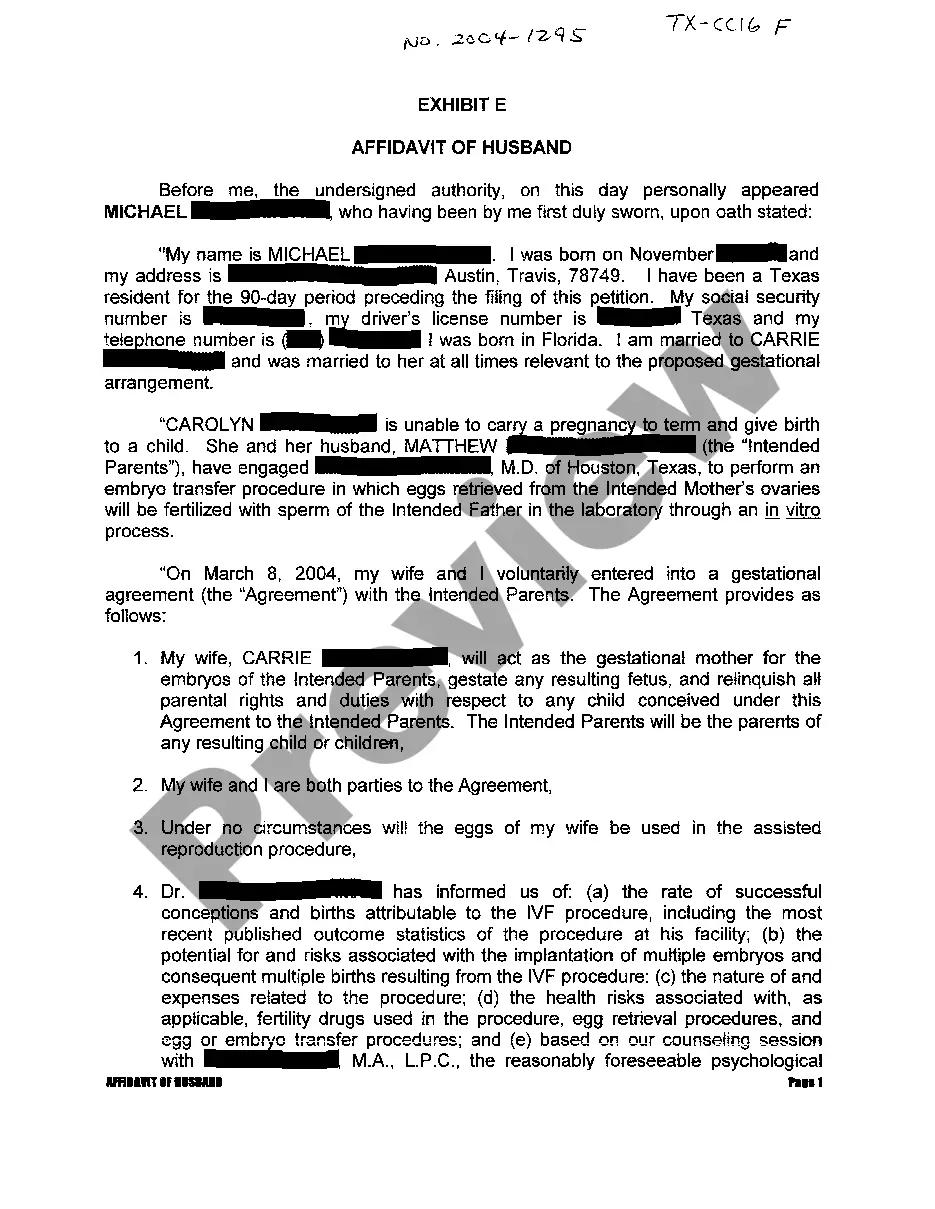

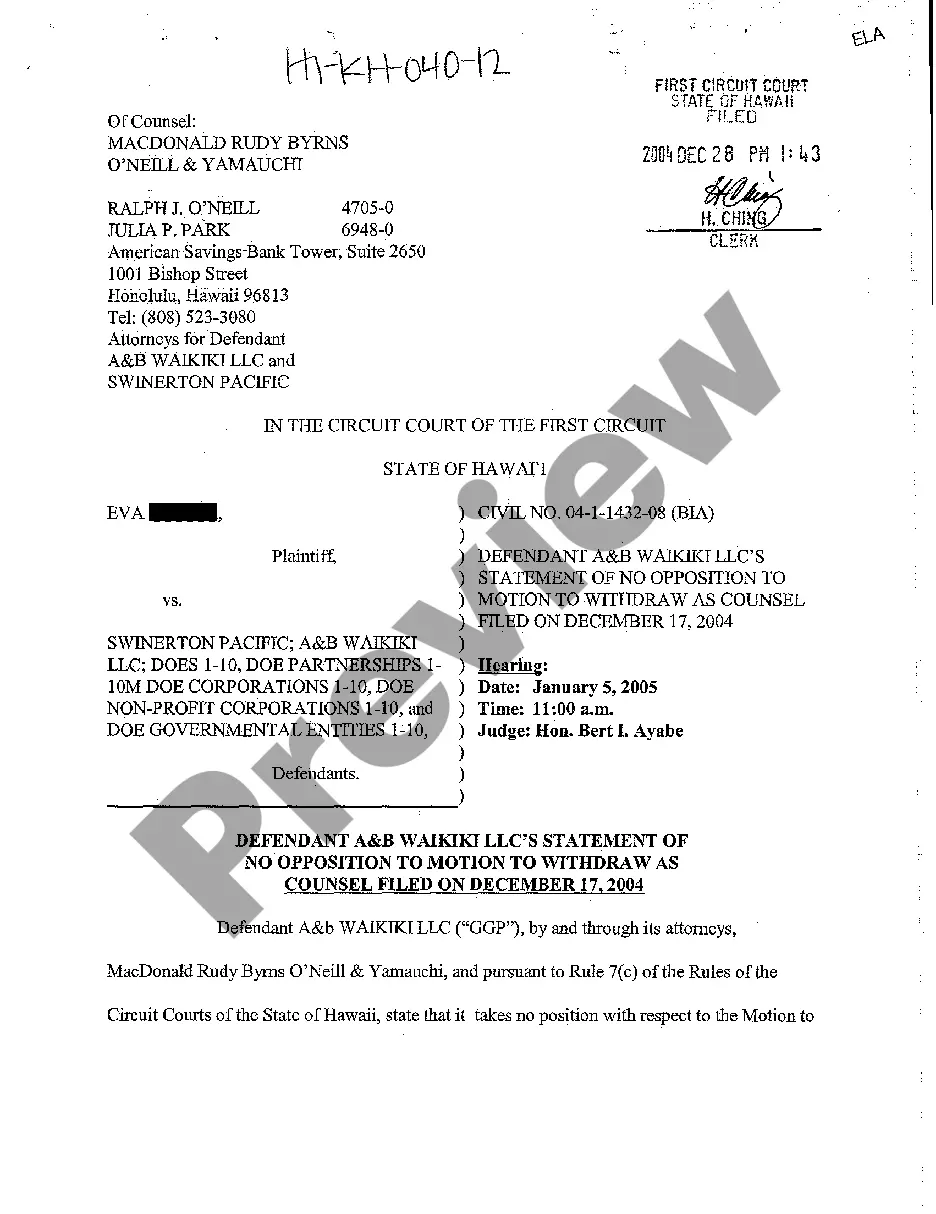

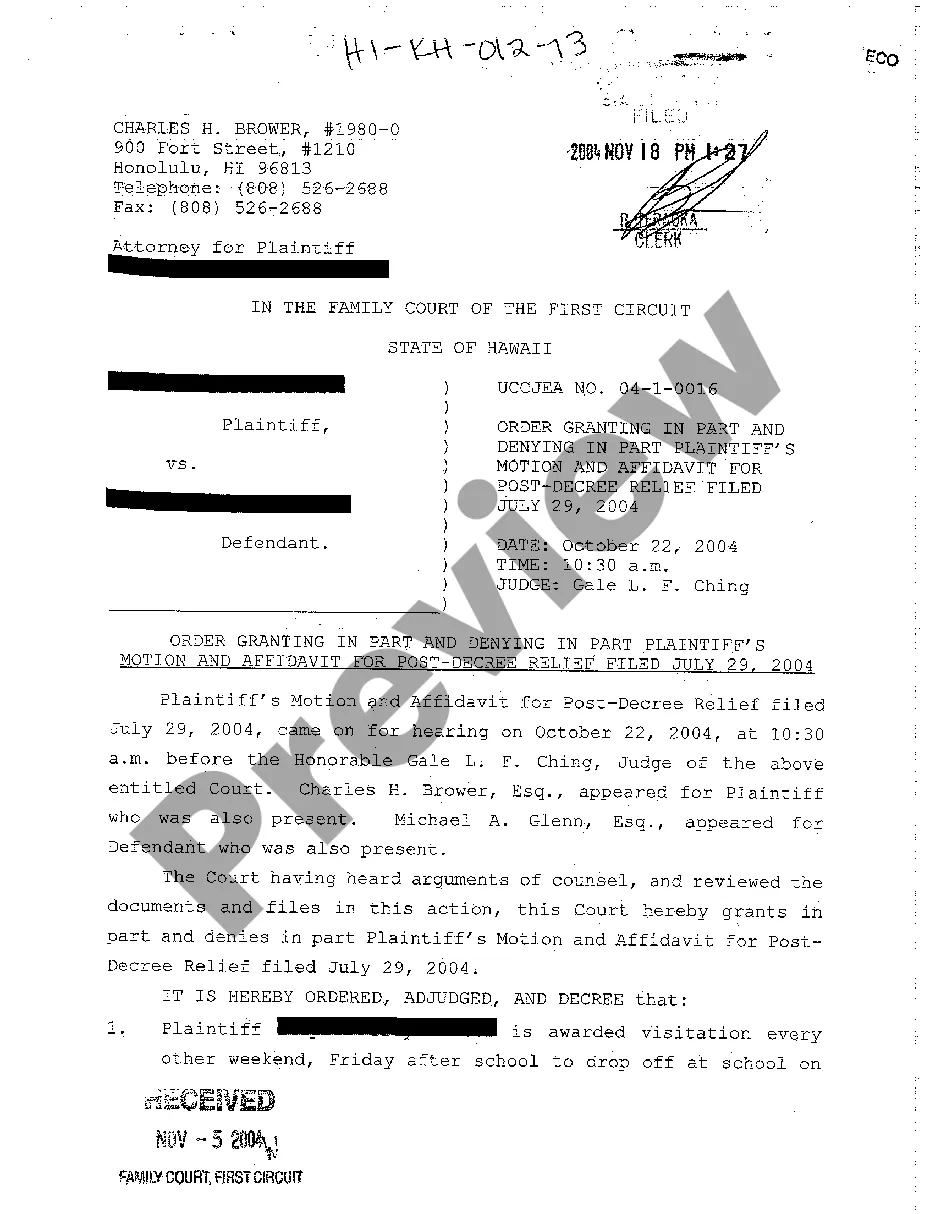

Chicago, Illinois is one of the major hubs for businesses and corporations, housing a diverse range of industries and organizations. To ensure efficient corporate governance, it is crucial to understand the various types of security ownership held by directors, nominees, and officers in Chicago, Illinois. 1. Sole Ownership: Sole ownership refers to securities held exclusively by an individual without any shared ownership. In Chicago, Illinois, directors, nominees, and officers may acquire stocks, bonds, or other securities solely in their name, indicating full ownership and control over those assets. 2. Shared Ownership: Shared ownership involves securities held jointly by multiple individuals, either through partnerships or collective ownership structures. In Chicago, Illinois, directors, nominees, and officers can collectively own securities by forming partnerships, limited liability companies (LCS), or trusts. These entities allow multiple individuals to hold partial ownership stakes, combining their resources and expertise for shared investment purposes. 