Phoenix, Arizona Stockholder Derivative Actions: A Comprehensive Overview In the bustling city of Phoenix, Arizona, stockholder derivative actions play a crucial role in corporate governance and protecting the rights and interests of shareholders. These legal actions empower shareholders to initiate lawsuits on behalf of the corporation when corporate directors or officers fail to act in the best interest of the company. Let's delve deeper into the specifics of Phoenix, Arizona stockholder derivative actions, highlighting their types and significance. 1. Definition and Purpose: Stockholder derivative actions are legal proceedings filed by a shareholder, typically a minority shareholder, against officers and directors of a corporation for their alleged breach of fiduciary duty. The purpose is to enforce actions that the corporation itself should have taken to remedy the wrongdoing, such as corporate mismanagement, fraud, or insider trading. 2. Phoenix, Arizona Legal Framework: Stockholder derivative actions in Phoenix, Arizona fall under the state's corporate laws and are governed by relevant statutes like the Arizona Business Corporation Act. These laws set the guidelines for initiating and pursuing derivative actions in state courts. 3. Requirements for Filing: To file a stockholder derivative action in Phoenix, Arizona, several key requirements must be met. These include: a. Standing: The shareholder must have continuous ownership of the corporation's stock throughout the legal process. b. Demand Requirement: The shareholder must make a demand on the corporation's board of directors to take action before filing the derivative suit. Exceptions to this requirement exist if such a demand would be futile or if the board is conflicted. c. Adequate Representation: The shareholder must fairly and adequately represent the interests of the corporation, as the lawsuit is pursued on behalf of the corporation itself. 4. Different Types of Stockholder Derivative Actions in Phoenix, Arizona: While the basic concept of a stockholder derivative action remains the same, there are different types of cases that shareholders can pursue in Phoenix, Arizona. These include: a. Breach of Fiduciary Duty: Claims against officers or directors for actions or decisions that disadvantage the corporation's interests, such as self-dealing, excessive compensation, or mismanagement. b. Fraudulent Practices: Lawsuits targeting officers or directors engaged in fraudulent activities, including accounting fraud, false reporting, or insider trading, adversely impacting the corporation. c. Insider Abuse: Actions aimed at preventing insiders from benefitting unfairly at the expense of the corporation, such as undisclosed conflicts of interest or unfair related-party transactions. 5. Benefits and Significance: Stockholder derivative actions play a vital role in safeguarding shareholder interests and maintaining a level playing field in the corporate world. In Phoenix, Arizona, these actions serve to: — Encourage corporate accountability and transparency by holding officers and directors responsible for their actions. — Protect shareholders' investment and financial interests from potential harm due to mismanagement or unlawful practices. — Set a precedent for ethical conduct, ensuring corporations prioritize the best interests of shareholders and the company as a whole. In conclusion, Phoenix, Arizona stockholder derivative actions provide shareholders with a powerful legal tool to initiate lawsuits on behalf of corporations. By holding officers and directors accountable, these actions serve as a safeguard against corporate malfeasance, thereby promoting transparency, ethical behavior, and the long-term growth and success of corporations in the vibrant city of Phoenix, Arizona.

