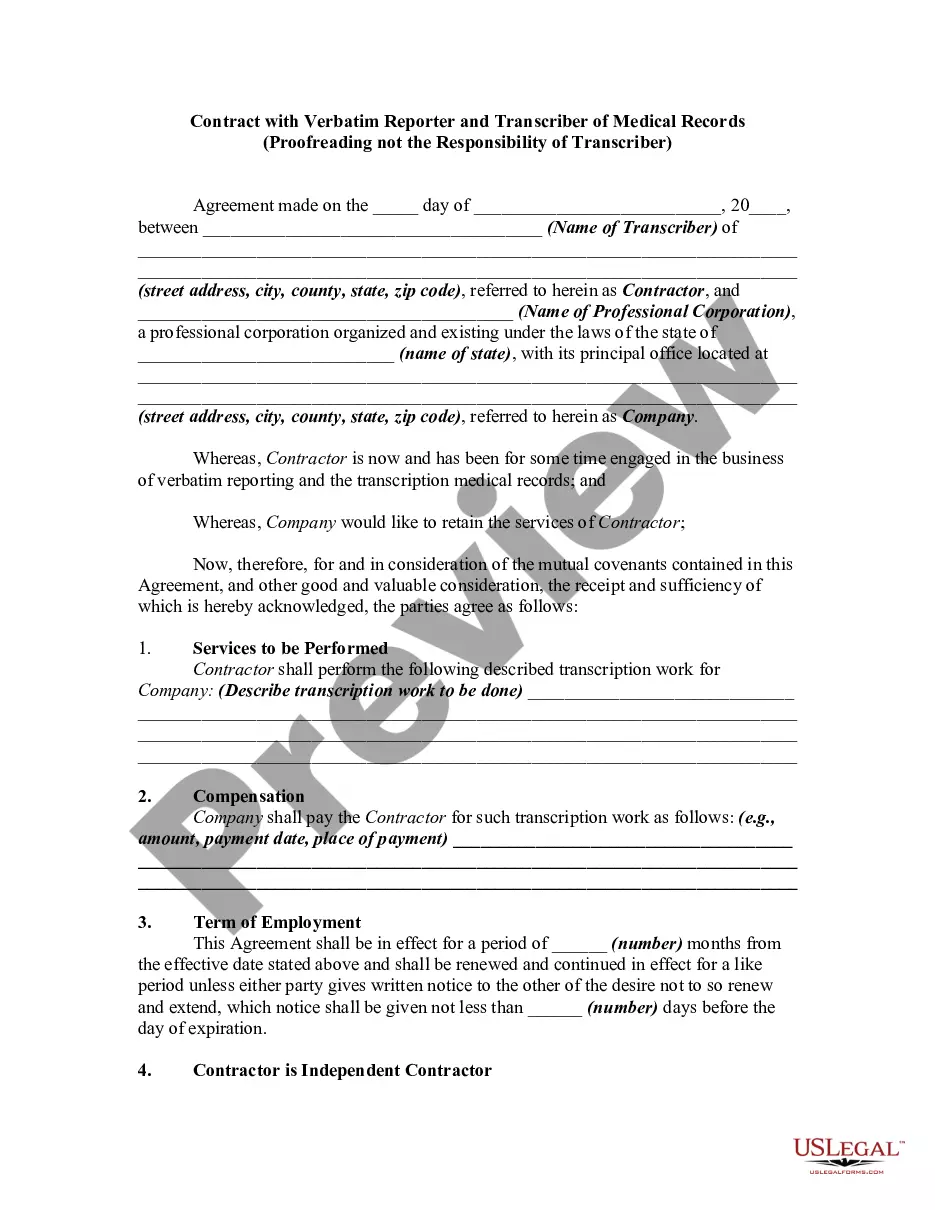

Chicago, Illinois is a thriving city located in the Midwest region of the United States. Known for its stunning architecture, diverse culinary scene, vibrant arts and culture, and deep-rooted history, Chicago attracts millions of tourists and residents each year. In the business realm, Chicago serves as a hub for various industries including finance, technology, healthcare, manufacturing, and transportation. As such, it is common for companies in Chicago to enter into various agreements to outline the terms and conditions of their business relationships. Three such agreements commonly entered into by businesses in Chicago are the Disclosure of Distribution Agreement, Services Agreement, and Tax Sharing Agreement. 1. Disclosure of Distribution Agreement: This type of agreement is crucial when two parties intend to collaborate on distributing products or services. The agreement sets forth the terms and conditions regarding the distribution rights, responsibilities, and obligations of both parties. It ensures that both parties are fully aware of their roles and responsibilities, and also provides mechanisms for dispute resolution and confidentiality. Essential keywords and phrases: distribution rights, collaboration, terms and conditions, responsibilities, obligations, dispute resolution, confidentiality. 2. Services Agreement: A Services Agreement is a contract between a service provider and a client that outlines the terms and conditions of the services to be rendered. In Chicago, where the service industry is thriving, this agreement facilitates agreements between businesses for services such as consulting, marketing, IT, advertising, and various other professional services. The agreement typically incorporates details regarding the scope of services, payment terms, intellectual property rights, confidentiality, and liability limitations. Essential keywords and phrases: service provider, client, terms and conditions, professional services, scope of services, payment terms, intellectual property rights, confidentiality, liability limitations. 3. Tax Sharing Agreement: When multiple entities are connected through common ownership or affiliation, a Tax Sharing Agreement may be established to govern the allocation and sharing of tax responsibilities. This agreement outlines how taxes such as income tax, sales tax, and property tax will be apportioned among the affiliated entities in Chicago. It specifies how the tax liabilities are computed, reported, and paid, ensuring fair and consistent tax treatment across all parties involved. Essential keywords and phrases: common ownership, tax responsibilities, allocation, tax liabilities, income tax, sales tax, property tax, apportioned, computed, reported, paid. It is important to note that these agreements can have variations and be tailored to specific industries, businesses, or circumstances. Always consult legal professionals familiar with Chicago business laws and regulations to draft agreements that suit your specific needs and comply with local laws. In conclusion, Chicago, Illinois fosters a dynamic business environment where various agreements, including the Disclosure of Distribution Agreement, Services Agreement, and Tax Sharing Agreement, play a vital role in facilitating business relationships and ensuring fair and mutually beneficial collaborations.

