Contra Costa California Private Placement of Common Stock is a type of investment opportunity offered exclusively to accredited investors within Contra Costa County, California. Private placement refers to the sale of securities, in this case, common stock, directly to these select investors, bypassing public exchanges like the stock market. The primary purpose of Contra Costa California Private Placement of Common Stock is to raise capital for the issuing company. By offering shares of their common stock privately, companies can secure funds for various purposes such as expanding their business, funding research and development, acquiring new assets, or reducing debt. This investment option is typically only available to accredited investors, who are individuals or entities that meet certain income or financial requirements set by the Securities and Exchange Commission (SEC). Accredited investors have a higher level of financial sophistication and are deemed capable of evaluating the risks associated with private placements. Contra Costa California Private Placement of Common Stock allows investors to purchase shares directly from the issuing company, often at a discounted price compared to the potential future market price when the company goes public. This can present an opportunity for investors to potentially profit from the future growth of the company. It is important to note that private placement investments inherently carry a higher level of risk compared to public offerings. They are typically illiquid, meaning investors might not be able to easily sell their shares or access their investment until specific conditions, like a public offering or acquisition, occur. Different types of Contra Costa California Private Placement of Common Stock can include offerings from startups, established companies seeking growth capital, or real estate investment opportunities. Each offering can have its own unique terms, regulations, and investment minimums. Therefore, it is crucial for potential investors to thoroughly review the offering memorandum, financial statements, and consult with financial professionals before making any investment decisions. In conclusion, Contra Costa California Private Placement of Common Stock presents an exclusive investment opportunity for accredited investors in the region. It allows investors to purchase common stock directly from the issuing company, promising potential growth and financial returns. However, it is important to exercise caution, conduct comprehensive due diligence, and seek professional advice before engaging in any private placement investment.

Contra Costa California Private placement of Common Stock

Description

How to fill out Contra Costa California Private Placement Of Common Stock?

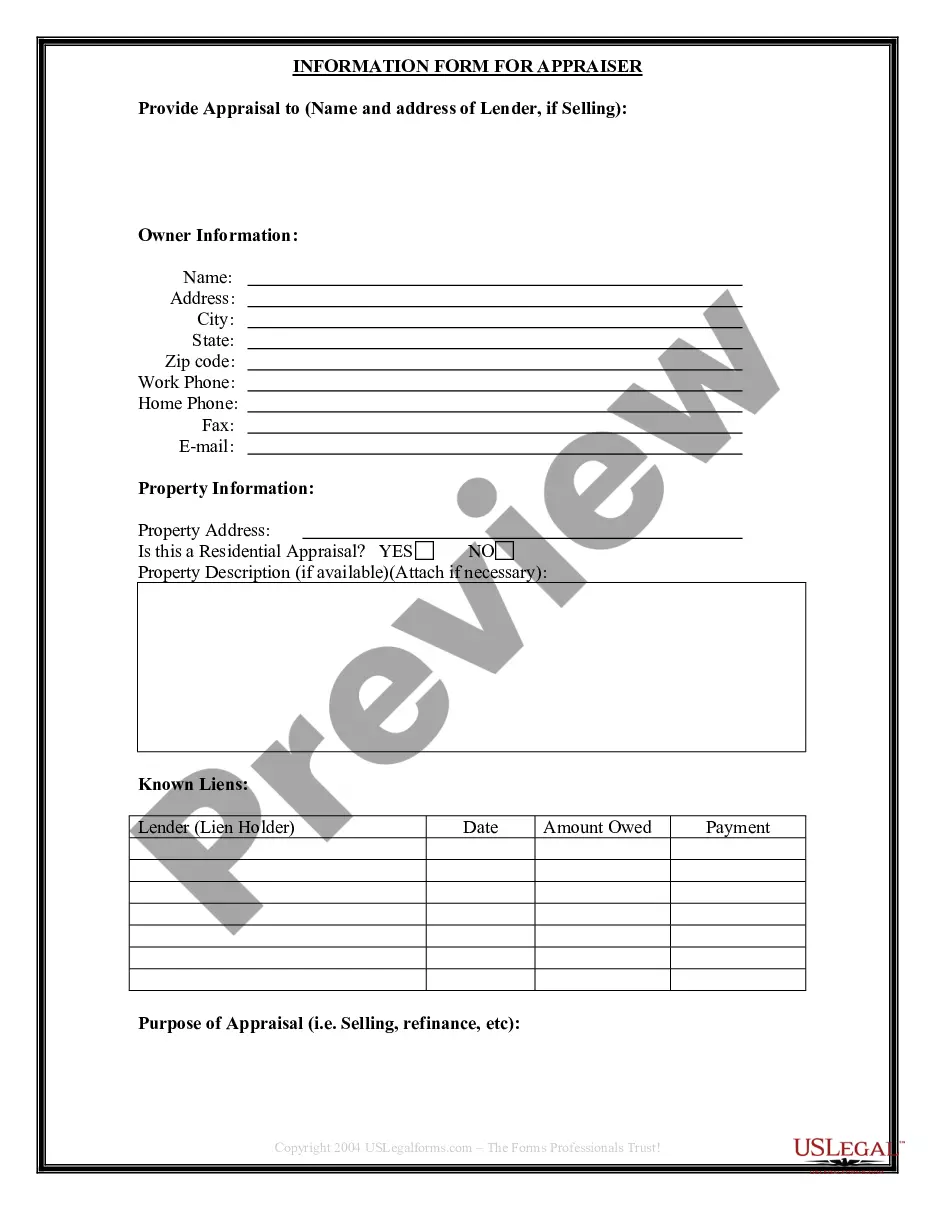

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, locating a Contra Costa Private placement of Common Stock suiting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, grouped by states and areas of use. In addition to the Contra Costa Private placement of Common Stock, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Specialists check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can pick the file in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Contra Costa Private placement of Common Stock:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the selected file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Contra Costa Private placement of Common Stock.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!