San Bernardino California Directors and Officers Liability Insurance: A Comprehensive Overview Introduction: Directors and Officers Liability Insurance (D&O Insurance) is a specialized coverage designed to protect directors and officers of organizations from legal claims arising out of their employment decisions and managerial actions. San Bernardino, California-based business owners and executives can greatly benefit from having this insurance in place to shield them from potential financial risks and legal obligations. This article offers a detailed description of San Bernardino California Directors and Officers Liability Insurance, outlining its importance, coverage features, and different types available. Key Benefits: Directors and Officers Liability Insurance provides crucial protection for executives, directors, officers, and managers, safeguarding their personal assets and reputation against allegations of wrongful acts committed in their official capacity. With the ever-increasing scrutiny faced by organizations and their leadership, having D&O Insurance is an essential component of comprehensive risk management. It provides coverage for legal defense costs, settlements, and judgments, ensuring financial security throughout the claims process. Coverage Features: D&O Insurance policies in San Bernardino typically encompass three main coverage parts: 1. Side A Coverage: Protects directors and officers when the organization cannot indemnify them directly. This coverage kicks in when the company is legally prohibited from providing indemnification or when it is financially incapable of doing so. 2. Side B Coverage: Reimburses the organization for indemnifying directors and officers against covered claims. It essentially reimburses the company for the amounts it has paid to protect its executives. 3. Side C Coverage: Protects the corporate entity itself, covering claims made directly against the organization. Specific Types of D&O Insurance in San Bernardino, California: 1. Non-Profit D&O Insurance: Designed specifically for directors and officers serving non-profit organizations, including charities, educational institutions, and religious organizations. It addresses the unique risks faced by these entities. 2. Private Company D&O Insurance: Tailored for directors and officers of privately-held companies. It shields executives from risks associated with their management decisions, while also addressing employment-related claims. 3. Public Company D&O Insurance: Aimed at directors and officers of publicly traded companies. It provides coverage for securities claims, including allegations of misrepresentation, insider trading, and investment failures. 4. Financial Institution D&O Insurance: Specifically crafted for directors and officers serving in financial institutions such as banks, credit unions, and insurance companies. It addresses the complex risks and compliance issues unique to these organizations. 5. Healthcare D&O Insurance: Catered to directors and officers serving in the healthcare industry. This coverage offers protection against claims related to malpractice, patient privacy breaches, and regulatory non-compliance. Conclusion: Directors and Officers Liability Insurance plays a crucial role in safeguarding the interests of directors, officers, and executives in San Bernardino, California. By hedging against potential legal claims and offering a safety net for personal assets, this coverage provides peace of mind and reinforces the financial stability of organizations. Understanding the different types available allows businesses to select the most suitable coverage based on their industry, size, and risk profile. Investing in competent D&O Insurance is a proactive step, ensuring business leaders can focus on their responsibilities without constantly worrying about potential legal repercussions.

San Bernardino California Directors and officers liability insurance

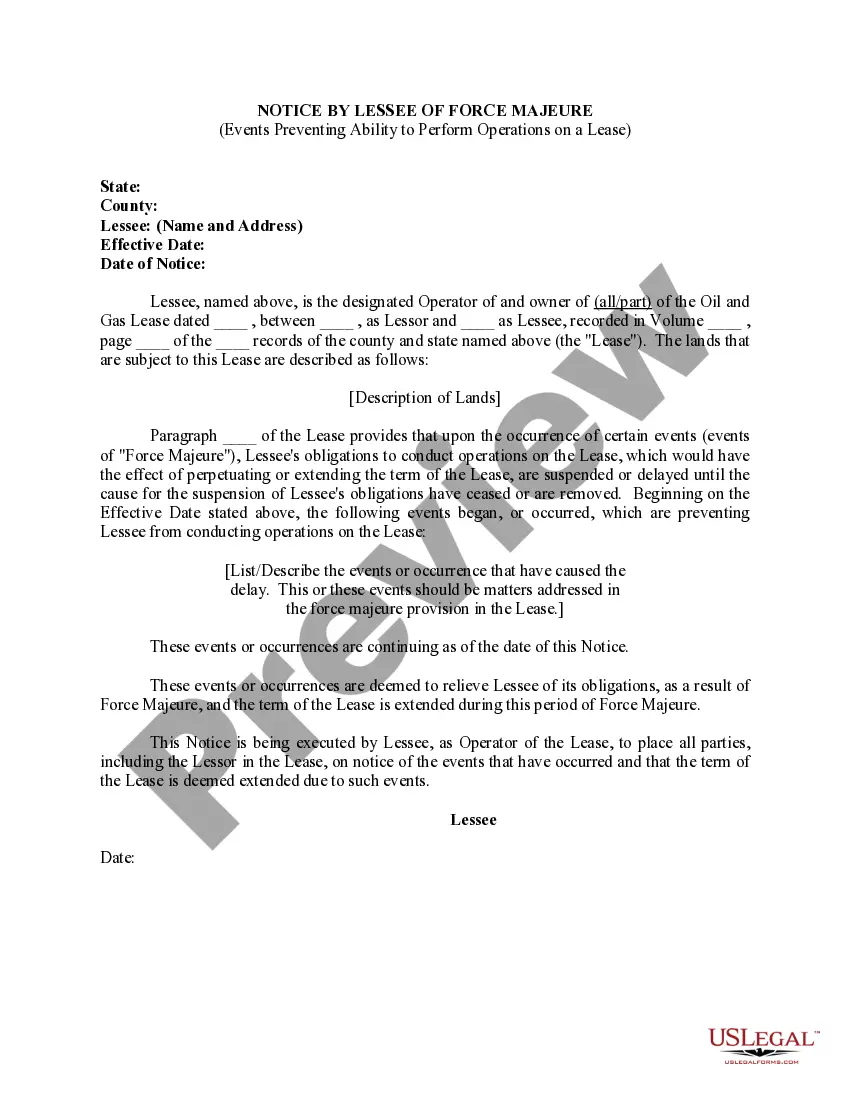

Description

How to fill out San Bernardino California Directors And Officers Liability Insurance?

Creating legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from scratch, including San Bernardino Directors and officers liability insurance, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different categories ranging from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find information resources and tutorials on the website to make any activities related to paperwork completion simple.

Here's how to locate and download San Bernardino Directors and officers liability insurance.

- Take a look at the document's preview and outline (if available) to get a basic idea of what you’ll get after downloading the document.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the legality of some documents.

- Check the related forms or start the search over to locate the correct file.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Choose the option, then a suitable payment method, and buy San Bernardino Directors and officers liability insurance.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate San Bernardino Directors and officers liability insurance, log in to your account, and download it. Of course, our platform can’t replace a lawyer completely. If you need to deal with an extremely challenging situation, we recommend getting a lawyer to check your form before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork with ease!