Maricopa Arizona Schedule 14D-9 is a crucial document for companies that are involved in solicitation activities, particularly those related to tender offers or other forms of business transactions. It is a recommendation statement that is filed with the Securities and Exchange Commission (SEC) to provide shareholders with important information regarding the solicitation and their rights as investors. In the case of Maricopa, Arizona, there may not be different types of Schedule 14D-9 statements specific to this location. However, it is essential to understand the purpose and content of this document. The Schedule 14D-9 statement typically includes the following key components: 1. Introduction: The statement begins with an overview of the solicitation and the parties involved, including the bidder and the target company. 2. Background information: This section provides a detailed history of the transaction, highlighting any prior negotiations and discussions between the parties. 3. Reason for the solicitation: The company explains the rationale behind the tender offer, merger, acquisition, or other transaction. It may discuss strategic goals, potential synergies, and benefits that shareholders may gain from accepting the offer. 4. Terms and conditions: The statement outlines the terms and conditions of the offer, such as the price, payment method, and any contingencies. This section can also include information about any shareholder support agreements or irrevocable commitments. 5. Company recommendations: Maricopa Arizona Schedule 14D-9 typically includes the board of directors' recommendation concerning the offer. It may either support accepting the offer or advise shareholders against it, based on the board's evaluation of the offer's fairness and benefits to shareholders. 6. Financial analysis: This section may contain detailed financial information, such as historical and projected financial statements, as well as valuation analyses performed by financial advisors to help shareholders in evaluating the offer. 7. Additional information: The statement includes any relevant disclosure regarding legal proceedings, potential conflicts of interest, regulatory approvals, and any other information that may impact shareholders' decision-making process. It is important to note that Maricopa, Arizona, is a specific geographic location, and the Schedule 14D-9 statement does not vary based on location. However, local laws and regulations may impact the content and specific requirements for filing. It is advisable for companies operating in Maricopa, Arizona, to consult with legal counsel or financial advisors experienced in securities regulations to ensure compliance with applicable rules.

Maricopa Arizona Schedule 14D-9 - Solicitation - Recommendation Statement

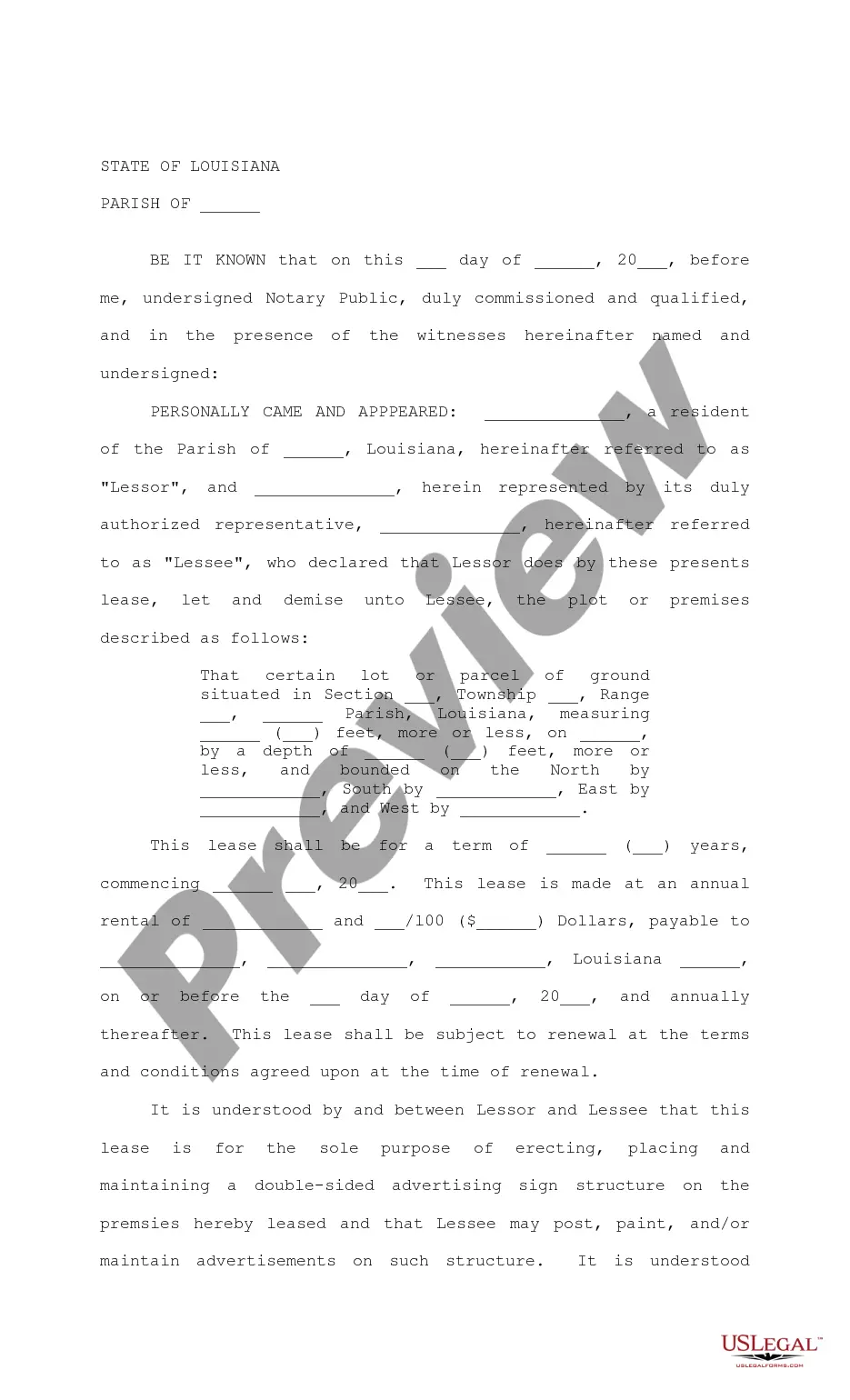

Description

How to fill out Maricopa Arizona Schedule 14D-9 - Solicitation - Recommendation Statement?

Creating forms, like Maricopa Schedule 14D-9 - Solicitation - Recommendation Statement, to take care of your legal matters is a tough and time-consumming process. A lot of situations require an attorney’s participation, which also makes this task expensive. However, you can get your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents crafted for different cases and life circumstances. We make sure each document is in adherence with the regulations of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Maricopa Schedule 14D-9 - Solicitation - Recommendation Statement form. Go ahead and log in to your account, download the form, and personalize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading Maricopa Schedule 14D-9 - Solicitation - Recommendation Statement:

- Make sure that your document is compliant with your state/county since the regulations for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Maricopa Schedule 14D-9 - Solicitation - Recommendation Statement isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or register an account to begin using our service and get the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is all set. You can try and download it.

It’s easy to find and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!