Bexar Texas Private Placement Financing is a form of funding for businesses or projects located in Bexar County, Texas. Private Placement Financing refers to the process of raising capital through the sale of securities to a select group of private investors, rather than through public offerings in the stock market. This type of financing allows businesses to access funds while maintaining a level of discretion and control over the investment process. There are several types of Bexar Texas Private Placement Financing options available: 1. Equity Private Placement: In this type of financing, businesses sell ownership stake (equity) in their company to private investors. In return, investors receive shares of the company and potential future profits. 2. Debt Private Placement: Here, businesses raise funds by issuing debt securities, such as bonds or promissory notes, to private investors. The investors act as lenders and receive periodic interest payments along with the principal amount at maturity. 3. Convertible Private Placement: This financing option combines elements of both equity and debt. Businesses issue securities, usually convertible bonds or preferred stock, which can be later converted into equity shares at a predetermined price or upon certain conditions. 4. Mezzanine Private Placement: Mezzanine financing lies between debt and equity, typically taking the form of subordinated debt or preferred equity. It provides businesses with additional capital while giving investors potential higher returns than traditional debt financing. Bexar Texas Private Placement Financing can benefit businesses by providing access to capital for various purposes, such as expanding operations, launching new products, or acquiring assets. It allows businesses to negotiate terms directly with investors, potentially securing more favorable terms than traditional lending institutions. However, it is essential for businesses seeking private placement financing to have a well-prepared business plan and financial projections to attract potential investors. In Bexar County, Texas, private placement financing can be facilitated by local financial institutions, venture capital firms, or private equity companies that specialize in providing these types of funding options for businesses in the region. It is crucial for businesses to conduct thorough research and seek professional advice to identify the most suitable private placement financing option for their unique needs in Bexar County, Texas.

Bexar Texas Private Placement Financing

Description

How to fill out Bexar Texas Private Placement Financing?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare certain documentation corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal documents for any individual or business occurrence. All files are collected by state and area of use, so picking a copy like Bexar Private Placement Financing is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Bexar Private Placement Financing. Adhere to the guidelines below:

