San Diego California Private Placement Financing refers to a funding method used by businesses or individuals in the region to raise capital privately from accredited investors. It involves the sale of securities, such as stocks, bonds, or limited partnership interests, to a specific group of investors without making a public offering. Private placement financing offers various advantages, including flexibility in structuring the deal, reduced regulatory requirements, and the ability to access capital quickly. In San Diego, there are different types of private placement financing options available to cater to the specific needs of businesses and investors. These include: 1. Equity-based financing: This type of private placement involves the sale of company shares to investors in exchange for capital. It allows businesses to raise funds without taking on debt. Equity investors become partial owners and may have the potential for capital appreciation. 2. Debt-based financing: San Diego businesses can opt for private placement financing through debt instruments, such as corporate bonds or promissory notes. Investors provide capital in exchange for regular interest payments and the return of principal at maturity. This type of financing is suitable for companies seeking to raise funds without diluting ownership. 3. Mezzanine financing: Mezzanine financing combines elements of both equity and debt financing. It involves selling subordinate debt or preferred equity to investors, providing them with a higher potential return in exchange for taking on more risk. Mezzanine financing bridges the gap between senior debt and equity financing and is commonly used to fund growth initiatives or acquisitions. 4. Real estate private placement: This type of private placement financing is specifically geared towards real estate development and investment projects in San Diego. Investors contribute capital to acquire or develop properties, and in return, they benefit from potential rental income, property value appreciation, and tax advantages. 5. Resource-based financing: San Diego, with its proximity to natural resources and renewable energy projects, offers resource-based private placement financing. It involves investment opportunities in sectors such as mining, oil and gas, solar power, wind energy, and other natural resource-based ventures. Private placement financing enables San Diego businesses to secure the necessary funds for various purposes, such as expanding operations, launching new products or services, or restructuring debt. It is important for businesses considering private placement to work closely with legal and financial advisors to ensure compliance with securities laws and regulations. Keywords: San Diego California, private placement financing, equity-based financing, debt-based financing, mezzanine financing, real estate private placement, resource-based financing, raising capital, accredited investors, securities, flexibility, regulatory requirements, ownership, corporate bonds, promissory notes, subordinate debt, preferred equity, real estate development, renewable energy projects, mining, oil and gas, solar power, wind energy, natural resources.

