Fairfax Virginia Stockholder Derivative Actions: A Detailed Description Fairfax, Virginia is a city located in the northern part of the state. It is known for its vibrant business community and being home to various corporations and financial institutions. Stockholder derivative actions refer to a legal mechanism through which shareholders can sue company directors and officers on behalf of the company, challenging their actions or decisions that may be detrimental to shareholders' interests. Here, we will delve into the details of Fairfax Virginia Stockholder Derivative Actions, including their types and relevant keywords. Stockholder derivative actions in Fairfax, Virginia are governed by the Virginia Stock Corporation Act (CSCA), which provides shareholders with a means to hold corporate directors accountable for actions that harm the corporation and its stockholders. These actions can be initiated when directors and officers breach their fiduciary duty or engage in fraudulent activities that cause financial harm to the company or its shareholders. Keywords: 1. Fairfax, Virginia: This vibrant city in Northern Virginia serves as the backdrop for stockholder derivative actions taking place within the jurisdiction. 2. Stockholder Derivative Actions: These legal actions are brought by shareholders on behalf of the company against the responsible directors and officers. 3. Virginia Stock Corporation Act (CSCA): The statutory framework that governs stockholder derivative actions in Fairfax, Virginia and determines the rights and responsibilities of shareholders and directors. 4. Corporate Directors and Officers: The individuals responsible for the management and decision-making within a corporation, who can be held accountable through stockholder derivative actions. 5. Fiduciary Duty: The legal obligation of directors and officers to act in the best interest of the corporation and its shareholders, failure of which can be subject to a stockholder derivative action. 6. Fraudulent Activities: Actions taken by directors and officers that involve misrepresentation, deception, or intentional harm to the corporation, which can lead to a stockholder derivative action. Types of Fairfax Virginia Stockholder Derivative Actions: 1. Breach of Fiduciary Duty: Shareholders can file derivative actions when directors or officers fail to act in the best interests of the company or engage in self-dealing, conflicts of interest, or negligence that harm the corporation. 2. Fraud and Misrepresentation: Derivative actions can be initiated when the directors or officers intentionally deceive shareholders through false statements, manipulating financial records, or other fraudulent activities that cause financial harm to the company. 3. Insider Trading: If directors or officers engage in illegal insider trading, using non-public information to gain personal profits at the expense of the corporation or other shareholders, stockholder derivative actions can be pursued. Overall, stockholder derivative actions in Fairfax, Virginia offer a legal recourse for shareholders to protect their investments and challenge improper actions taken by directors and officers. By understanding the legal framework and the different types of derivative actions, shareholders can seek justice and enhance transparency within the corporate governance structure of Fairfax's thriving business community.

