Contra Costa County, located in California, prides itself on promoting transparency and accountability in various business transactions, including the disclosure of distribution agreements, services agreements, and tax sharing agreements. These legally binding contracts play a crucial role in defining the terms and conditions governing partnerships, service provisions, and taxation arrangements among different parties. A Contra Costa California Disclosure of Distribution Agreement is an agreement entered into between two or more parties, often manufacturers, suppliers, or distributors. It outlines the terms and conditions under which goods or products will be distributed, including responsibilities, delivery schedules, pricing details, and any exclusivity or geographical restrictions. This agreement ensures transparency in the distribution process and helps avoid conflicts or misunderstandings among the involved parties. Similarly, a Contra Costa California Services Agreement is a contract that defines the scope, terms, and conditions of services to be provided by one party to another. This agreement sets out the responsibilities, performance standards, timelines, and compensation details, ensuring that both parties have a clear understanding of the specific services to be delivered. This agreement serves as a valuable tool for managing expectations and preventing disputes between service providers and recipients. Additionally, Contra Costa California Tax Sharing Agreements are contracts designed to establish the sharing of tax revenue among different jurisdictions or entities. These agreements typically involve negotiations between local governments or organizations to determine how tax revenues will be distributed and allocated fairly. They address issues such as tax collection, apportionment, reporting, and dispute resolution mechanisms. By ensuring transparency and equitable distribution, tax sharing agreements help foster cooperation and economic development within Contra Costa County. Different types of these agreements can be categorized based on their specific purposes, such as Contra Costa California Sales Distribution Agreement, Service Level Agreement (SLA), and Inter-governmental Tax Sharing Agreement. Each type of agreement caters to different industries, business models, or governmental jurisdictions, but they all share the common goal of providing a comprehensive framework for managing relationships, expectations, and financial implications. In conclusion, Contra Costa California places importance on the disclosure and implementation of various agreements, including Distribution Agreements, Services Agreements, and Tax Sharing Agreements. These legal documents promote transparency, fair business practices, and effective governance within the county. Whether it is a Distribution Agreement, Services Agreement, or Tax Sharing Agreement, each serves as a crucial tool in ensuring that business transactions and tax allocations are carried out in a transparent and mutually beneficial manner.

Contra Costa California Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement

Description

How to fill out Contra Costa California Disclosure Of Distribution Agreement, Services Agreement And Tax Sharing Agreement?