San Diego California Private Placement Financing

Description

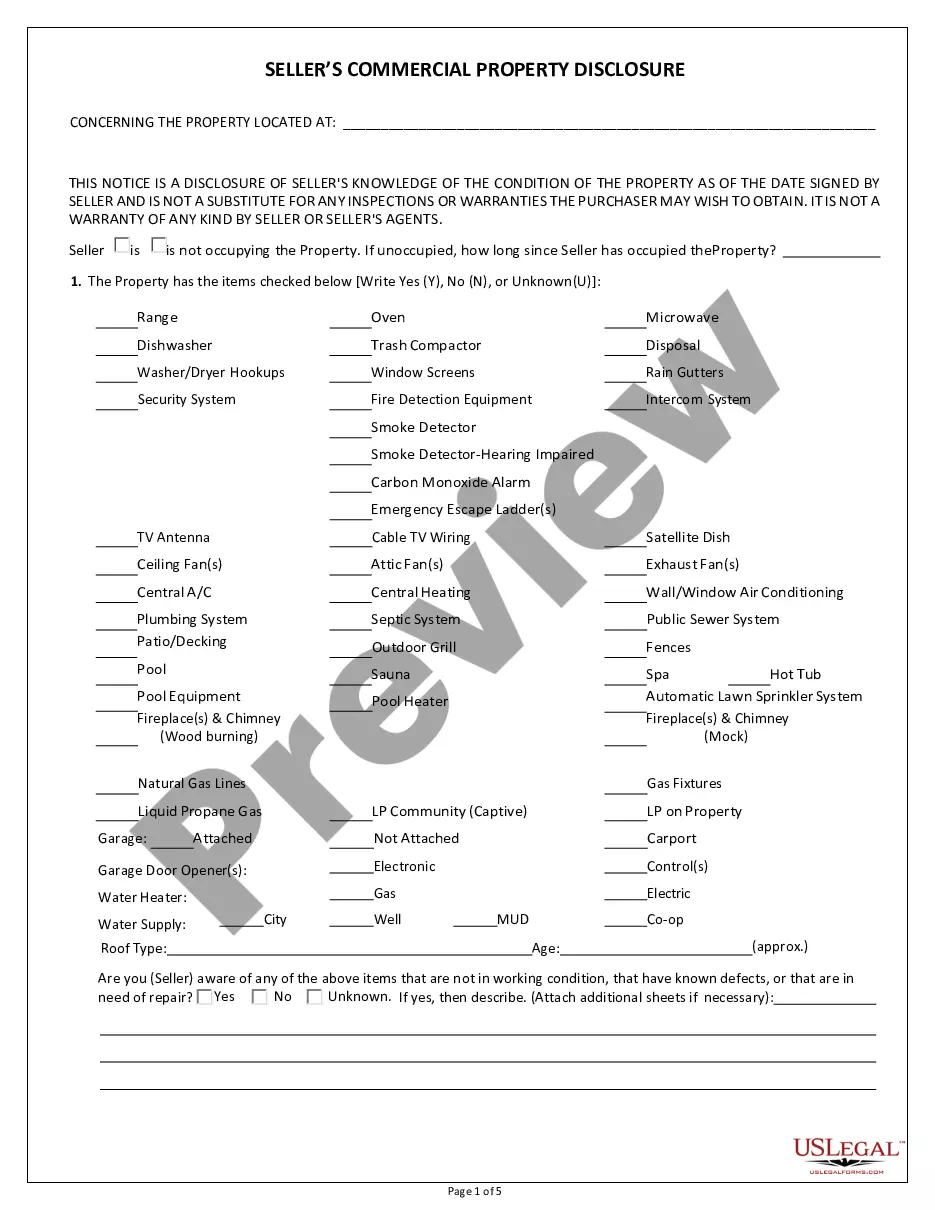

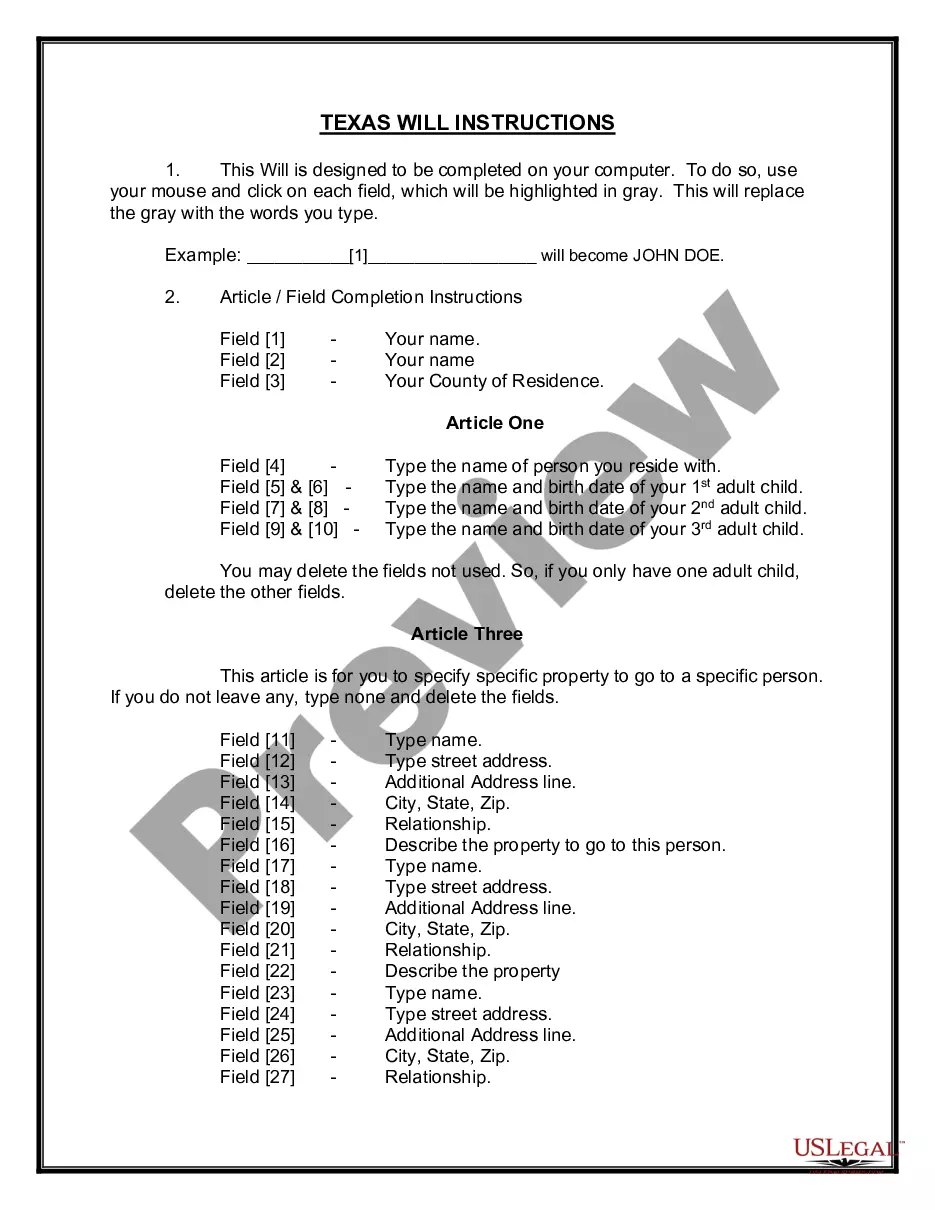

How to fill out San Diego California Private Placement Financing?

If you need to get a reliable legal document supplier to obtain the San Diego Private Placement Financing, consider US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the appropriate form.

- You can search from over 85,000 forms categorized by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support make it easy to get and execute various documents.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply select to search or browse San Diego Private Placement Financing, either by a keyword or by the state/county the document is intended for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the San Diego Private Placement Financing template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Register an account and select a subscription option. The template will be immediately available for download once the payment is processed. Now you can execute the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive collection of legal forms makes this experience less costly and more affordable. Create your first company, organize your advance care planning, create a real estate contract, or complete the San Diego Private Placement Financing - all from the convenience of your sofa.

Sign up for US Legal Forms now!