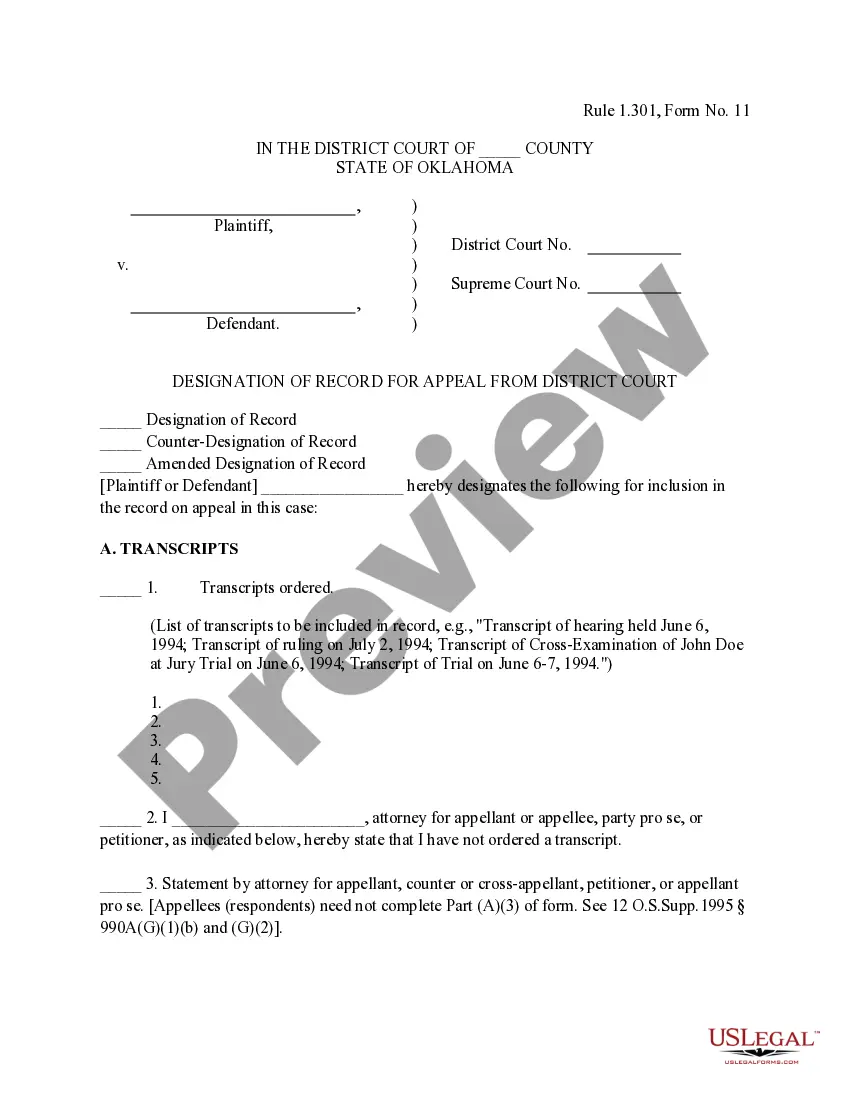

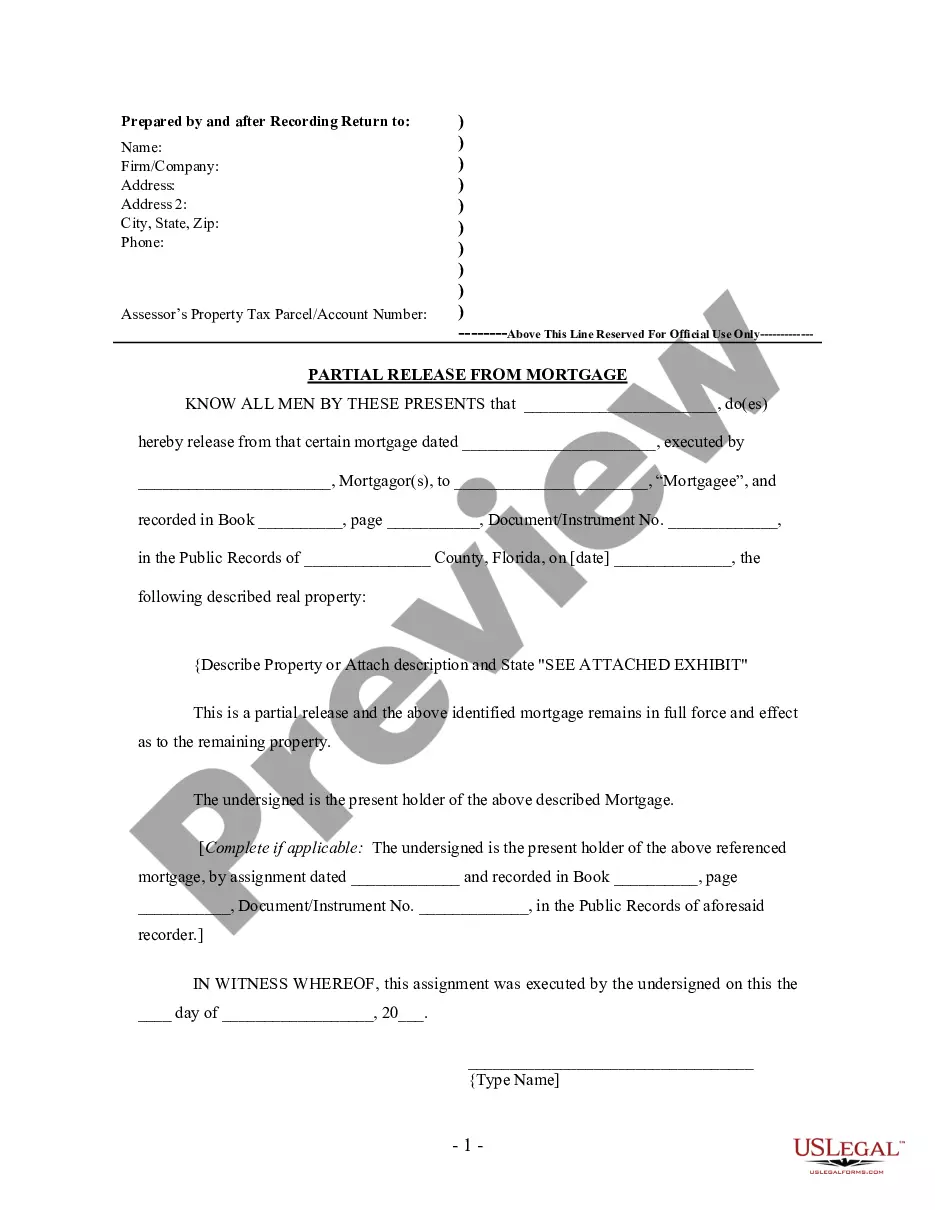

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Use the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the right one.

- Select the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Bexar Private Placement Financing in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!