Phoenix Arizona Stockholder derivative actions

Description

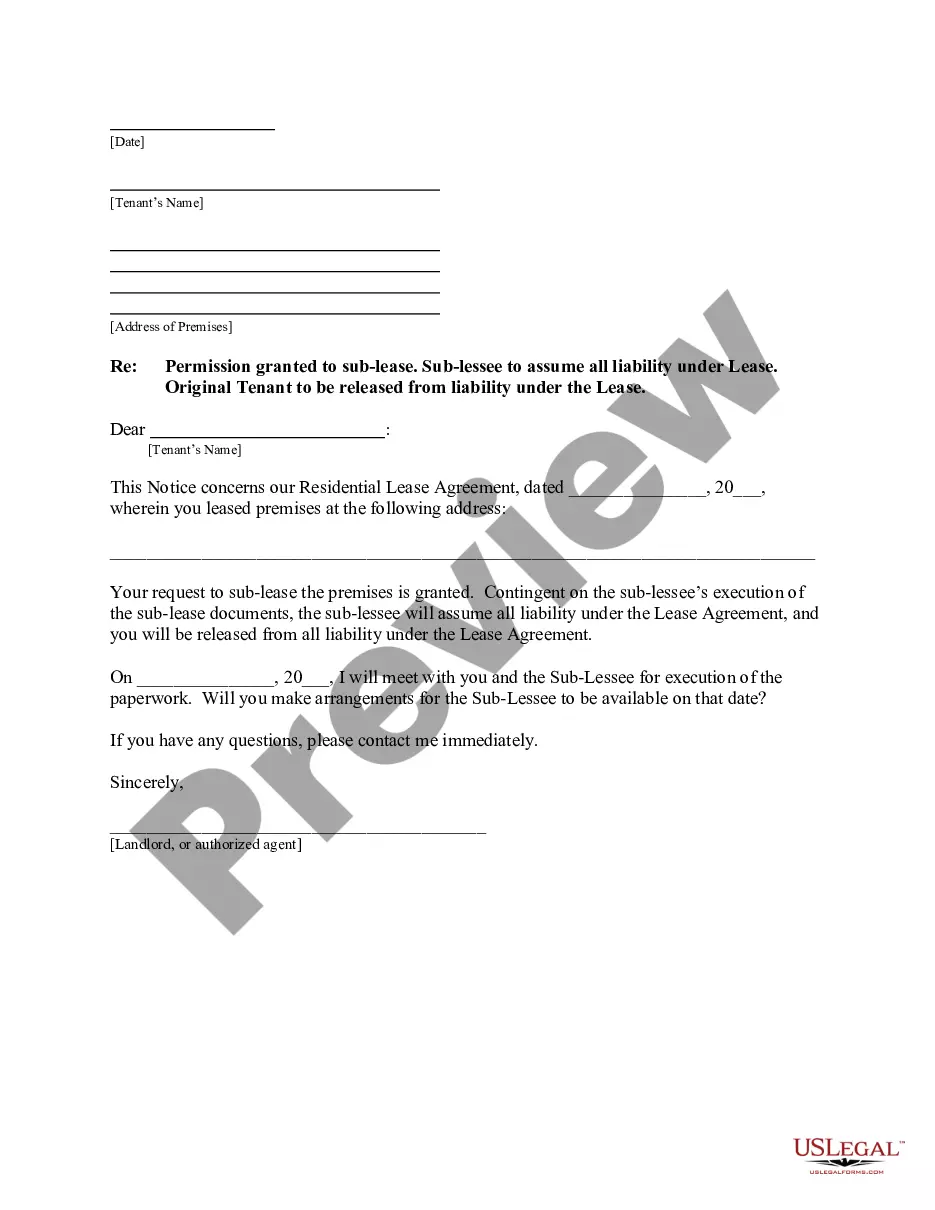

How to fill out Phoenix Arizona Stockholder Derivative Actions?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Phoenix Stockholder derivative actions, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Therefore, if you need the latest version of the Phoenix Stockholder derivative actions, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Stockholder derivative actions:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Phoenix Stockholder derivative actions and download it.

Once finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Make a demand in writing requiring the corporation to take suitable action before the action (Generally, a derivative suit can only be filed 90 days after written demand. But it may be initiated ahead of time if a) the corporation rejects the demand, or b) the corporation will suffer irreparable harm if they wait).

The majority shareholders who sold control and their successors get nothing. While a claim for breach of fiduciary duty can only be brought as a derivative suit, other claims can be brought by either individual shareholders as direct claims or as a derivative action on behalf of the corporation.

What is the process for shareholders bringing a derivative action? Shareholder begin the derivative action process by making a request to the board of directors to bring a legal action against the alleged wrongdoer. This is called making demand on the board.

A derivative claim (or derivative action) is a claim brought or continued by a shareholder on behalf of the company in relation to a breach of duty by a director. It will usually be used in circumstances when the majority wrongfully prevent the company bringing or proceeding with such a claim itself.

Relevant provisions of the Act The starting point is that section 260 of the Act provides that a derivative claim may be brought only in respect of a cause of action arising from an actual or proposed act or omission involving negligence, default, or breach of trust by a director of the company.

A derivative action is a type of lawsuit in which the corporation asserts a wrong against the corporation and seeks damages. Derivative actions represent two lawsuits in one: (1) the failure of the board of directors to sue on an existing corporate claim and (2) the existing claim.

A shareholder (stockholder) derivative suit is a lawsuit brought by a shareholder or group of shareholders on behalf of the corporation against the corporation's directors, officers, or other third parties who breach their duties. The claim of the suit is not personal but belongs to the corporation.

The statutory derivative action is a special type of court action that enables a shareholder to pursue a wrongdoer in the company, for example, by proceeding against a director for breach of directors' duties.

A derivative action is a type of lawsuit in which the corporation asserts a wrong against the corporation and seeks damages. Derivative actions represent two lawsuits in one: (1) the failure of the board of directors to sue on an existing corporate claim and (2) the existing claim.

At its essence, a derivative suit is used as a means for a shareholder or group of shareholders, acting on behalf of the corporation, to reclaim value lost to the corporation by its management. Essentially, the form of a derivative action is the same as the form of any other lawsuit.