Chicago Illinois Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement

Description

How to fill out Chicago Illinois Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing Agreement?

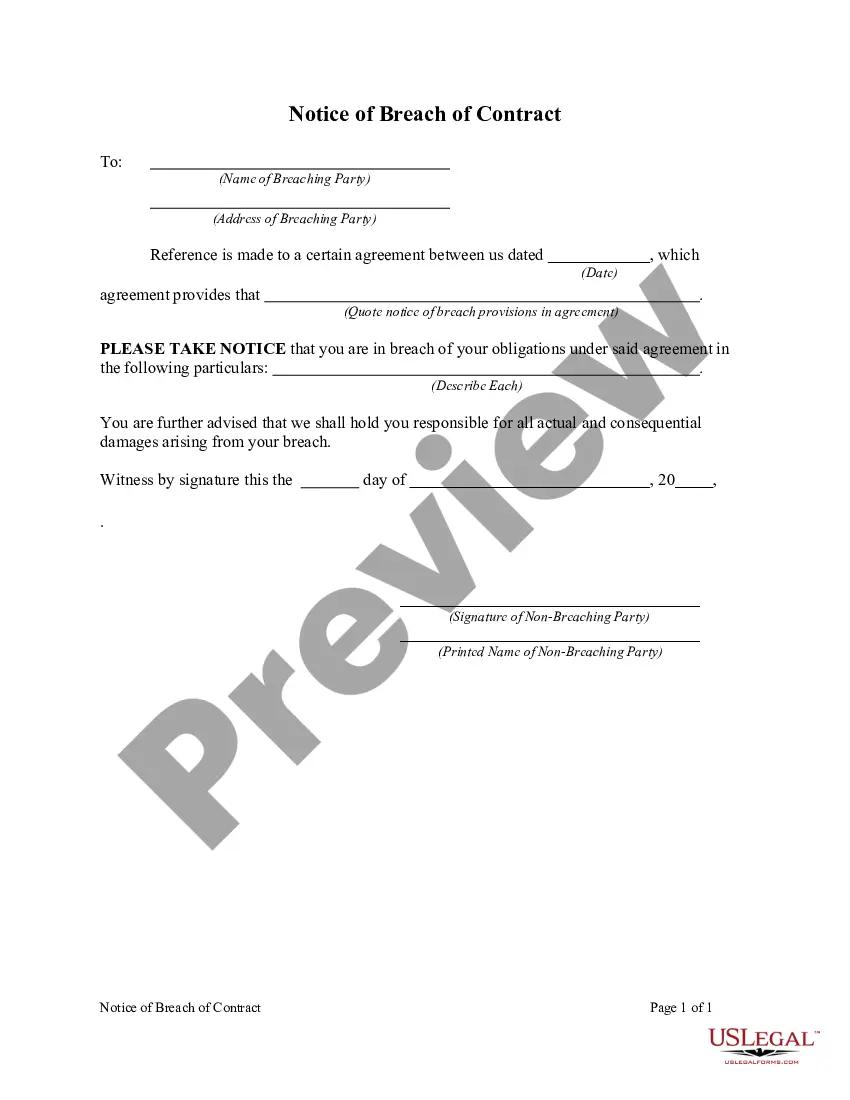

How much time does it normally take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a Chicago Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement suiting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. In addition to the Chicago Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement, here you can get any specific form to run your business or individual deeds, complying with your regional requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required sample, and download it. You can retain the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Chicago Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Chicago Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