Fairfax Virginia Stockholder derivative actions

Description

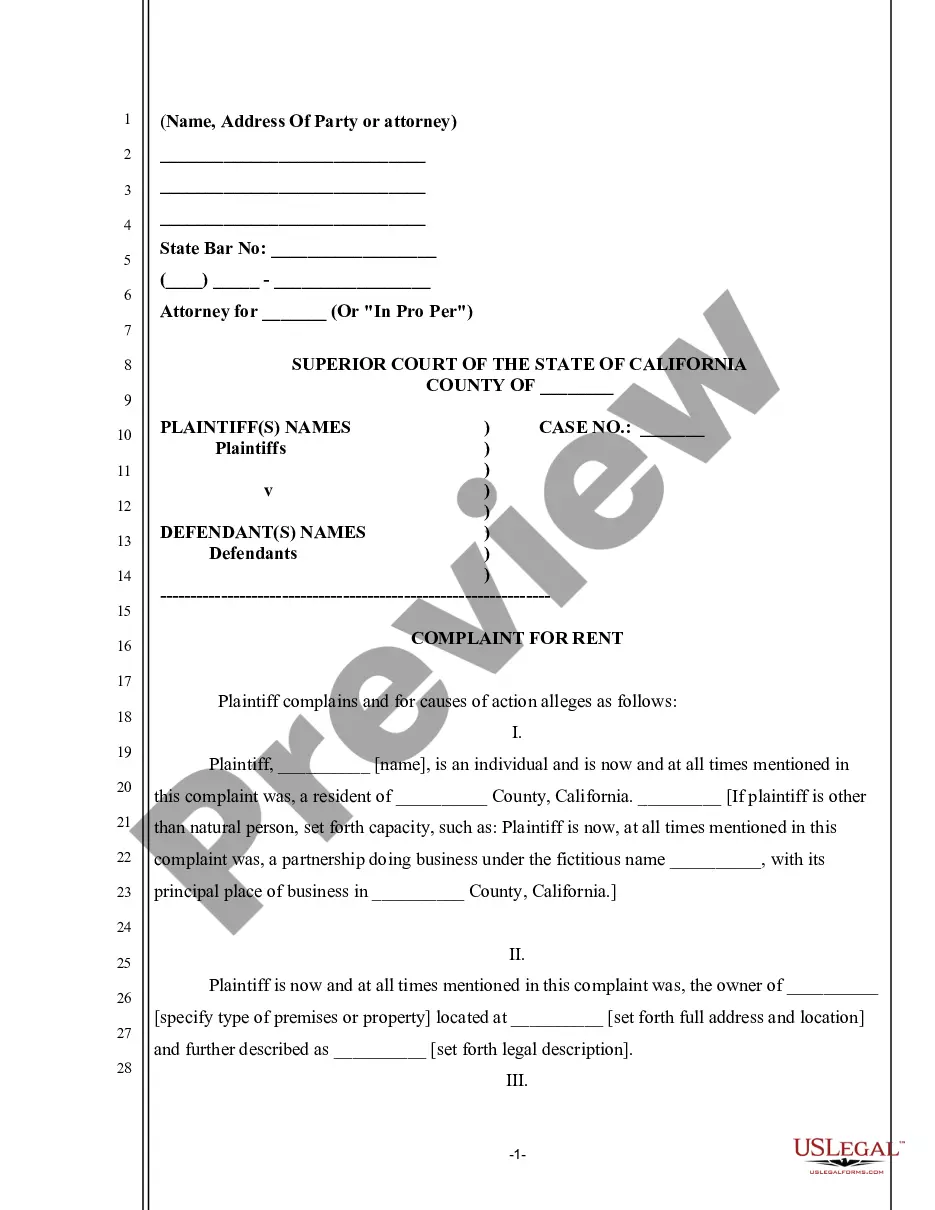

How to fill out Fairfax Virginia Stockholder Derivative Actions?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Fairfax Stockholder derivative actions, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can just log in and re-download the Fairfax Stockholder derivative actions from the My Forms tab.

For new users, it's necessary to make several more steps to get the Fairfax Stockholder derivative actions:

- Analyze the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to get the document once you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

A shareholder brings a direct action because s/he believes that the corporation has violated some type of duty owed to the shareholder. However, this same individual can also file a class action lawsuit as a representative of an entire class of shareholders whose rights have allegedly been abridged or violated.

Some states allow a person to bring a derivative suit as long as he or she held the company's stock at the time of the incident that gave rise to the suit. Others require that the shareholder owns stock in the company at the time of the inciting action and continuously throughout the resolution of the lawsuit.

Only shareholders of a corporation can bring a derivative suit.

A derivative action is a type of lawsuit in which the corporation asserts a wrong against the corporation and seeks damages. Derivative actions represent two lawsuits in one: (1) the failure of the board of directors to sue on an existing corporate claim and (2) the existing claim.

Derivative suits are necessary because the board of directors are the primary operators of the corporation. The directors make decisions about when a corporation can sue someone else for a breach of contract, breach of duty of care, etc.

A derivative action permits a minority shareholder, as representative of all of the other shareholders, to institute proceedings on behalf of the Company in an attempt to redress a wrong perpetrated by the majority shareholders on the Company.

Derivative Lawsuit Moreover, a corporate shareholder may not bring a derivative action against a corporation's officers or board of directors simply because he/she disagrees with a decision made on behalf of the corporation.

A shareholder derivative suit is a lawsuit brought by a shareholder on behalf of a corporation. Generally, a shareholder can only sue on behalf of a corporation when the corporation has a valid cause of action, but has refused to use it.

3. Who files these actions? A shareholder derivative action is brought by a shareholder or group of shareholders. Generally, the plaintiff must be a legal or beneficial owner of stock security, or other equityoptions, warrants, or other rights to purchase or receive stock do not confer standing.

Definition. A shareholder derivative suit is a lawsuit brought by a shareholder on behalf of a corporation. Generally, a shareholder can only sue on behalf of a corporation when the corporation has a valid cause of action, but has refused to use it.