Clark Nevada Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company

Description

How to fill out Standstill Agreement Of Grossmans, Inc. - Internal Agreement Regarding Shareholders Of Single Company?

Organizing documentation for business or personal requirements is consistently a significant obligation.

When formulating a contract, a public service application, or a power of attorney, it is crucial to take into account all local and federal laws of the particular region.

Nonetheless, smaller counties and even municipalities also possess legislative processes that you must contemplate.

Engage the search bar in the page header to locate the one that satisfies your requirements.

- All of these aspects make it burdensome and time-consuming to produce the Clark Standstill Agreement of Grossmans, Inc. - Internal agreement concerning shareholders of a sole company without expert aid.

- It is feasible to circumvent expenses on lawyers drafting your paperwork and create a legally acceptable Clark Standstill Agreement of Grossmans, Inc. - Internal agreement about shareholders of a singular company independently, utilizing the US Legal Forms online repository.

- It represents the most comprehensive online compilation of state-specific legal documents that are professionally verified, ensuring you can trust their legitimacy when selecting a template for your jurisdiction.

- Previous subscribers simply need to Log In to their accounts to retrieve the essential form.

- Should you still lack a subscription, navigate the step-by-step guide outlined below to procure the Clark Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of a single company.

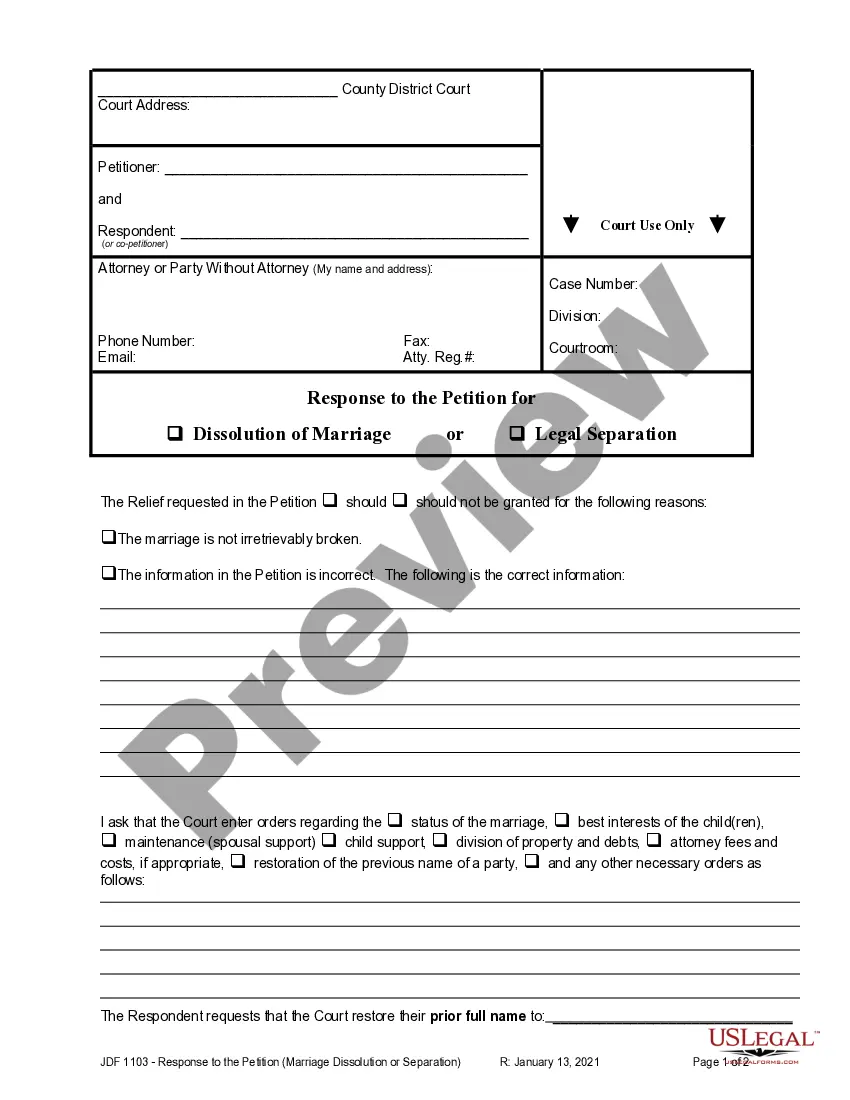

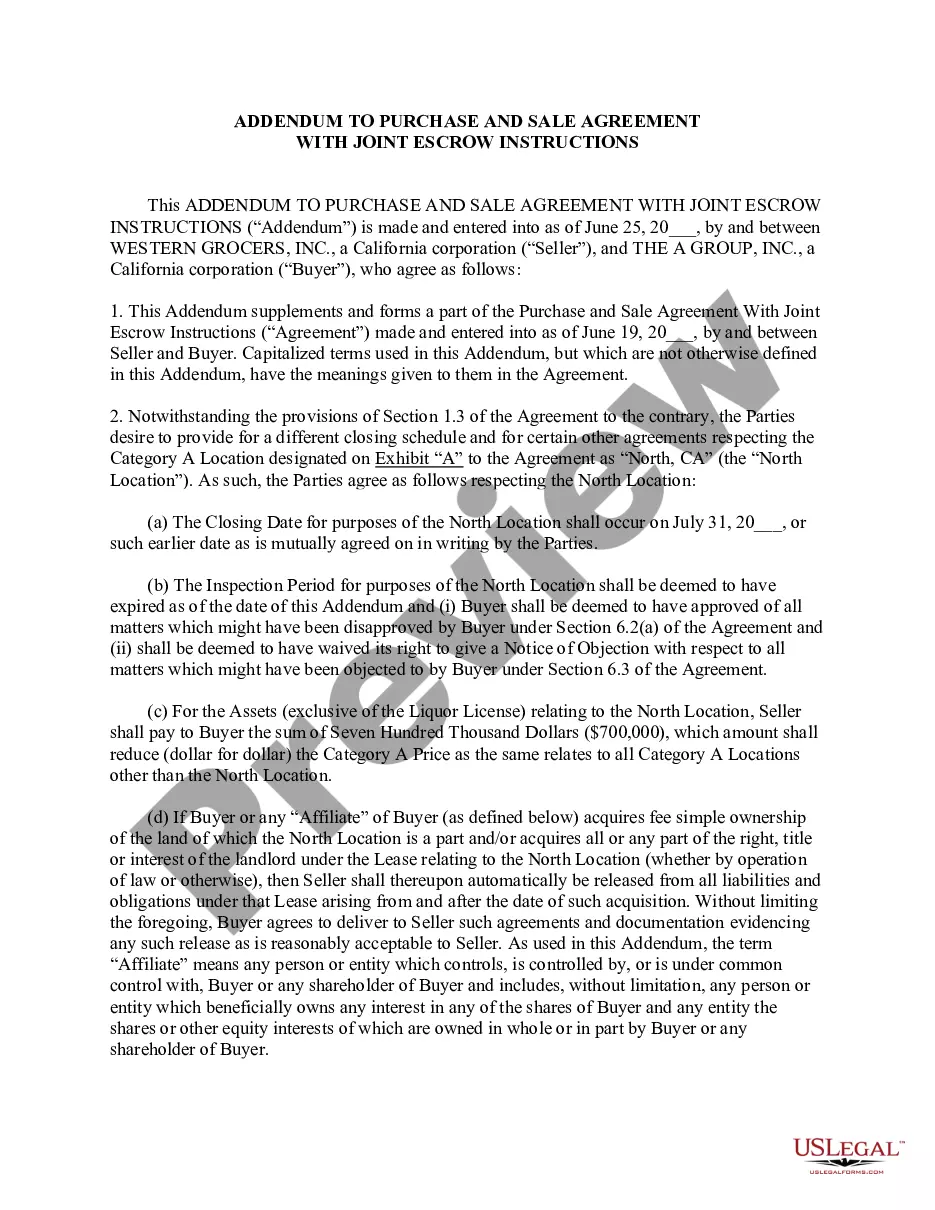

- Inspect the webpage you've accessed and confirm if it possesses the sample you require.

- To verify this, utilize the form description and preview if these features are at hand.

Form popularity

FAQ

A standstill agreement is a contract between parties to pause certain legal and financial moves for a specified time. The Clark Nevada Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of a single company serves this purpose by providing a framework for shareholders to negotiate and discuss concerns. This agreement lays the groundwork for collaboration, ultimately benefiting all stakeholders.

