Mecklenburg North Carolina Directors and Officers Liability Insurance is a form of insurance coverage designed to protect company directors and officers from financial losses resulting from legal actions related to their duties and decisions while serving in their respective positions. It provides coverage for defense costs, settlements, and judgments arising from claims such as negligence, breach of fiduciary duty, misrepresentation, and wrongful acts. Directors and officers (D&O) liability insurance in Mecklenburg North Carolina safeguards individuals who hold positions of authority within an organization, including board members, executives, officers, and managers, from personal financial risks arising from their management actions or decisions made on behalf of the company. This coverage is essential since these individuals can be held personally liable for their actions while acting in their official capacities. Here are different types or aspects of Mecklenburg North Carolina Directors and Officers Liability Insurance: 1. Management Liability Insurance: This broad coverage provides protection not only for directors and officers but also for the management team. It includes coverage for claims arising from employment practices, crime, cyber liability, fiduciary liability, and other management-related risks in addition to traditional D&O coverage. 2. Side A Coverage: Side A coverage is designed to protect individual directors and officers when the company is unable to indemnify them (due to financial distress, bankruptcy, or legal constraints). It provides coverage directly to the insured persons, ensuring personal asset protection. 3. Side B Coverage: Side B insurance reimburses the company when it indemnifies directors and officers. This coverage helps safeguard the company's assets by providing reimbursement for the costs it incurs while protecting its executives and officials. 4. Side C Coverage: Also known as entity coverage, Side C coverage protects the company itself as an entity from losses arising from claims against directors and officers. It provides coverage for claims that target the organization due to alleged wrongful acts committed by its executives or officials. 5. Not-for-profit D&O Insurance: This insurance type specifically caters to directors and officers serving in non-profit organizations. It offers protection for claims arising from mismanagement, negligence, or wrongful acts committed by individuals involved in the governance of non-profit entities. Each of these types of Mecklenburg North Carolina Directors and Officers Liability Insurance aims to provide specific coverage based on the unique risks faced by directors, officers, and companies operating in various industries. It is crucial for businesses and organizations to carefully assess their potential liabilities and determine the most appropriate D&O insurance coverage to adequately protect their directors, officers, and their overall financial well-being.

Mecklenburg North Carolina Directors and officers liability insurance

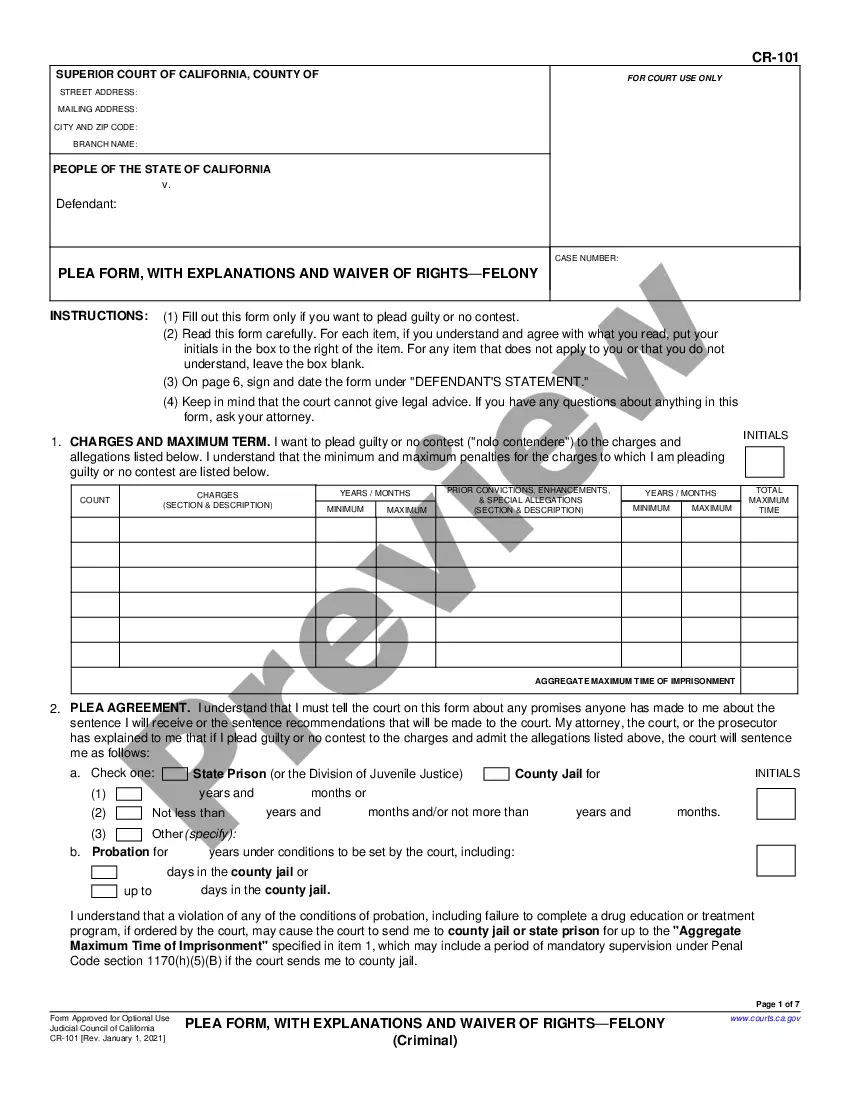

Description

How to fill out Mecklenburg North Carolina Directors And Officers Liability Insurance?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life situations require you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business objective utilized in your region, including the Mecklenburg Directors and officers liability insurance.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Mecklenburg Directors and officers liability insurance will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Mecklenburg Directors and officers liability insurance:

- Ensure you have opened the right page with your local form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the Mecklenburg Directors and officers liability insurance on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs efficiently with the US Legal Forms!