Allegheny, Pennsylvania is a vibrant and diverse county located in the southwestern part of the state. It is known for its rich history, cultural attractions, and robust economy. In this article, we will delve into the various aspects of the Allegheny Pennsylvania Disclosure of Distribution Agreement, Services Agreement, and Tax Sharing Agreement, explaining their significance and different types that exist. The Disclosure of Distribution Agreement in Allegheny Pennsylvania is a legal document that outlines the terms and conditions of distributing products or services within the county. This agreement is crucial for businesses as it ensures transparency and compliance with applicable laws and regulations. It typically covers aspects such as payment terms, delivery requirements, quality control measures, and dispute resolution mechanisms. By disclosing the details of the distribution process, this agreement promotes a fair and mutually beneficial relationship between the distributor and the business entity. Similarly, the Services Agreement in Allegheny Pennsylvania governs the provision of services between two or more parties within the county. This agreement specifies the scope of services, responsibilities of each party, payment terms, intellectual property rights, confidentiality provisions, and termination conditions. Different types of services agreements in Allegheny Pennsylvania could include consulting and advisory services, professional services, maintenance and support services, or any other type of service-based relationship. The Tax Sharing Agreement in Allegheny Pennsylvania is an agreement between different municipalities or jurisdictions within the county that governs the allocation and sharing of tax revenues. It establishes a framework for cooperation and coordination among these entities, ensuring a fair distribution of tax monies collected. This agreement can be particularly important for regions with overlapping or shared tax jurisdictions, helping to prevent any potential disputes or conflicts. It's worth noting that the specific types and variations of these agreements may vary based on the industry, size of the business, or individual requirements. For example, a distribution agreement for a manufacturing company might differ from that of a software company. Similarly, a professional services agreement for a consulting firm may have distinctive clauses compared to a service agreement for a maintenance company. Therefore, it is essential to tailor these agreements to the specific needs and circumstances of each situation. In conclusion, the Allegheny Pennsylvania Disclosure of Distribution Agreement, Services Agreement, and Tax Sharing Agreement are legal documents that play a crucial role in promoting fair business practices and efficient financial management within the county. By ensuring transparency, defining responsibilities, and allocating tax revenues appropriately, these agreements contribute to a thriving business environment and enhanced collaboration among different entities in Allegheny, Pennsylvania.

Allegheny Pennsylvania Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement

Description

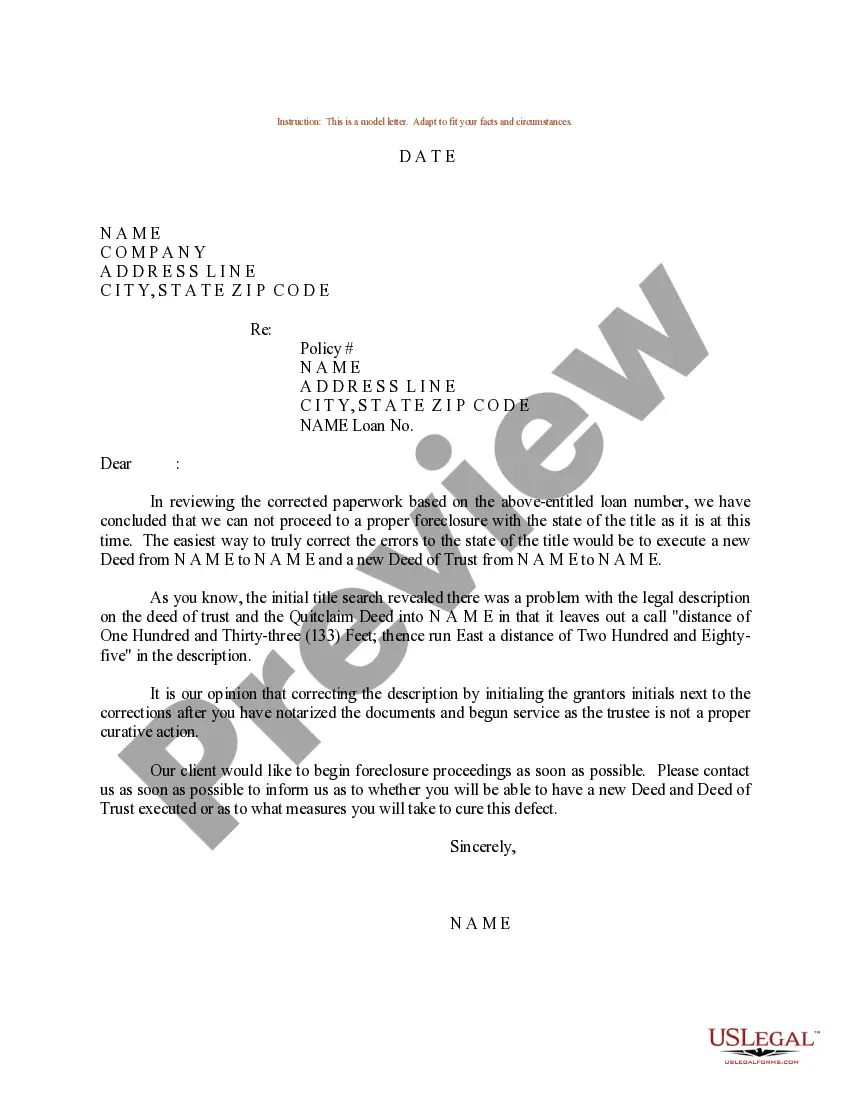

How to fill out Allegheny Pennsylvania Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing Agreement?

If you need to find a reliable legal form supplier to find the Allegheny Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement, look no further than US Legal Forms. Whether you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support make it easy to get and complete different papers.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to search or browse Allegheny Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement, either by a keyword or by the state/county the form is intended for. After locating necessary template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply locate the Allegheny Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Handling your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less expensive and more affordable. Set up your first company, arrange your advance care planning, create a real estate contract, or complete the Allegheny Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement - all from the comfort of your sofa.

Join US Legal Forms now!