Contra Costa California Stockholder Derivative Actions: A Comprehensive Overview of the Different Types In Contra Costa, California, stockholder derivative actions refer to lawsuits filed by shareholders on behalf of a corporation against its directors or officers for alleged wrongdoing. These actions aim to hold errant individuals accountable and recover damages for the corporation's benefit. Keywords: Contra Costa California, stockholder derivative actions, lawsuits, shareholders, corporation, directors, officers, alleged wrongdoing, damages, accountability. 1. Standard Stockholder Derivative Actions: Standard stockholder derivative actions in Contra Costa, California occur when shareholders bring claims against directors or officers for breaching their fiduciary duties, acting in bad faith, neglecting responsibilities, or engaging in fraudulent activities. The lawsuits seek to enforce the company's rights and recover financial losses caused by such misconduct. Keywords: Standard stockholder derivative actions, Contra Costa, California, shareholders, directors, officers, fiduciary duties, bad faith, neglect, fraudulent activities, financial losses. 2. Demand Futility Stockholder Derivative Actions: Demand futility stockholder derivative actions arise when shareholders believe that making a demand to the corporation's directors or officers to initiate legal action would be futile. This commonly occurs when the alleged wrongdoers hold significant control over the company's board or when the alleged misconduct implicates a large portion of the board. Keywords: Demand futility stockholder derivative actions, Contra Costa, California, shareholders, corporation, directors, officers, legal action, futile demand, alleged wrongdoers, board control, large-scale misconduct. 3. Derivative Actions Asserting Breach of Duty of Loyalty: Derivative actions asserting breach of duty of loyalty focus on situations where directors or officers prioritize their personal interests over those of the corporation. This could involve engaging in self-dealing transactions, misappropriating corporate assets, or taking advantage of corporate opportunities for personal gain. Keywords: Derivative actions, breach of duty, loyalty, Contra Costa, California, directors, officers, personal interests, self-dealing transactions, misappropriation, corporate assets, personal gain, corporate opportunities. 4. Derivative Actions Asserting Breach of Duty of Care: Derivative actions asserting breach of duty of care typically involve allegations that directors or officers failed to exercise the level of competence and care expected in their decision-making processes. These claims often arise when decisions result in significant financial losses or other harm to the corporation. Keywords: Derivative actions, breach of duty, care, Contra Costa, California, directors, officers, decision-making, competence, care, financial losses, harm to corporation. 5. Corporate Waste Stockholder Derivative Actions: Corporate waste stockholder derivative actions focus on cases where directors or officers squander corporate assets, misuse funds, or engage in extravagant or unnecessary expenditures, causing financial harm to the corporation. Keywords: Corporate waste stockholder derivative actions, Contra Costa, California, directors, officers, corporate assets, misuse of funds, extravagant expenditures, unnecessary expenditures, financial harm. 6. Insider Trading Stockholder Derivative Actions: Insider trading stockholder derivative actions involve claims against directors or officers who utilize non-public, material information to make unauthorized stock trades for personal gain. These actions aim to protect the interests of the corporation and prevent unfair advantages gained through illegal insider trading. Keywords: Insider trading stockholder derivative actions, Contra Costa, California, directors, officers, non-public information, material information, unauthorized stock trades, personal gain, corporation's interests, illegal insider trading. By understanding these various types of Contra Costa California stockholder derivative actions, shareholders can better navigate their legal options in seeking justice and safeguarding the interests of the corporation.

Contra Costa California Stockholder derivative actions

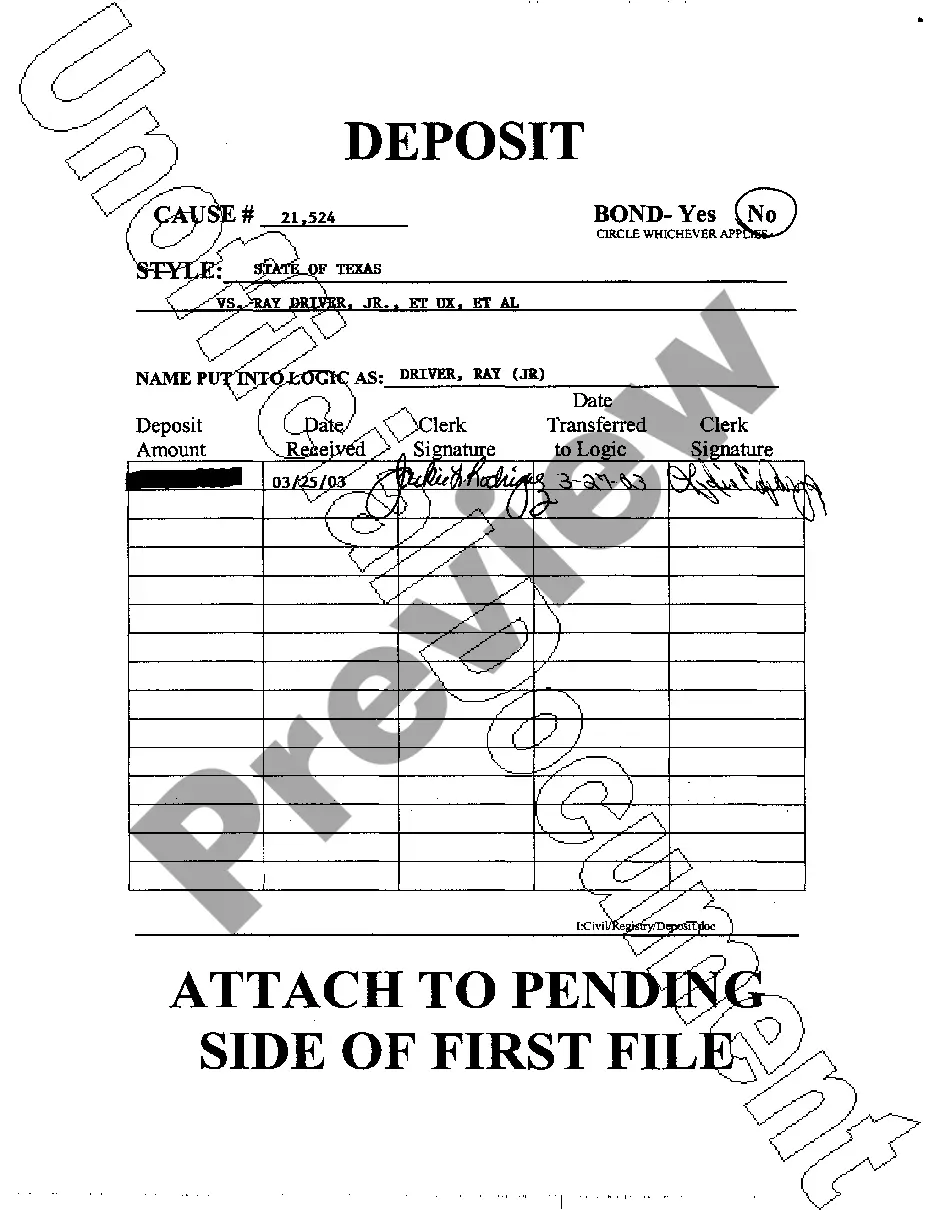

Description

How to fill out Contra Costa California Stockholder Derivative Actions?

Laws and regulations in every area differ from state to state. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the Contra Costa Stockholder derivative actions, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for different life and business scenarios. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Contra Costa Stockholder derivative actions from the My Forms tab.

For new users, it's necessary to make some more steps to get the Contra Costa Stockholder derivative actions:

- Examine the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the document once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!