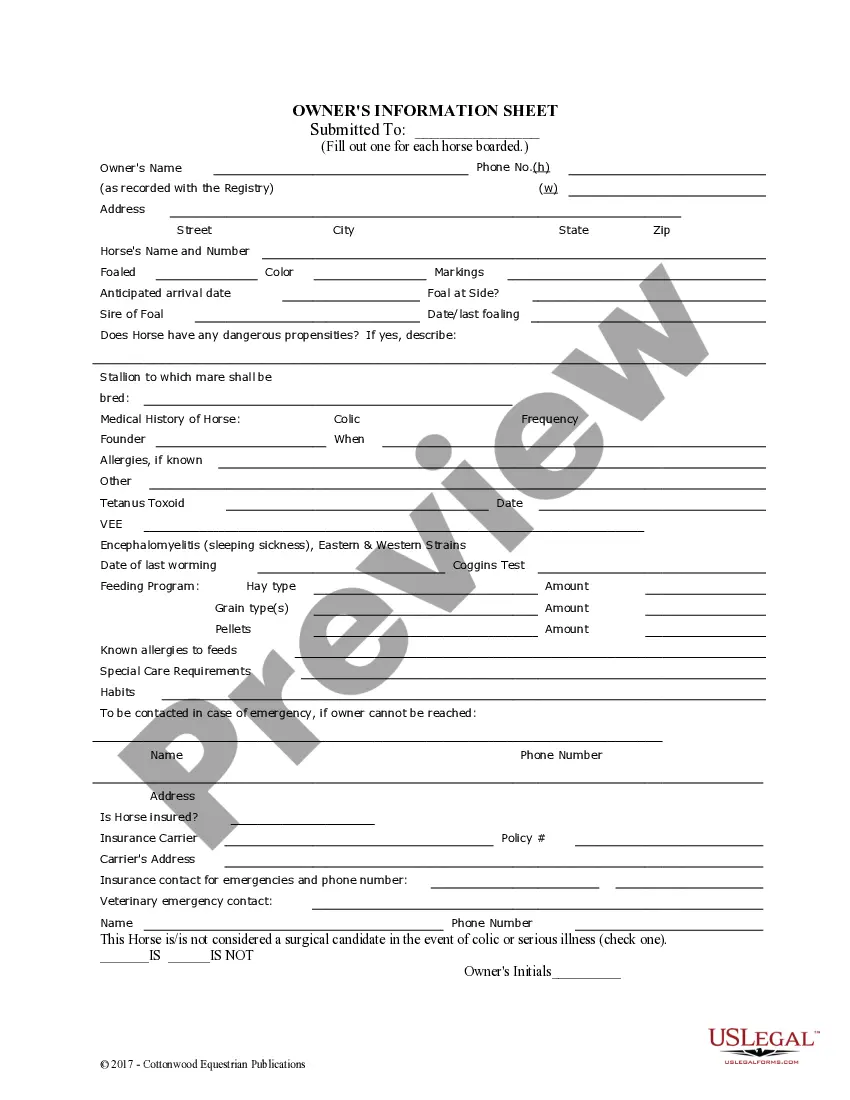

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Tarrant Supplemental Employee Stock Ownership Plan of SPX Corporation.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

For stock plan participants with retail account transactions, Schwab will provide cost basis for covered and non-covered securities, as available, on a Form 1099 Composite statement. For ESPP participants, Schwab provides cost basis information on Substitute Form 1099-B.

How Do I Enter Employee Stock Purchase Plan (ESPP) Sales inYouTube Start of suggested clip End of suggested clip With your return open in turbotax search for 1099-b. And select the jump to link have your 1099-bMoreWith your return open in turbotax search for 1099-b. And select the jump to link have your 1099-b form 3922 for the shares you sold and w-2 or year-end pay stub available for reference.

With ESPPs, the purchase discount for tax purposes is reported to the IRS on Form W-2 and is included in your income in the year of sale. Thus, when you sell the shares, do not make the purchase price your cost basis without following other steps when you complete Form 8949 to report the sale.

IRS Form 3922 Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c) is for informational purposes only and is not entered into your return. You will need this information when you sell the stock, so the form should be kept for your records.

How Do I Enter Employee Stock Purchase Plan (ESPP) Sales inYouTube Start of suggested clip End of suggested clip With your return open in turbotax search for 1099-b. And select the jump to link have your 1099-bMoreWith your return open in turbotax search for 1099-b. And select the jump to link have your 1099-b form 3922 for the shares you sold and w-2 or year-end pay stub available for reference.

When you sell ESPP shares, your employer reports your ESPP income as wages in box 1 of your Form W-2. ESPPs have no withholding for income tax, and Social Security and Medicare taxes do not apply. Whether you had a qualified or disqualified disposition determines how much of the income is on your W-2.

You must report this amount as compensation income on line 7 of your 2021 Form 1040. You must show the sale of the stock on your 2021 Schedule D. It's considered long-term because more than one year passed from the date acquired (January 2, 2020) to the date of sale (January 20, 2021).

You should report a long-term gain on Schedule D of Form 1040. A short-term gain will typically appear in box 1 of your W-2 as ordinary income, and you should file it as wages on Form 1040.

With ESPPs, the purchase discount for tax purposes is reported to the IRS on Form W-2 and is included in your income in the year of sale.