Dallas Texas Private Placement of Common Stock is a method used by companies to raise funds by offering common stock to a select group of investors within the state of Texas. This fundraising strategy involves selling securities to a limited number of accredited investors without the need for a public offering. Private placement of Common Stock in Dallas Texas involves offering shares of a company's stock to high-net-worth individuals, institutional investors, and other qualified buyers who meet the requirements set by securities regulations in Texas. The investors who participate in this type of offering typically have a certain level of sophistication and financial capability. There are a few different types of Private Placement of Common Stock transactions that can occur in Dallas Texas: 1. Rule 506(b) Offering: This type of private placement allows companies to raise an unlimited amount of capital without the need to register with the Securities and Exchange Commission (SEC) if they exclusively sell to accredited investors and a limited number of non-accredited investors who meet certain financial thresholds. 2. Rule 506© Offering: This type of private placement allows companies to advertise and market their offering to potential investors, which was previously prohibited under Rule 506(b). However, companies conducting this type of offering are required to verify the accreditation status of their investors. 3. Intrastate Offering: This type of private placement is limited to investors within the state of Texas, under the Texas State Securities Board's Intrastate Exemption rules. It allows companies to raise funds from investors located within the state, bypassing some federal securities laws and regulations. For investors, participating in private placements of common stock in Dallas Texas can offer opportunities for potentially higher returns compared to traditional stock market investments. However, these investments often carry higher risks due to the limited information available publicly about the company and potential limitations on liquidity. It is essential for both companies and investors engaging in private placements of common stock in Dallas Texas to consult with legal and financial professionals familiar with securities laws to ensure compliance and mitigate risks associated with these types of transactions.

Dallas Texas Private placement of Common Stock

Description

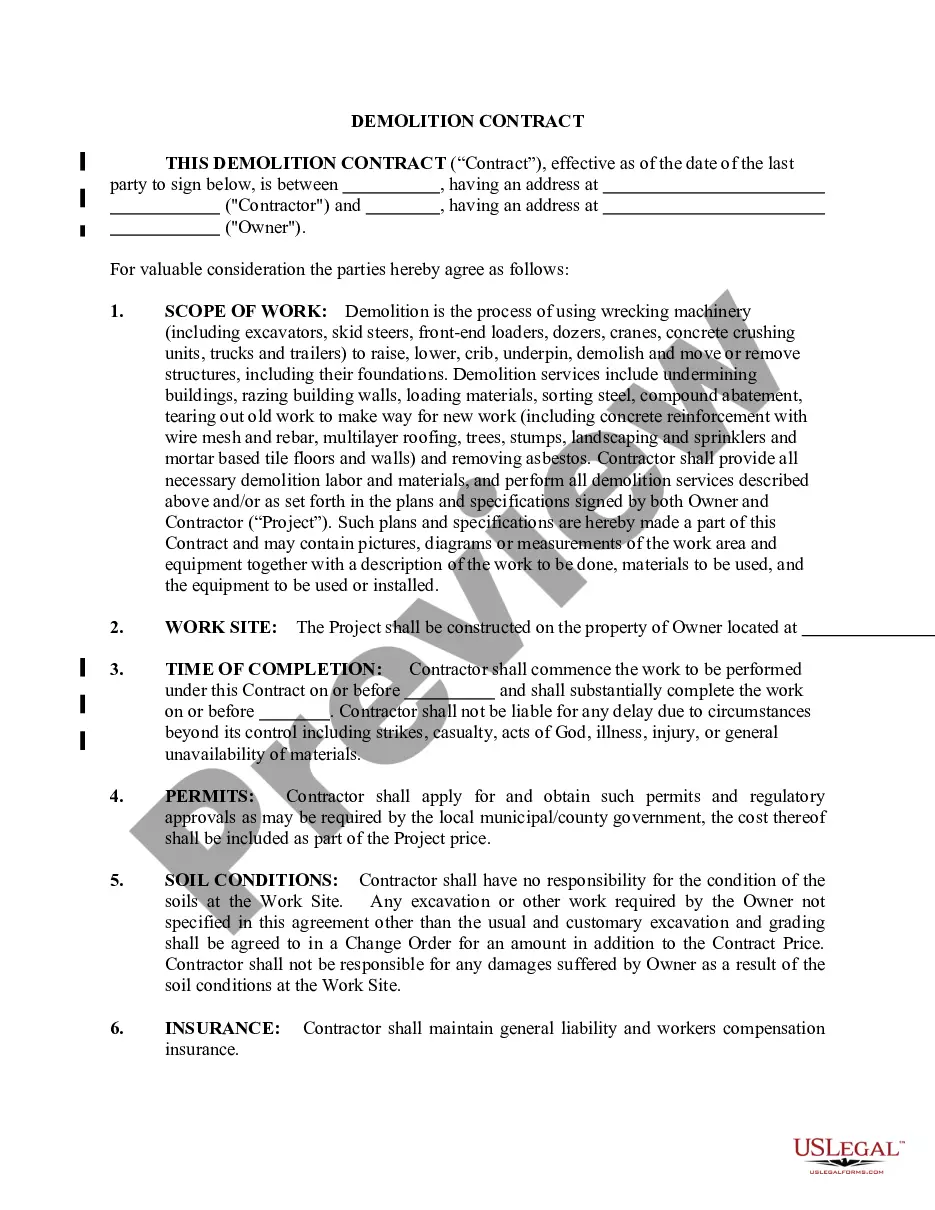

How to fill out Dallas Texas Private Placement Of Common Stock?

Are you looking to quickly create a legally-binding Dallas Private placement of Common Stock or probably any other document to handle your personal or business affairs? You can select one of the two options: contact a legal advisor to draft a valid document for you or draft it entirely on your own. The good news is, there's another option - US Legal Forms. It will help you get professionally written legal papers without having to pay sky-high fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific document templates, including Dallas Private placement of Common Stock and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, carefully verify if the Dallas Private placement of Common Stock is adapted to your state's or county's laws.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the searching process over if the form isn’t what you were seeking by utilizing the search box in the header.

- Select the plan that best suits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Dallas Private placement of Common Stock template, and download it. To re-download the form, just head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the paperwork we offer are reviewed by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!