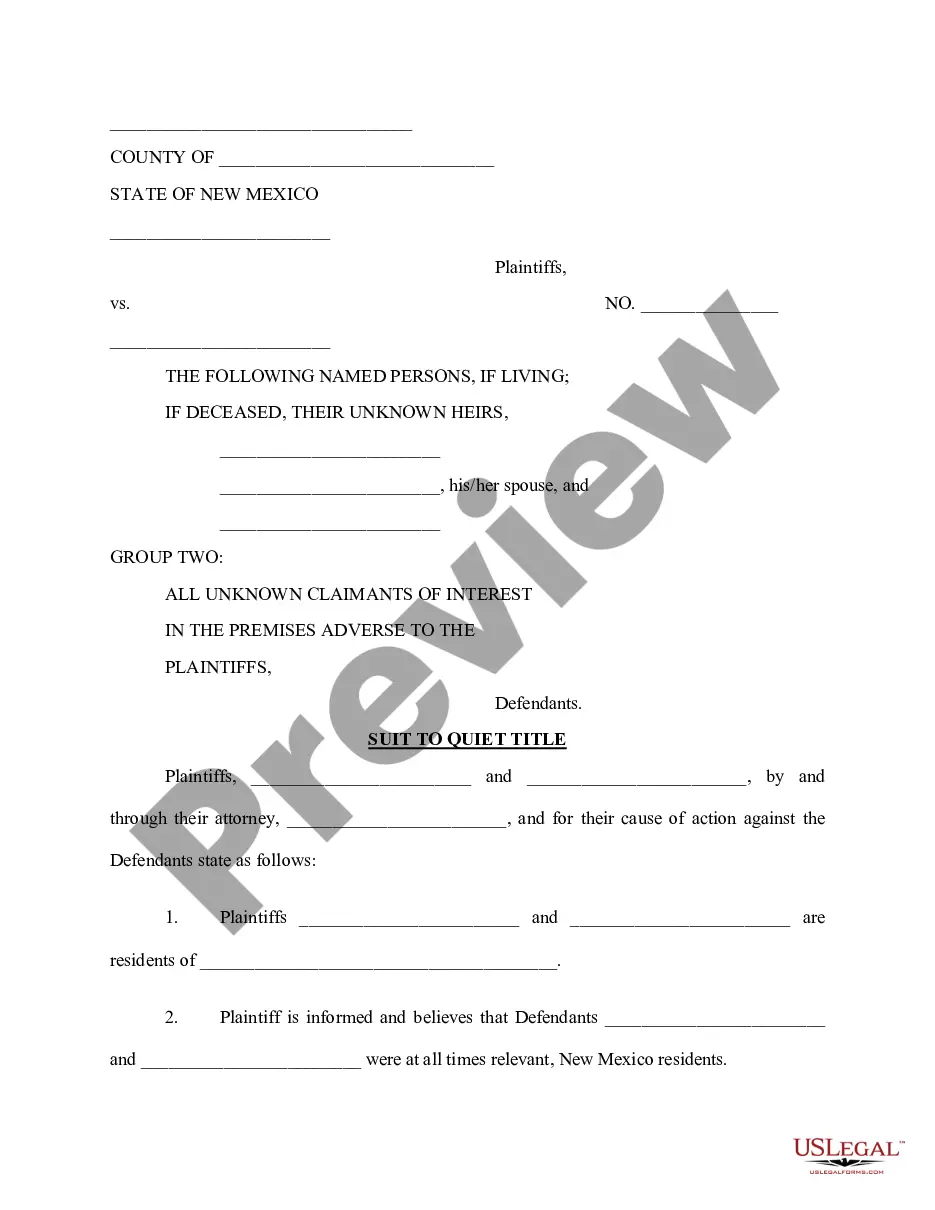

Are you looking to quickly draft a legally-binding Contra Costa Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement or probably any other form to take control of your personal or corporate affairs? You can go with two options: contact a legal advisor to write a valid paper for you or create it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you get neatly written legal documents without paying unreasonable prices for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-compliant form templates, including Contra Costa Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement and form packages. We offer templates for a myriad of life circumstances: from divorce papers to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- First and foremost, double-check if the Contra Costa Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement is adapted to your state's or county's regulations.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the document isn’t what you were looking for by utilizing the search bar in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Contra Costa Disclosure of Distribution Agreement, Services Agreement and Tax Sharing Agreement template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the templates we provide are updated by law professionals, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Which of the following disclosures are not required in a sales contract? UTILITY COST: Sellers are not requires to disclose their utility costs on the sales contract.

California Real Estate Disclosure Requirements In California, sellers must provide a Transfer Disclosure Statement (TDS) to any potential buyer whose offer has been accepted. This form asks specific questions about defects or malfunctions the seller may be aware of.

A residential purchase agreement (RPA) is a basic document outlining the details of a real estate purchase between a buyer and a seller. It can include a variety of specifics related to the transaction, including price, settlement, property details, option to terminate, and lead-based paint disclosure.

You will need to include information about all appliances in the home, including which are included in the sale as well as whether they are operational. You will also need to disclose any room additions, damage, or neighborhood noise problems.

As a home purchase is such an important transaction, buyers need to know that they are protected. In California, residential property sellers are required to provide a comprehensive Transfer Disclosure Statement (TDS) to the buyer.

Here are eight common real estate seller disclosures to be aware of, whether you're on the buyer's side or the seller's side. Death in the Home.Neighborhood Nuisances.Hazards.Homeowners' Association Information.Repairs.Water Damage.Missing Items.Other Possible Disclosures.

How to fill out RPA ( Residential Purchase Agreement) Zipforms YouTube Start of suggested clip End of suggested clip Now here is the agency relationships. Okay this is where we input who's representing the seller andMoreNow here is the agency relationships. Okay this is where we input who's representing the seller and who's representing the buyer. You can look up the license. Numbers directly from the mls.

How To Fill Out The New 2021 California Residential PurchaseYouTube Start of suggested clip End of suggested clip Address city county zip assessor's parcel number which can be found on the mls listing on the tax.MoreAddress city county zip assessor's parcel number which can be found on the mls listing on the tax. Bill on a title company's property profile or realist property profile.

Real Property Administrator (RPA®)

California Residential Listing Agreement (CAR Form- YouTube YouTube Start of suggested clip End of suggested clip Relationship disclosure. It's a two-page. Form you simply put in the name or names of the seller.MoreRelationship disclosure. It's a two-page. Form you simply put in the name or names of the seller. Here. And then your brokerage name brokerage license. Number your name as an agent.