San Jose, California is a city located in the heart of Silicon Valley, known for its flourishing technology industry and robust startup ecosystem. In this vibrant business environment, private placement of common stock serves as a popular means for companies to raise capital and expand their operations. A private placement is a funding method that allows companies to sell securities, such as common stock, directly to a select group of investors, without making a public offering. This approach is in contrast to a public offering where shares are sold to a wide range of investors through the stock market. Private placements are typically governed by the Securities Act of 1933, Regulation D, and other applicable securities regulations. San Jose, being a hub of technological innovation, hosts various types of private placements of common stock. Some common types include: 1. Technology Startup Private Placements: San Jose attracts numerous technology startups seeking funding to fuel their growth. These private placements are often driven by companies operating in sectors such as artificial intelligence, machine learning, biotechnology, clean energy, and software development. Investors looking to invest in cutting-edge technologies and emerging startups find these private placements enticing. 2. Venture Capital/Private Equity Backed Private Placements: San Jose is home to several prestigious venture capital and private equity firms that actively support local businesses. These firms often facilitate private placements of common stock for their portfolio companies, aiming to secure additional capital to scale their operations and capture market opportunities. 3. Established Corporation Private Placements: Not limited to startups, established corporations in San Jose may also opt for private placements as a means of raising capital. Such placements may occur when a company plans to expand its business, launch new products or services, or pursue strategic acquisitions. These private placements allow companies to optimize their capital structure without facing the rigorous regulations associated with public offerings. 4. Real Estate Private Placements: San Jose's real estate market, driven by its thriving tech industry, presents lucrative investment opportunities. Real estate developers and property owners often leverage private placements of common stock to fund large-scale projects, such as commercial developments, residential complexes, and infrastructure ventures. It is important to note that private placements of common stock are typically available to accredited investors, who meet specific financial criteria, such as high net worth or income thresholds. Additionally, these investment opportunities often involve risks, and potential investors should thoroughly evaluate the offering memorandum or prospectus, complete with detailed information on the company, its financials, industry outlook, and associated risks. In conclusion, San Jose, California, home to an active and dynamic business community, offers various types of private placements of common stock. These placements act as a vital mechanism for companies, from startups to established corporations, to raise capital and drive their growth initiatives in the ever-evolving technological landscape of Silicon Valley.

San Jose California Private placement of Common Stock

Description

How to fill out San Jose California Private Placement Of Common Stock?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a San Jose Private placement of Common Stock suiting all regional requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, grouped by states and areas of use. Apart from the San Jose Private placement of Common Stock, here you can get any specific document to run your business or personal deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required form, and download it. You can pick the file in your profile anytime later on. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your San Jose Private placement of Common Stock:

- Check the content of the page you’re on.

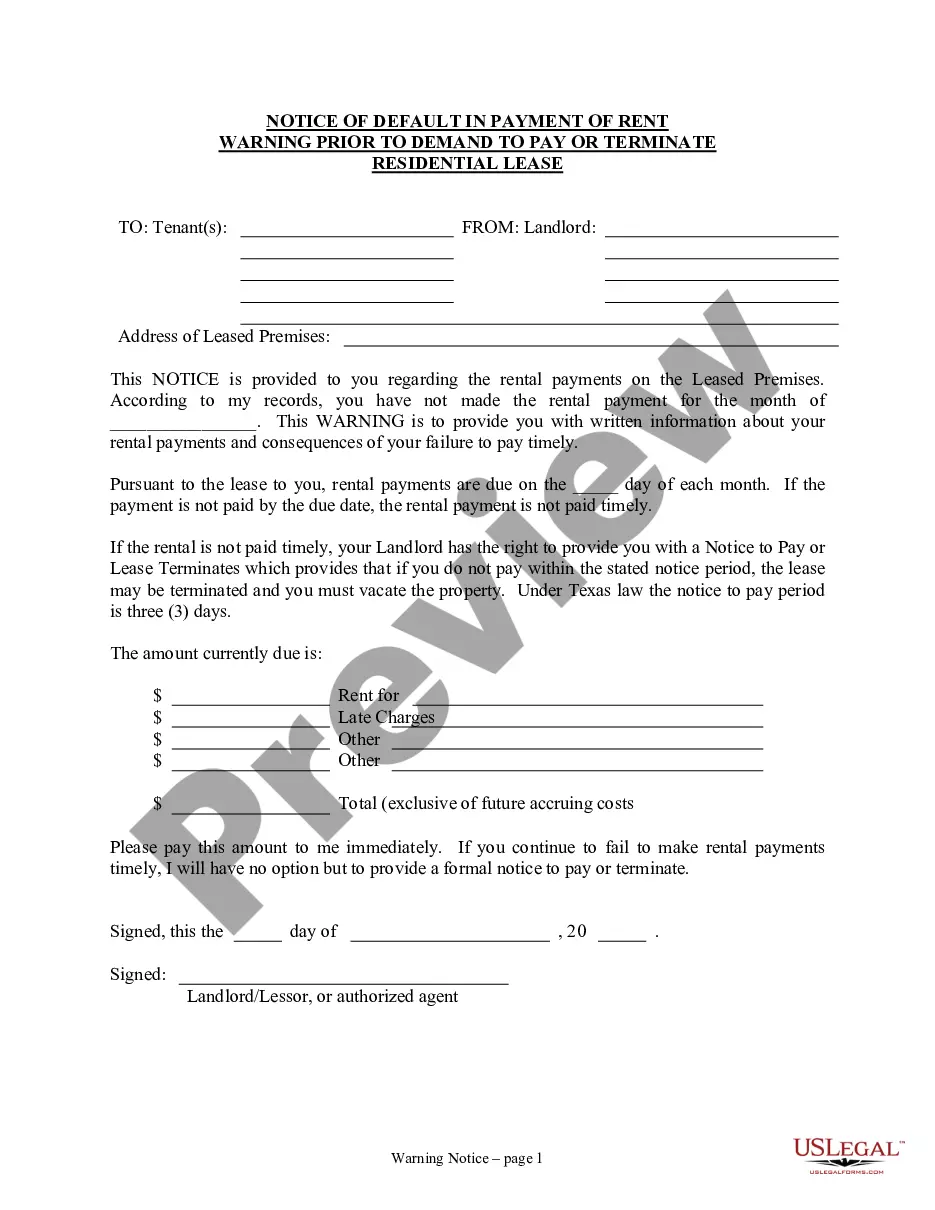

- Read the description of the sample or Preview it (if available).

- Look for another document using the related option in the header.

- Click Buy Now when you’re certain in the selected file.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the San Jose Private placement of Common Stock.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!