Salt Lake Utah Private Placement Financing is a financial arrangement wherein businesses seek capital investment directly from private investors. This type of financing is primarily used by small and medium-sized enterprises (SMEs) or startups in Salt Lake City, Utah, to fund their operations, expansion plans, or new product development. Private Placement Financing provides an alternative to traditional methods of funding, such as bank loans or public offers, by targeting select private investors. These investors can include high-net-worth individuals, venture capital firms, private equity firms, or angel investors. The advantage of private placement financing is that it allows businesses to secure funds quickly, bypassing the lengthy and cumbersome process often associated with obtaining traditional financing. In Salt Lake City, Utah, there are several types of private placement financing options available: 1. Equity Private Placement: This involves offering shares or ownership stakes in the company to investors in exchange for capital investment. Investors become partial owners and share in the profits and losses of the business. Equity private placement is typically suitable for businesses with high growth potential or those looking for long-term partnerships. 2. Debt Private Placement: In this type of financing, businesses issue bonds, notes, or other debt securities to investors. Investors provide capital in the form of loans, which are repaid over a specified period with interest. Debt private placement is an attractive option for businesses needing capital without diluting ownership or relinquishing control. 3. Mezzanine Financing: Mezzanine financing combines elements of both debt and equity financing. It involves offering a combination of debt instruments (subordinated loans or convertible bonds) and equity options to investors. This type of financing is commonly used to bridge the gap between senior debt and equity financing, providing an additional layer of capital for expansion or acquisition purposes. 4. Preferred Equity Financing: Preferred equity private placement involves issuing preferred shares offering certain rights and privileges to investors, such as priority in dividends or liquidation proceeds. Preferred equity sits between debt and common equity, providing a fixed return for investors while still allowing them to participate in the growth of the business. These various types of private placement financing serve different purposes and cater to the specific needs and preferences of businesses in Salt Lake City, Utah. They offer flexibility, speed, and access to capital for businesses looking to expand, innovate, or launch new products and services. It is essential for businesses to consult with financial advisors or investment banks to determine the most suitable private placement financing option for their specific requirements.

Salt Lake Utah Private Placement Financing

Description

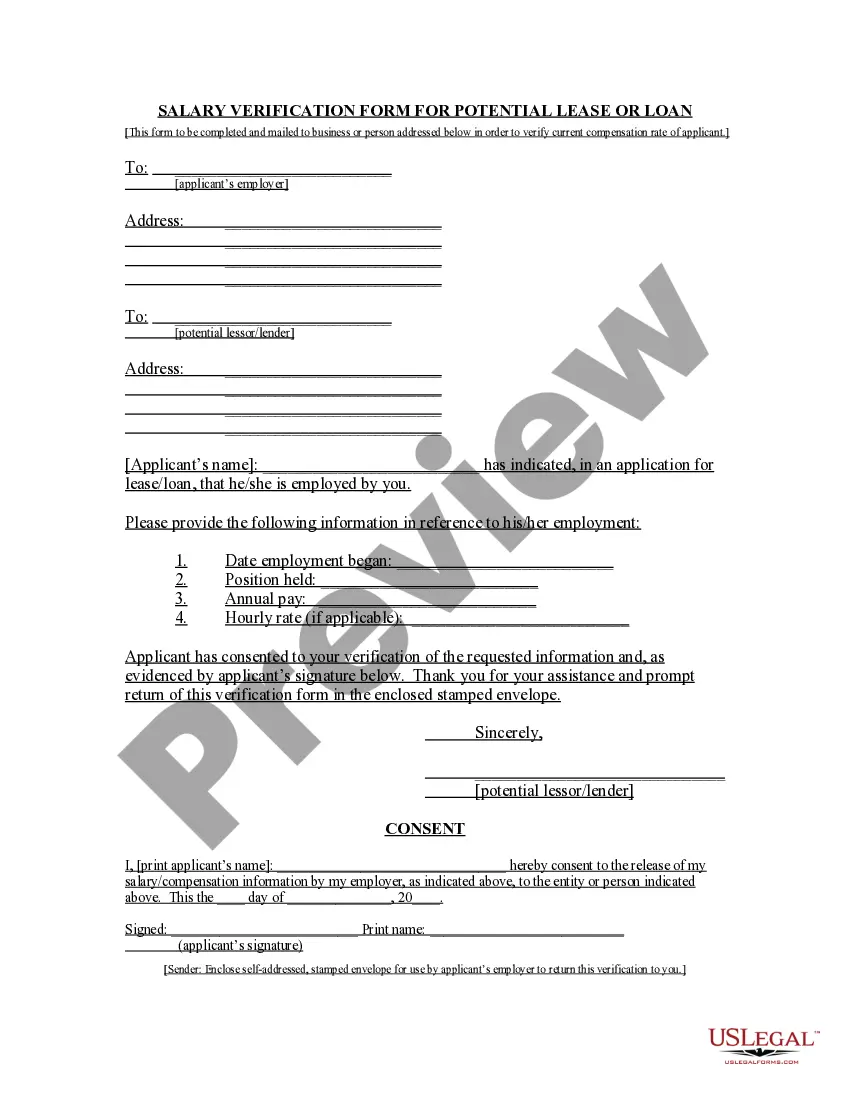

How to fill out Salt Lake Utah Private Placement Financing?

If you need to find a reliable legal document provider to find the Salt Lake Private Placement Financing, look no further than US Legal Forms. Whether you need to start your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of supporting materials, and dedicated support team make it simple to get and execute different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply select to search or browse Salt Lake Private Placement Financing, either by a keyword or by the state/county the form is created for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Salt Lake Private Placement Financing template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes this experience less costly and more affordable. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Salt Lake Private Placement Financing - all from the comfort of your sofa.

Sign up for US Legal Forms now!