3. Stock Option Plans: Stock option plans are a common form of security ownership granted to directors, nominees, and officers as a part of their compensation package. These plans enable individuals to purchase a specified number of company shares at a predetermined price (exercise price) within a set timeframe. In Chicago, Illinois, stock option plans encourage directors, nominees, and officers to align their interests with the company's performance and shareholders' value. 4. Restricted Stock Units (RSS): Restricted stock units are another form of security ownership available to directors, nominees, and officers. RSS represents a promise to deliver company shares to individuals at a future date or upon the occurrence of certain conditions, such as achieving performance targets or remaining within the company for a specific period. In Chicago, Illinois, RSS offer long-term incentives to directors, nominees, and officers, ensuring their commitment to the company's success. 5. Stock Purchase Programs: Some companies in Chicago, Illinois may offer stock purchase programs to directors, nominees, and officers, allowing them to buy shares at a discounted price. These programs typically include regular contributions from an individual's salary, which are used to purchase company stock periodically. By participating in such programs, directors, nominees, and officers can accumulate shares over time and benefit from potential stock price appreciation. 6. Fiduciary Responsibilities: In addition to ownership structures, directors, nominees, and officers in Chicago, Illinois also bear fiduciary responsibilities towards the company and its shareholders. Fiduciary duties include acting in the best interest of the company, avoiding conflicts of interest, and maintaining confidentiality regarding sensitive business matters. These duties ensure that directors, nominees, and officers prioritize the success and sustainability of the organization they serve. In summary, the security ownership of directors, nominees, and officers in Chicago, Illinois encompasses sole ownership, shared ownership through partnerships or entities, stock option plans, restricted stock units, stock purchase programs, and fiduciary responsibilities. These various ownership structures and arrangements contribute to the overall corporate governance and align the interests of key personnel with the company and its shareholders.

