Nassau New York Private Placement of Common Stock is a financial practice that involves offering and selling common stocks to a select group of accredited investors in the Nassau County, New York area. This method allows companies to raise capital without having to go through the traditional public offering process. Private placement refers to the process of offering securities to a small group of sophisticated investors, such as high-net-worth individuals, mutual funds, or pension funds. By opting for private placement, companies can target specific investors who may have a greater understanding of the industry and can provide meaningful contributions to the organization. Nassau County, located in the state of New York, is a hub of business activity, attracting investors from various sectors. Private placement of common stock in Nassau New York provides opportunities for local businesses to raise capital for expansion, research and development, debt payment, or other business initiatives. The focus of these private placements may vary based on the specific needs and objectives of the issuing companies. Some common types of Nassau New York private placements of common stock include: 1. Early-stage Private Placement: This type of private placement targets early-stage companies looking to secure funding to develop their innovative ideas or launch a new product. These companies typically attract venture capitalists or angel investors who are willing to take on higher risks for potentially higher returns. 2. Growth-stage Private Placement: Growth-stage companies seeking capital to finance expansion initiatives or acquisitions often turn to private placements. These companies have established market presence and seek capital injection to fuel their accelerated growth strategies. 3. Debt-to-Equity Conversion: In certain cases, companies burdened with high levels of debt might opt for a private placement of common stock to convert their debt into equity. This approach can help alleviate financial strain, improve balance sheets, and provide an opportunity for new investors to participate in the company's growth while reducing the interest burden. 4. Restricted Stock Offering: A restricted stock offering is a private placement where the issued common stocks are subject to certain restrictions, such as lock-up periods or limitations on resale. This type of placement enables companies to control stock market supply, maintain investor confidence, and minimize market volatility when the stock is eventually listed. The Nassau New York private placement of common stock serves as an attractive financing option for companies looking to access capital quickly, efficiently, and on their own terms. It offers investors an opportunity to participate in the growth and success of local businesses while potentially reaping substantial returns on their investments.

Nassau New York Private placement of Common Stock

Description

How to fill out Nassau New York Private Placement Of Common Stock?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business purpose utilized in your county, including the Nassau Private placement of Common Stock.

Locating samples on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Nassau Private placement of Common Stock will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the Nassau Private placement of Common Stock:

- Ensure you have opened the proper page with your local form.

