Riverside California Private Placement Financing, also known as direct placement or private placement, is a method utilized by businesses to raise capital by offering securities to a select group of accredited investors. This form of financing allows businesses in Riverside, California, to attract investment without conducting a public offering, ultimately giving them more control over the terms and conditions of the investment and potentially reducing costs associated with regulatory compliance. Private Placement Financing in Riverside, California, encompasses various types depending on the specific securities being offered and the target investors: 1. Equity Private Placement: This refers to the issuance of company shares or ownership stakes to accredited investors in exchange for capital. These investors become partial owners of the business and may receive dividends or capital gains if the company performs well. 2. Debt Private Placement: In this form, businesses raise capital by issuing debt securities, such as corporate bonds or promissory notes, to accredited investors. The issuing company agrees to repay the principal amount and interest over a predetermined period. Debt private placement can be an attractive option for businesses looking to fund expansion or meet short-term financial obligations. 3. Convertible Securities Private Placement: This type of financing involves offering convertible securities, such as convertible bonds or preferred stocks, to investors. These securities can be converted into common equity shares at a later stage depending on the terms outlined in the offering. Convertible securities private placement provides the potential for investors to benefit from future company growth. 4. Real Estate Private Placement: This form of private placement primarily targets real estate developers or investors seeking opportunities in Riverside, California's real estate market. It involves offering securities related to real estate projects, such as residential or commercial properties, to accredited investors. Real estate private placement financing can help fund property acquisitions, construction, or renovations. When considering Riverside California Private Placement Financing, it is crucial for businesses to comply with securities laws and regulations established by the Securities and Exchange Commission (SEC). These laws are in place to protect investors and ensure adequate disclosure of information. Seeking legal and financial advice from professionals experienced in private placements is advisable to mitigate risks and ensure regulatory compliance. The terms, conditions, and investor requirements for private placement offerings are typically outlined in a private placement memorandum (PPM), a comprehensive document that potential investors receive before deciding to invest.

Riverside California Private Placement Financing

Description

How to fill out Riverside California Private Placement Financing?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any personal or business purpose utilized in your region, including the Riverside Private Placement Financing.

Locating forms on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. After that, the Riverside Private Placement Financing will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Riverside Private Placement Financing:

- Make sure you have opened the proper page with your local form.

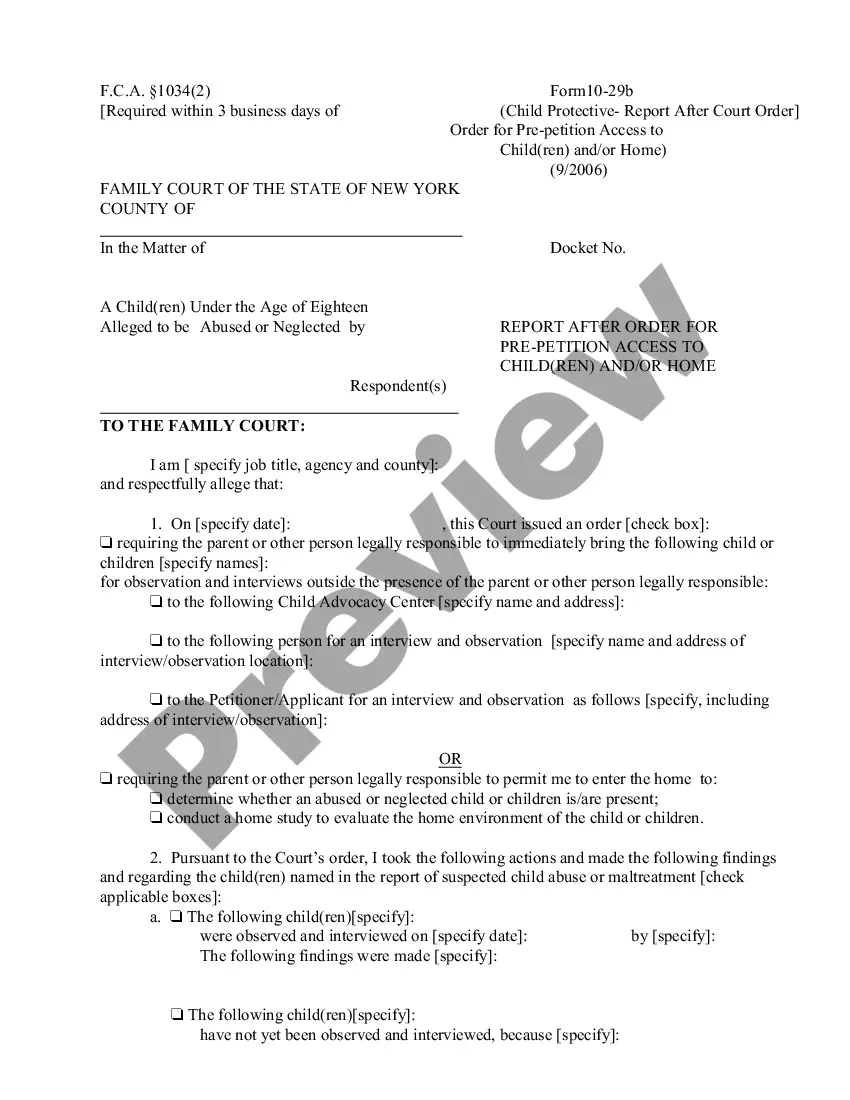

- Utilize the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Riverside Private Placement Financing on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!