San Diego, California, is a vibrant coastal city located in the southwestern United States. Known for its stunning beaches, temperate climate, and diverse culture, San Diego offers residents and visitors a plethora of attractions and activities to enjoy. In terms of the advisory agreement, the San Diego California Terms of advisory agreement outline the contractual terms and conditions established between a client and an advisory firm operating in San Diego. These agreements serve to define the scope of services, responsibilities, and obligations for both parties involved. Some key keywords relating to the San Diego California Terms of Advisory Agreement may include: 1. Advisory services: The specific services and advice that the advisory firm will provide to the client, such as financial planning, wealth management, or investment advice. 2. Client responsibilities: The obligations and responsibilities of the client, including providing accurate information, financial documentation, and promptly informing the advisor of any changes in circumstances. 3. Fees and compensation: The agreed-upon fee structure for the advisory services provided, including any hourly rates, flat fees, or commission-based compensation models. 4. Confidentiality: A clause highlighting the importance of maintaining client confidentiality and privacy, ensuring that sensitive information shared between the client and advisory firm remains confidential. 5. Termination: The circumstances and procedures for terminating the advisory agreement, including notice periods, penalties, and any associated costs. 6. Dispute resolution: The process for resolving any disputes that may arise between the client and the advisory firm, such as mediation or arbitration. 7. Governing law: The legal jurisdiction that will govern the advisory agreement, which may be specific to San Diego or the state of California. 8. Limitation of liability: A clause outlining the limits of liability for the advisory firm, acknowledging that they cannot be held responsible for unforeseen market fluctuations or losses. 9. Compliance with regulations: The advisory agreement should affirm the advisory firm's compliance with relevant laws, regulations, and licensing requirements in San Diego or the state of California. While there may not be different types of San Diego California Terms of Advisory Agreements per se, the specific content and details of each agreement can vary based on the type of advisory services provided, the complexity of the client's financial situation, and the preferences and requirements of both parties involved. Hence, the terms and conditions within the agreement should be customized to reflect the unique circumstances of the client and the advisory firm.

San Diego California Terms of advisory agreement

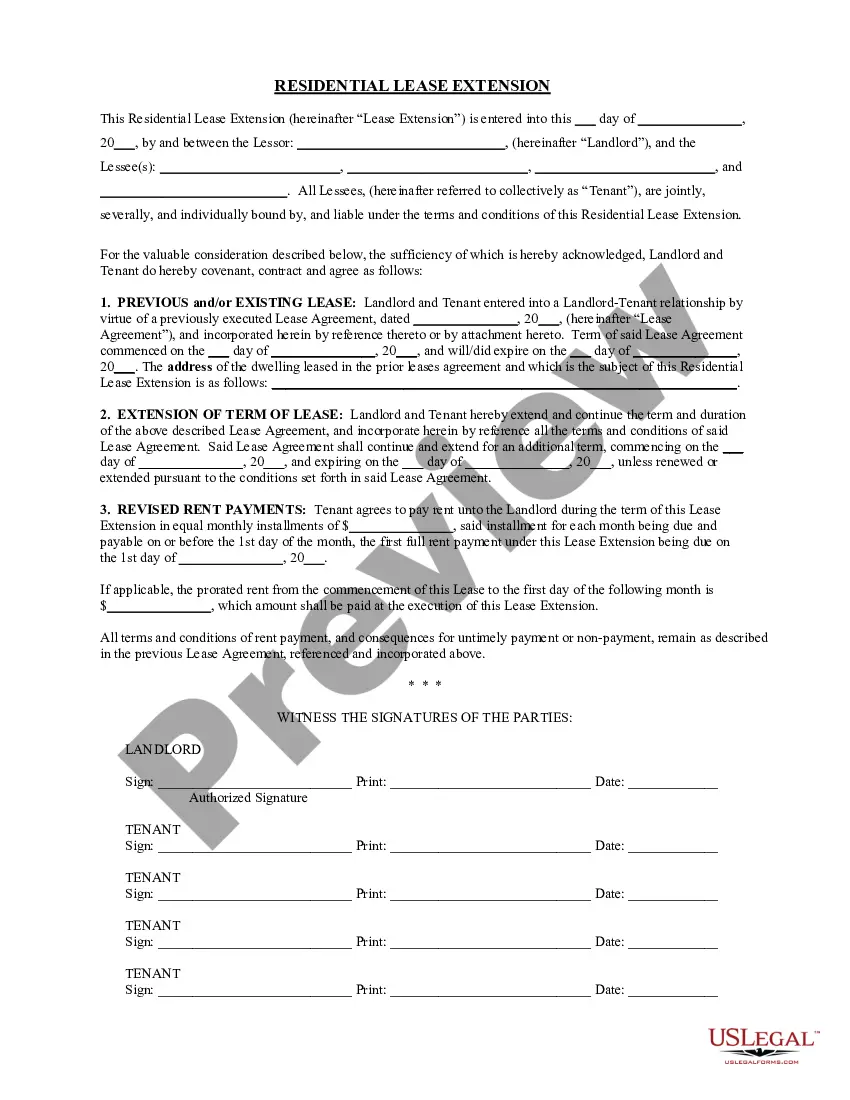

Description

How to fill out San Diego California Terms Of Advisory Agreement?

Do you need to quickly create a legally-binding San Diego Terms of advisory agreement or probably any other document to handle your personal or corporate matters? You can go with two options: hire a legal advisor to draft a legal document for you or create it completely on your own. The good news is, there's a third solution - US Legal Forms. It will help you get neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific document templates, including San Diego Terms of advisory agreement and form packages. We provide templates for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, carefully verify if the San Diego Terms of advisory agreement is adapted to your state's or county's laws.

- In case the form has a desciption, make sure to check what it's suitable for.

- Start the searching process over if the document isn’t what you were looking for by utilizing the search box in the header.

- Choose the subscription that best fits your needs and proceed to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, find the San Diego Terms of advisory agreement template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the documents we offer are updated by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!