Travis Texas Private Placement of Common Stock is a process used by companies based in Travis, Texas, to raise capital by offering shares of their common stock to a select group of private investors. This method allows companies to bypass the traditional public offering and seek funding directly from individuals or institutional investors. The primary purpose of a private placement is to secure funding for various corporate activities such as expansion plans, research and development, acquisitions, or debt repayments. By offering common stock to private investors, companies can obtain the necessary capital without going through the time-consuming and costly process of registering securities with regulatory authorities. There are different types of Travis Texas Private Placement of Common Stock, including: 1. Restricted Stock Offerings: In this type of private placement, companies offer common stock to a limited number of accredited investors who meet specific financial criteria set by regulatory bodies like the Securities and Exchange Commission (SEC). These investors are typically high net worth individuals or institutional investors, such as hedge funds or venture capital firms. 2. Regulation D Offering: This type of private placement is conducted under Rule 506 of Regulation D, which enables companies to raise an unlimited amount of capital from accredited investors. The offering can be conducted without publicly disclosing sensitive financial information. 3. PIPE (Private Investment in Public Equity): This type of private placement involves companies offering common stock to institutional investors, such as mutual funds or private equity firms, in order to raise funds quickly. PIPE offerings are typically used by publicly traded companies facing financial challenges or requiring immediate capital infusion. 4. Rule 144A Offering: This type of private placement allows companies to offer common stock to institutional investors qualified under Rule 144A of the Securities Act. Rule 144A offerings are typically conducted by large corporations seeking to raise significant amounts of capital. 5. Private Equity Placement: This type of private placement involves companies offering common stock to private equity firms in exchange for capital investment. Private equity firms typically seek to acquire a significant ownership stake and participate in the management and decision-making processes. In conclusion, Travis Texas Private Placement of Common Stock is a fundraising method used by companies in Travis, Texas, to secure capital by offering shares of their common stock to a select group of private investors. Different types of private placements include restricted stock offerings, Regulation D offerings, PIPE offerings, Rule 144A offerings, and private equity placements.

Travis Texas Private placement of Common Stock

Description

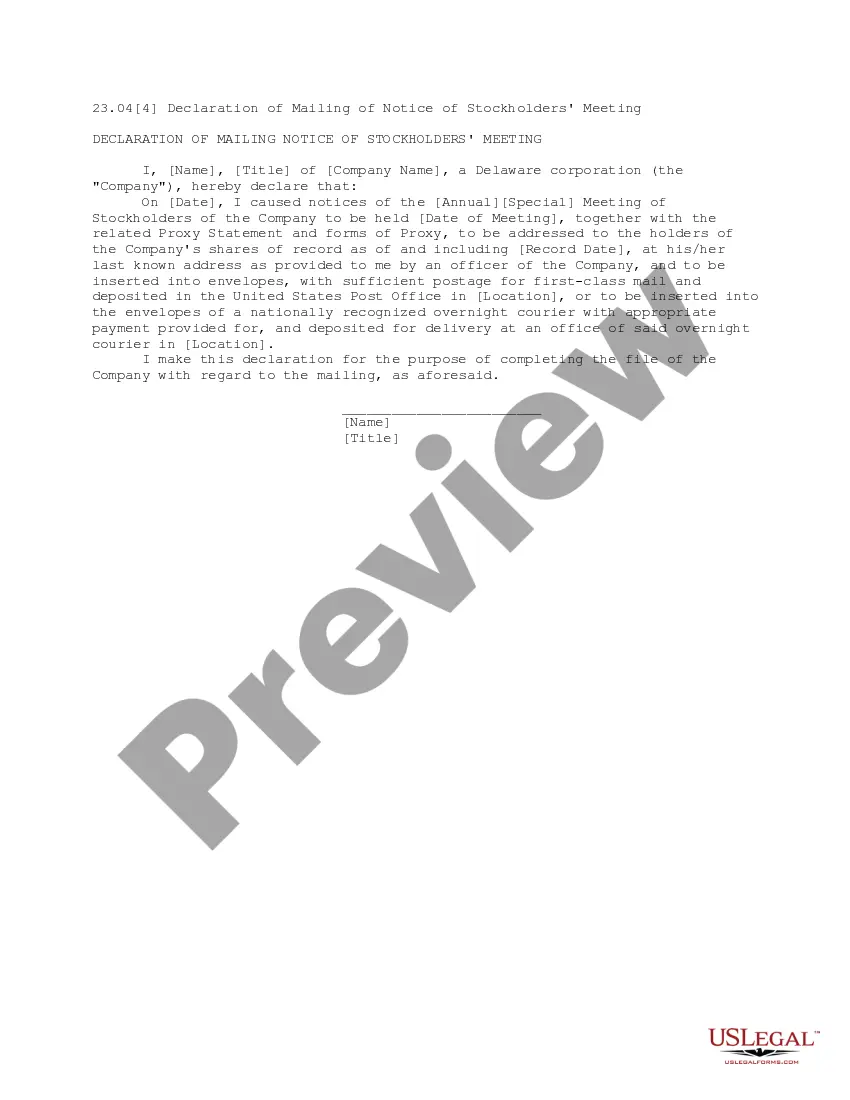

How to fill out Travis Texas Private Placement Of Common Stock?

Creating paperwork, like Travis Private placement of Common Stock, to manage your legal affairs is a difficult and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. However, you can take your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms intended for various cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Travis Private placement of Common Stock template. Go ahead and log in to your account, download the template, and personalize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before getting Travis Private placement of Common Stock:

- Make sure that your template is compliant with your state/county since the regulations for creating legal documents may differ from one state another.

- Learn more about the form by previewing it or going through a brief description. If the Travis Private placement of Common Stock isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our service and get the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is ready to go. You can try and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!

Form popularity

FAQ

The private placement of shares, if done by a private company, will not affect the share price because they are not listed. However, for a public listed company, this placement will lead to a decline in share price, at least in the near term.

Issuing in the private placement market offers companies a variety of advantages, including maintaining confidentiality, accessing long-term, fixed-rate capital, diversifying financing sources and creating additional financing capacity.

The effect of a private placement offering on share price is similar to the effect of a company doing a stock split. The long-term effect on share price is much less certain and depends on how effectively the company employs the additional capital raised from the private placement.

A private corporation is one that has not yet issued stock through an initial public offering. One or a few investors and/or founders might closely hold most of the corporation's common stock. Venture capitalists and private equity firms may own some of the corporation's common stock, preferred stock or debt.

Motivation for Private Placement The dilution of shares commonly leads to a corresponding decline in share priceat least in the near-term. The effect of a private placement offering on share price is similar to the effect of a company doing a stock split.

Examples of Private Placements You hear about a friend's startup that raised a small amount, say $200,000, for a stake in their company. It may have been a private placement to one or more high net-worth investors. They are known as angel investors.

A private placement is an offering of unregistered securities to a limited pool of investors. In a private placement, a company sells shares of stock in the company or other interest in the company, such as warrants or bonds, in exchange for cash.

For public companies, private placements can offer superior execution relative to the public market for small issuance sizes as well as greater structural flexibility. Cost Savings A company can often issue a private placement for a much lower all-in cost than it could in a public offering.

Common stock is a security that represents ownership in a corporation. Holders of common stock elect the board of directors and vote on corporate policies. This form of equity ownership typically yields higher rates of return long term.

For public companies, private placements can offer superior execution relative to the public market for small issuance sizes as well as greater structural flexibility. Cost Savings A company can often issue a private placement for a much lower all-in cost than it could in a public offering.