Bronx, New York: Overview and Introduction Bronx, New York is one of the five boroughs of New York City, known for its vibrant neighborhoods, cultural diversity, and rich history. Located in the northern part of the city, the Bronx is home to a population of over 1.4 million people, making it the third-most populous borough. Bronx New York Disclosure of Distribution Agreement A Bronx New York Disclosure of Distribution Agreement is a legally binding document that outlines the terms and conditions between two parties involved in a distribution arrangement within the Bronx, New York region. This agreement typically includes details about the products or services being distributed, the responsibilities of each party, pricing, delivery terms, and any specific terms unique to the Bronx market. Bronx New York Services Agreement A Bronx New York Services Agreement is a contract that establishes the agreement between a service provider and a client or company in the Bronx, New York area. This agreement outlines the scope of work, duration, payment terms, and any specific conditions related to the provision of services within the Bronx area. Bronx New York Tax Sharing Agreement A Bronx New York Tax Sharing Agreement is a contractual agreement between different municipalities within the Bronx, New York area aimed at sharing the tax revenue generated within the region. This agreement helps to ensure a fair distribution of tax funds amongst the involved parties while promoting socio-economic development within the Bronx. Types of Bronx New York Distribution Agreements — Retail Distribution Agreement: This type of agreement establishes the terms and conditions between a manufacturer or wholesaler and a retailer in the Bronx, New York area. It outlines the terms of product delivery, pricing, promotional activities, and other relevant details. — Wholesale Distribution Agreement: A wholesale distribution agreement is a contract between a distributor and a manufacturer or producer. This agreement governs the distribution of products or services within the Bronx, New York market, including details on pricing, volume requirements, marketing support, and other important factors. Types of Bronx New York Services Agreements — Professional Services Agreement: This agreement is commonly used for service providers, such as consultants, contractors, or freelancers operating in the Bronx, New York area. It defines the services to be provided, compensation, intellectual property rights, and other crucial terms. — Maintenance Services Agreement: A maintenance services agreement outlines the terms and conditions between a service provider and a client for the provision of maintenance services within the Bronx, New York area. It covers aspects such as service levels, response times, payment terms, and other relevant details. Types of Bronx New York Tax Sharing Agreements — Inter-Municipal Tax Sharing Agreement: This type of tax sharing agreement is made between multiple municipalities within the Bronx, New York area. It sets forth the mechanisms and formulas for redistributing tax revenues amongst the involved parties to ensure a fair distribution of funds for various public services and infrastructure development. — County-City Tax Sharing Agreement: A county-city tax sharing agreement is an agreement specifically made between a county and a city within the Bronx, New York area to address the sharing of tax revenues generated within their jurisdictions. The agreement defines the terms and conditions applicable to tax sharing between the two entities, allowing for coordinated planning and resource allocation. In conclusion, the Bronx, New York offers a diverse and dynamic environment for businesses and economic activities. The Bronx New York Disclosure of Distribution Agreement, Services Agreement, and Tax Sharing Agreement are key legal instruments that facilitate smooth and regulated business operations within the borough. Whether involved in distribution, provision of services, or tax revenue sharing, having well-drafted agreements is essential for successful business transactions in the Bronx, New York.