Legally, a standstill denotes an arrangement where parties agree to refrain from specific actions for an agreed duration. In the context of the Clark Nevada Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of a single company, this means shareholders voluntarily agree to hold off on actions like selling shares or instigating legal claims. This helps create a conducive atmosphere for problem-solving.

The standstill principle refers to the concept of maintaining the current status quo among parties involved in a business arrangement. In terms of the Clark Nevada Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company, this principle ensures no drastic changes occur without mutual agreement. This assists in safeguarding the interests of all shareholders and minimizes conflicts during delicate periods. Understanding this principle can contribute to more strategic decision-making processes among shareholders.

A shareholders' agreement is optional. But the founding shareholders or owners should consider entering into such an agreement before the company is established in order to create a contractual basis to govern the relationship among themselves and between the shareholders and the company.

A shareholder agreement will include the rights and obligations of each shareholder, how the shares of the company are sold, how the company will run, and how decisions will be made.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the

If you want to remove a shareholder, you first must decide if the shareholder is leaving the company voluntarily or involuntarily. For involuntary removals, the shareholder will usually need to have violated the shareholders agreement or company bylaws before they can be forced out of the company.

Standstill provisions limit the buyer's acquisition of securities or other rights in the seller, involvement in the solicitation of proxies with respect to the voting of securities of the seller, and other similar activities with respect to the seller's securities.

A Shareholder Agreement, also known as a stockholder agreement or SPA, is a contract between the stock owners of a corporation that addresses the rights, responsibilities, and ownership of a corporation.

Purposes of a Shareholders' Agreement To preserve a shareholder's proportion of the outstanding shares- e.g., to give the equivalent of preemptive rights to the shareholder parties to the agreement (who may include less than all of the shareholders). To place restrictions on the sale or other transfer of shares.