Orange California Private Placement of Common Stock refers to the process in which a company located in Orange, California offers shares of its common stock to a select group of private investors, excluding the public. This method of fundraising allows companies to raise capital without having to go through the rigorous process of a public offering. Private placement is commonly used by small to medium-sized businesses that seek funding for expansion, research and development, or to meet working capital requirements. It offers a more streamlined and cost-effective approach compared to an initial public offering (IPO), as it does not require registration with the Securities and Exchange Commission (SEC). Companies can tailor the terms of the private placement to meet their specific needs, including the number of shares issued, the price per share, and any associated rights or restrictions. These terms are negotiated between the issuing company and the private investors, providing flexibility and customization options. Some different types of private placements of common stock that may take place in Orange, California include: 1. Expansion Financing: Companies looking to expand their operations, launch new products or services, or enter new markets may opt for a private placement of common stock to secure the necessary funds. 2. Venture Capital Investment: Startups or early-stage companies in Orange, California may seek venture capital investments through a private placement. These investments help fund high-growth potential companies in exchange for an equity stake. 3. Bridge Financing: In situations where a company needs immediate capital to bridge a funding gap, private placement of common stock can serve as a short-term solution until additional financing is secured. 4. Strategic Partnerships: Private placements can also involve strategic investors who not only inject capital but also provide valuable industry expertise, networks, and resources to the issuing company. Private placement of common stock in Orange, California offers companies an efficient and discreet means of raising capital from selected investors. By choosing this method, companies can avoid the costs, regulatory burdens, and public disclosures associated with going public through an IPO. It provides flexibility in determining the terms of the offering, enabling companies to attract investors on their own terms and fulfill their growth objectives.

Orange California Private placement of Common Stock

Description

How to fill out Orange California Private Placement Of Common Stock?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare formal paperwork that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and get a document for any personal or business objective utilized in your region, including the Orange Private placement of Common Stock.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Orange Private placement of Common Stock will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to get the Orange Private placement of Common Stock:

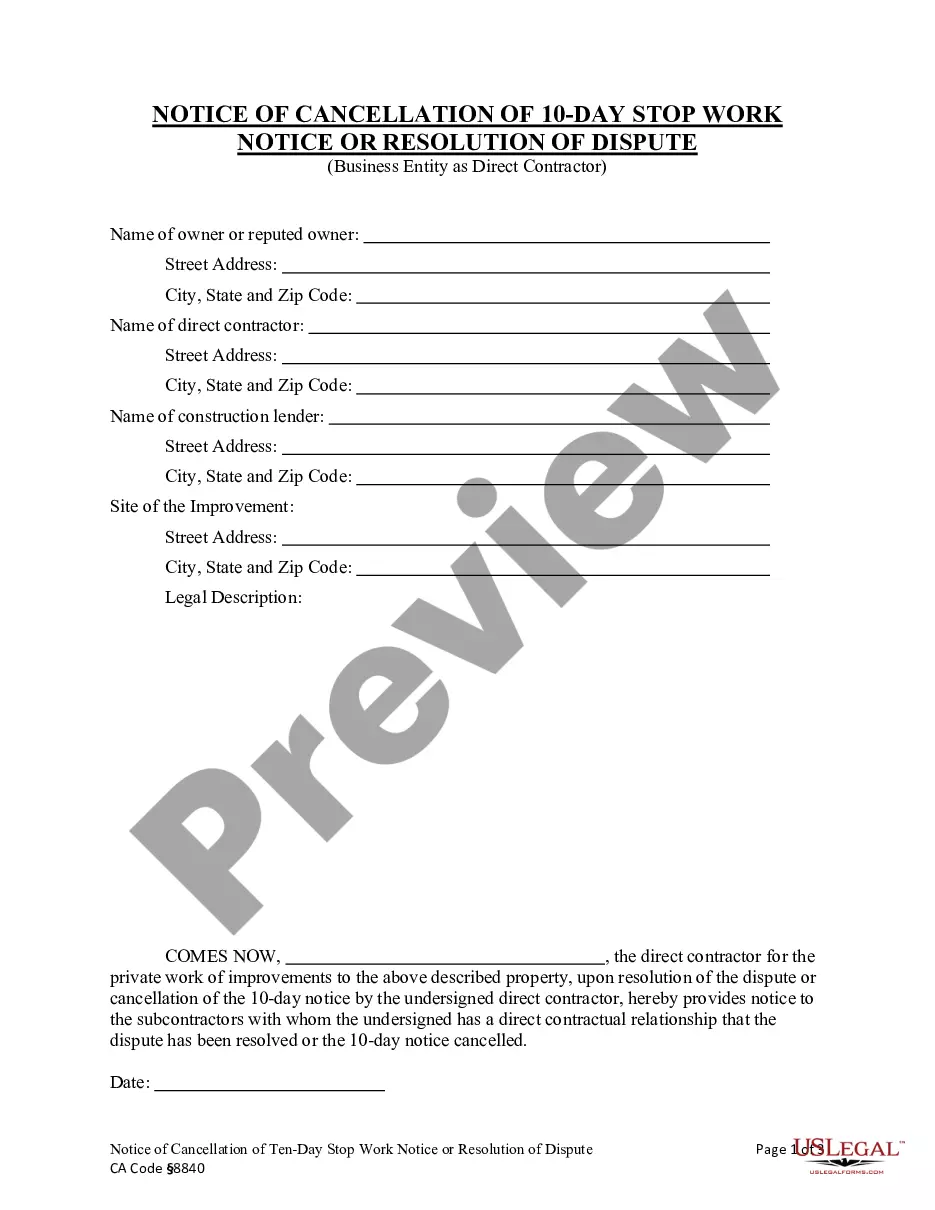

- Ensure you have opened the proper page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Orange Private placement of Common Stock on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!