Bronx New York Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement

Description

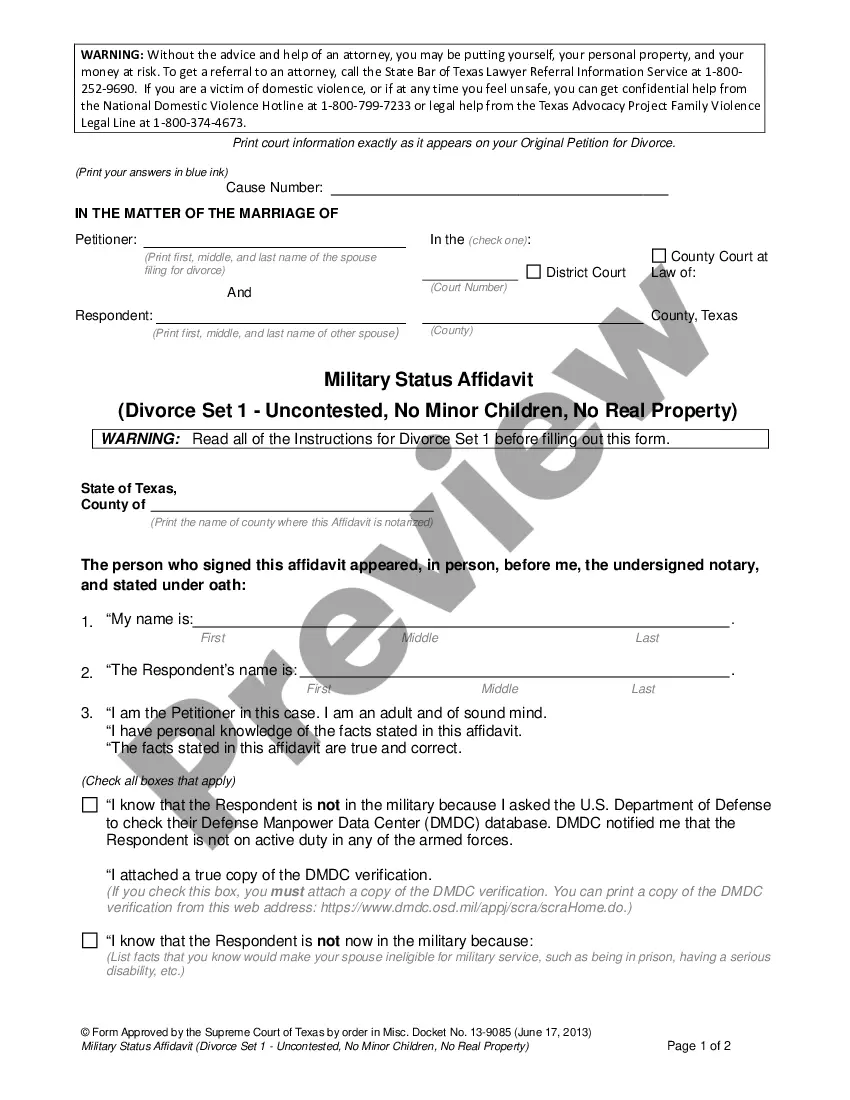

How to fill out Bronx New York Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing Agreement?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business purpose utilized in your county, including the Bronx Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Bronx Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Bronx Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement:

- Make sure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Bronx Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Signing a distribution agreement with a local distributor in the United States of America is one of the most common ways for foreign companies to enter the American market. It is also a great way to test whether a product can be marketed in the United States, without taking too many risks.

Distribution agreements define the terms and conditions under which a distributor may sell products provided by a supplier. Such an agreement may be for a limited term, and be further restricted by territory and distribution channel.

They allow the distributor to sell, market, and profit from the sales of a manufacturer's or wholesaler's product in bulk. A distribution agreement typically uses the terms and conditions that address territories, exclusivity rights, reporting requirements, and more.

What are the major advantages and disadvantages of filing a consolidated tax200b return? An advantage includes income of a profitable member can be offset by losses of another member. 200b However, a disadvantage includes losses of an unprofitable member may limit deductions or credits of a profitable member.

While brand-related intellectual property is typically held by the supplier, a thorough distribution agreement will always include an intellectual property clause that will give the distributor the legal right to use the supplier's intellectual property, including brand names and trademarks, for purposes of its sales

Distribution Agreement Checklist Specify the duration of the relationship including methods of ending the relationship and fair compensation on termination. Reserve your right to repurchase the distributor's inventory of products at cost, in order to facilitate a change in distributors.

Tax Sharing Arrangement means any written or unwritten agreement or arrangement for the allocation or payment of Tax liabilities or payment for Tax benefits with respect to a consolidated, combined or unitary Tax Return which includes the Company.

Although a tax sharing agreement is not required by law, Treasury Regulation Section 1.1552-1 does require that the tax liability of the consolidated group be allocated among the consolidated group members to determine the earnings and profits (E&P) of each member. A group member's allocated taxes reduce its E&P.

A tax sharing agreement (TSA) is a contract created to clarify the economic expectations among members of a related group of corporations included in consolidated or combined reporting tax returns.

Interesting Questions

More info

View 10-06033 11/07/2017 Joint Petition of Nevada Bell Telephone Company d/b/an AT&T Telecommunications Company L.L.C. and Western Union Communication Corporation (“Western Union”) for approval of Amendment No. 1 to their Interconnection Agreement pursuant to Section 252 of the Telecommunications Act of 1996. View 10-06032 11/06/2017 Petition of the Regulatory Operations Staff for an Expansion of Licensing Review Procedures for Non-Interconnected Local Connectors pursuant to NRS 704.68045. View 10-06031 10/05/2017 Application of Sierra Pacific Power Company d/b/a NV Energy for approval of its 2 Integrated Resource Plan and Notice of Modifications to the 2 Integrated Resource Plan. View 10-06010 10/04/2017 Notice by Tel rite Corporation d/b/a Life Wireless of a promotion for new customers with 100 or more local route miles and a 20 Mbps or higher download and upload speed to receive 50% off Lifeline™ Plus.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.