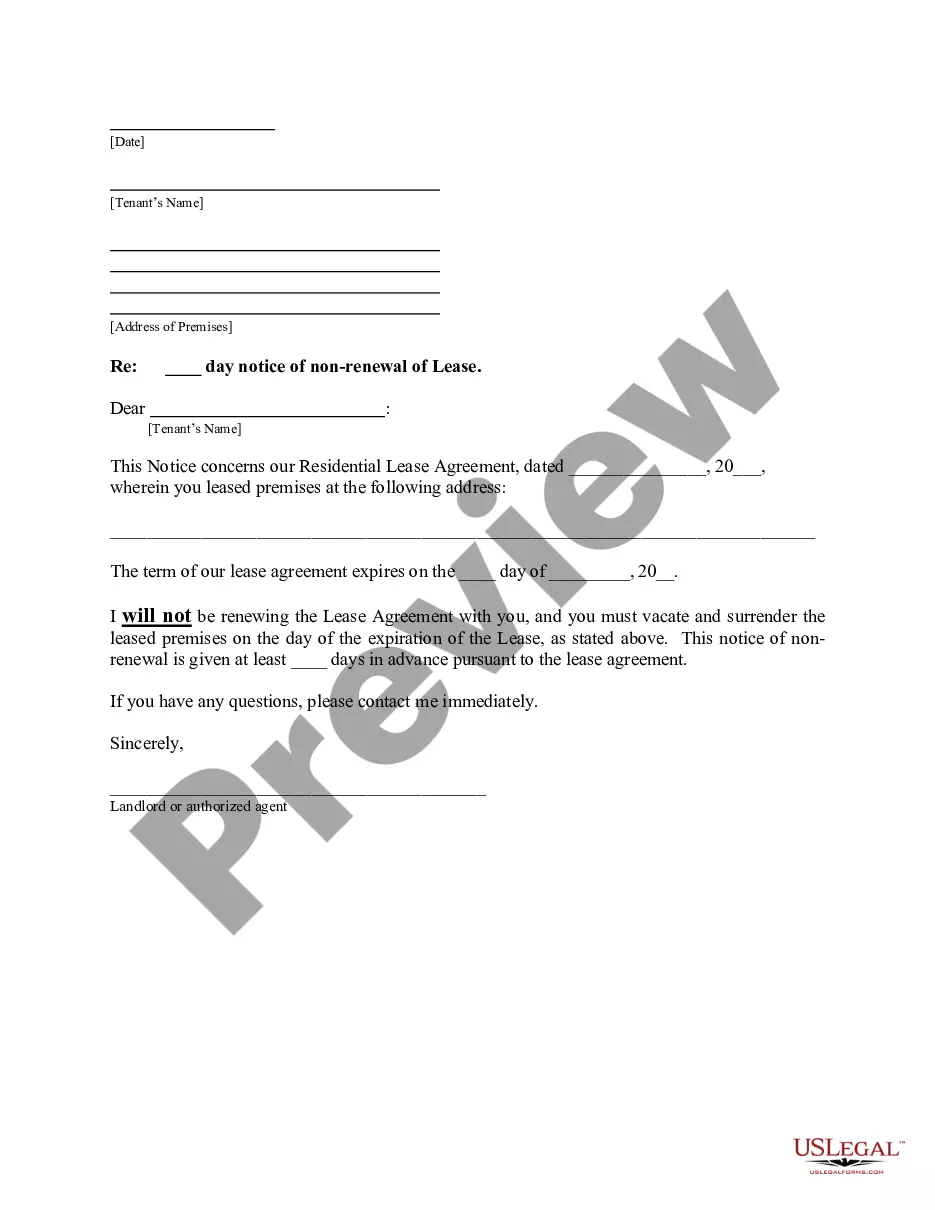

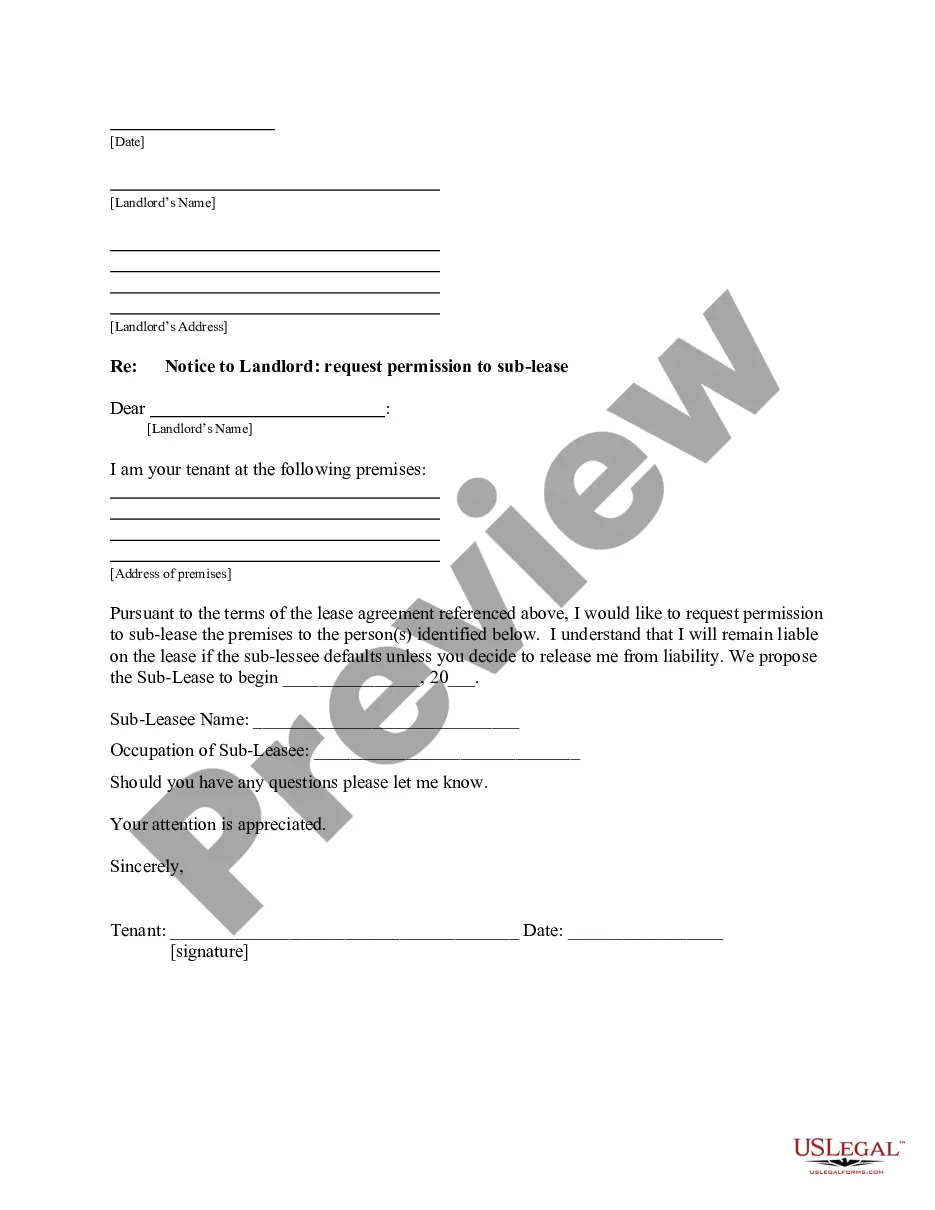

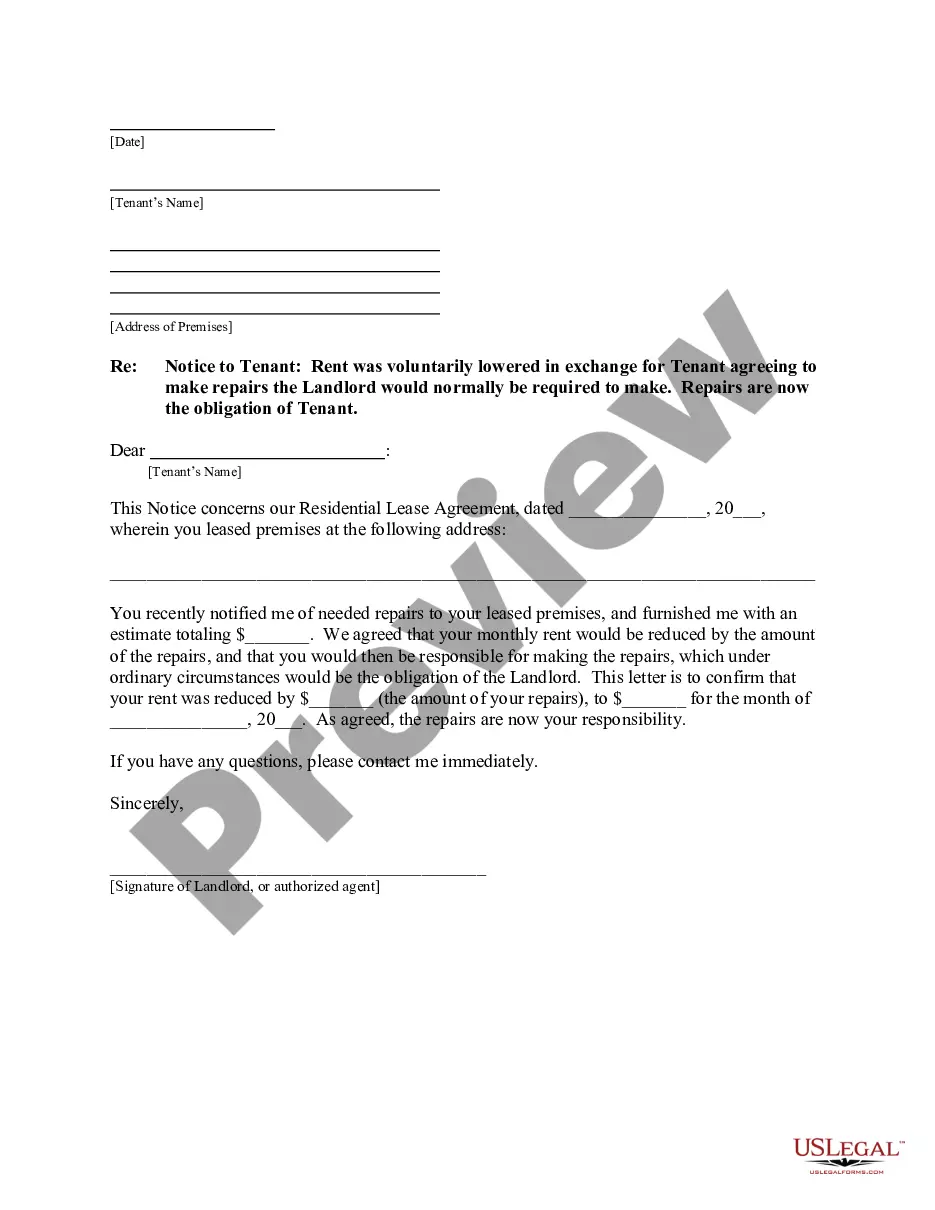

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your needs.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Nassau Private placement of Common Stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!