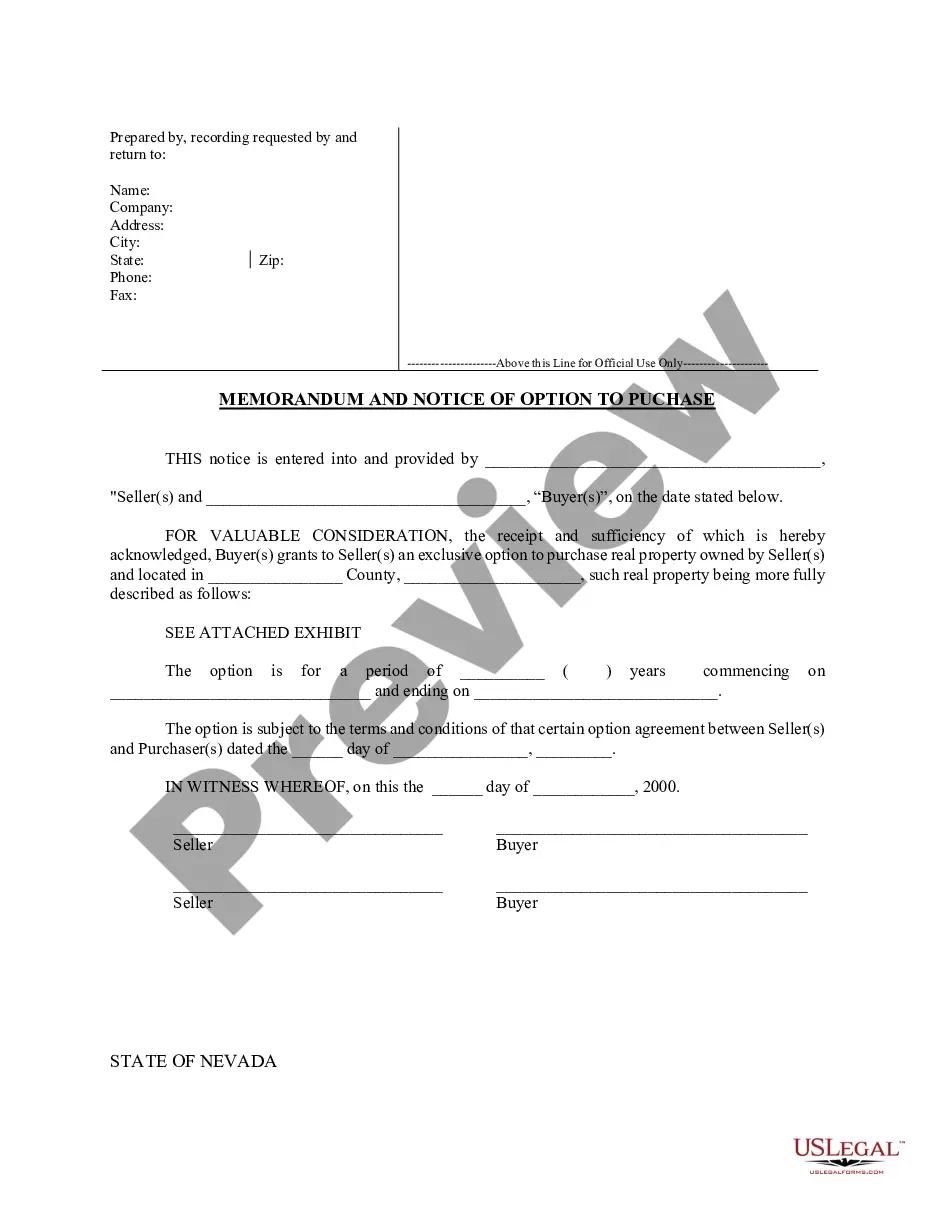

Chicago Illinois Security ownership of directors, nominees and officers showing sole and shared ownership

Description

How to fill out Chicago Illinois Security Ownership Of Directors, Nominees And Officers Showing Sole And Shared Ownership?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that varies throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Chicago Security ownership of directors, nominees and officers showing sole and shared ownership.

Locating forms on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Chicago Security ownership of directors, nominees and officers showing sole and shared ownership will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Chicago Security ownership of directors, nominees and officers showing sole and shared ownership:

- Ensure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Chicago Security ownership of directors, nominees and officers showing sole and shared ownership on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!