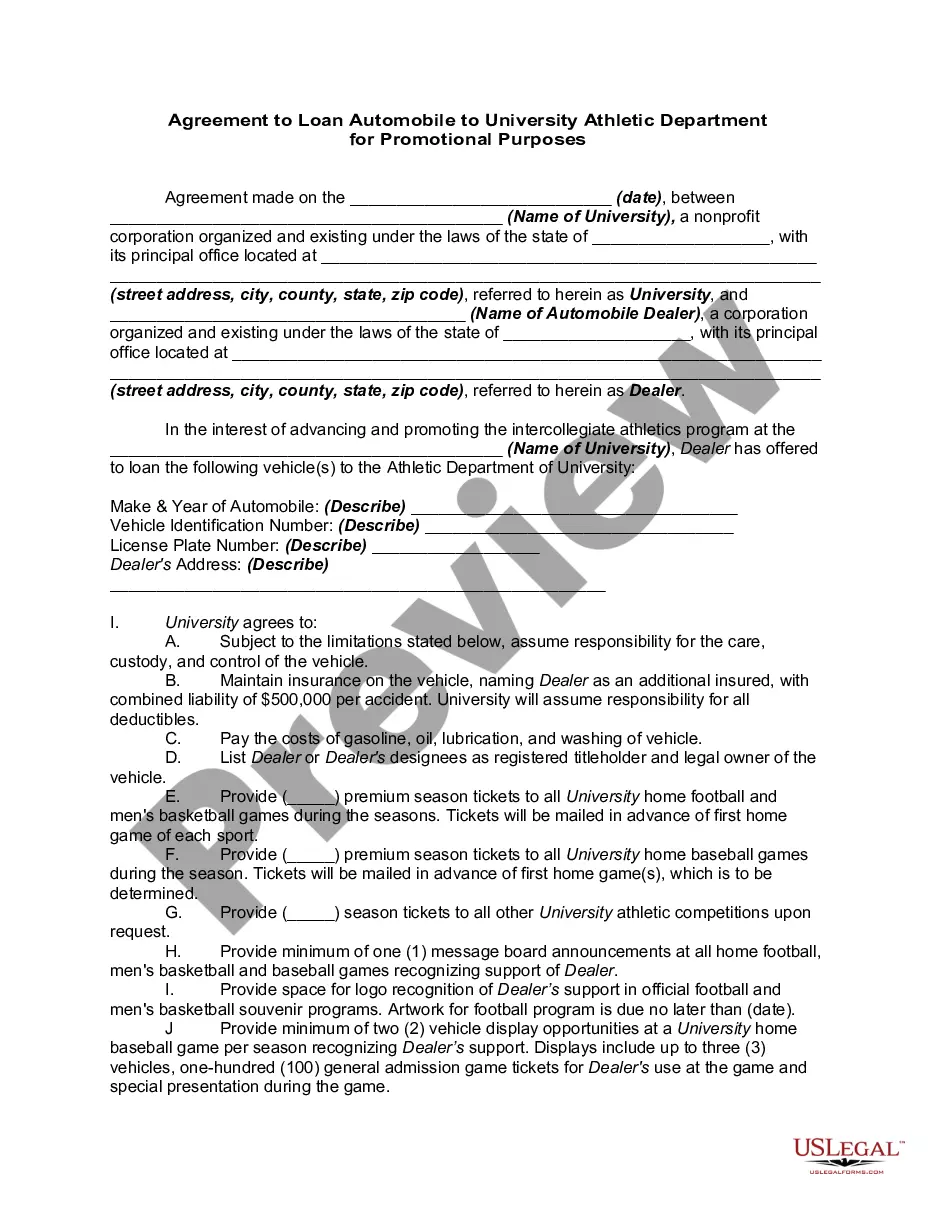

The distribution agreement (also known as a ?wholesale distribution agreement?) governs the distribution of items made by a producer (also known as a ?supplier?) and sold by a distributor. There are two primary parts to the distribution agreement.

Six Rules for Negotiating a Better Distribution Agreement Balance. Balance in a distribution agreement ensures that neither party holds unfair power over the other.Due Diligence.Annual Termination and Semiautomatic Renewal.Comparison with Proven Industry Agreements.Four Eyes versus Two Eyes.Cause and Convenience.

A distributorship agreement is a document that creates a relationship of distributorship between a manufacturer and a distributor. The agreement confers on the distributor the right to supply the manufacturer's goods within a region or regions. Such rights may be exclusive within that particular region/regions.

A purchase agreement is a legal document that is signed by both the buyer and the seller. Once it is signed by both parties, it is a legally binding contract. The seller can only accept the offer by signing the document, not by just providing the goods.

Distribution agreements define the terms and conditions under which a distributor may sell products provided by a supplier. Such an agreement may be for a limited term, and be further restricted by territory and distribution channel.

A distribution agreement, also known as a distributor agreement, is a contract between a supplying company with products to sell and another company that markets and sells the products. The distributor agrees to buy products from the supplier company and sell them to clients within certain geographical areas.

A distribution deal (also known as distribution contract or distribution agreement) is a legal agreement between one party and another, to handle distribution of a product. There are various forms of distribution deals. There are exclusive and non-exclusive distribution agreements.

A reseller is generally less closely associated with the manufacturer, and sometimes does not have a direct relationship with the manufacturer as it generally buys products from distributors. Resellers usually do not keep inventory of product or provide after-sale services.