The Maricopa Arizona Standstill Agreement is a crucial internal agreement that governs the relationship and obligations between shareholders within Gross mans, Inc., a prominent single company based in Maricopa, Arizona. This agreement aims to maintain stability, promote transparency, and facilitate efficient decision-making processes among the shareholders. Here, we will delve into the details of this agreement and shed light on its significance. The Maricopa Arizona Standstill Agreement primarily focuses on restricting certain activities of shareholders to maintain a harmonious environment within the company. By doing so, it aims to prevent any untimely disruptions or conflicts that may hinder the company's progress. This agreement often encompasses various provisions and restrictions, limiting certain actions of the shareholders, such as: 1. Shareholder Voting: The agreement may define specific limitations on the voting power of shareholders, ensuring equitable decision-making processes and preventing any party from acquiring excessive control over the company. 2. Transfer of Shares: It may establish restrictions on the transferability of shares held by the shareholders. This serves to regulate the sale or transfer of shares within the company, minimizing the risk of sudden changes in ownership or potential takeovers. 3. Proxy Voting: The agreement may contain provisions regarding the use of proxy voting, restricting shareholders from exerting influence indirectly through the appointment of proxies. 4. Dispute Resolution Mechanisms: In the event of disputes between shareholders, the agreement may outline the procedures and mechanisms that should be followed to resolve such conflicts efficiently. This ensures a fair and unbiased approach to handling internal disagreements. 5. Confidentiality: To protect the sensitive information and interests of the company, the agreement may include confidentiality clauses, prohibiting shareholders from disclosing confidential information to external parties. It is worth noting that there may be variations or different types of the Maricopa Arizona Standstill Agreement within Gross mans, Inc. These variations could be tailored to the specific needs and circumstances of the shareholders involved. Some potential types of these agreements may include: 1. Basic Standstill Agreement: This version typically covers the essential provisions mentioned above and establishes a foundation for shareholder cooperation, governance, and stability. 2. Advanced Standstill Agreement: This could include additional provisions, such as buy-sell agreements or restrictions on the transfer of shares to competitors, to address more complex shareholder dynamics or specific situations unique to Gross mans, Inc. 3. Customized Standstill Agreement: When the shareholder structure or objectives of the company demand a more personalized approach, a customized agreement may be drafted. This would involve tailoring the provisions to meet the specific needs and goals of Gross mans, Inc. and its shareholders. Ultimately, the Maricopa Arizona Standstill Agreement of Gross mans, Inc. plays a vital role in maintaining a healthy and balanced relationship among shareholders, promoting transparency, stability, and effective decision-making processes. It ensures a favorable environment for the company's growth and success while safeguarding the interests of all stakeholders involved.

Maricopa Arizona Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company

Description

How to fill out Maricopa Arizona Standstill Agreement Of Grossmans, Inc. - Internal Agreement Regarding Shareholders Of Single Company?

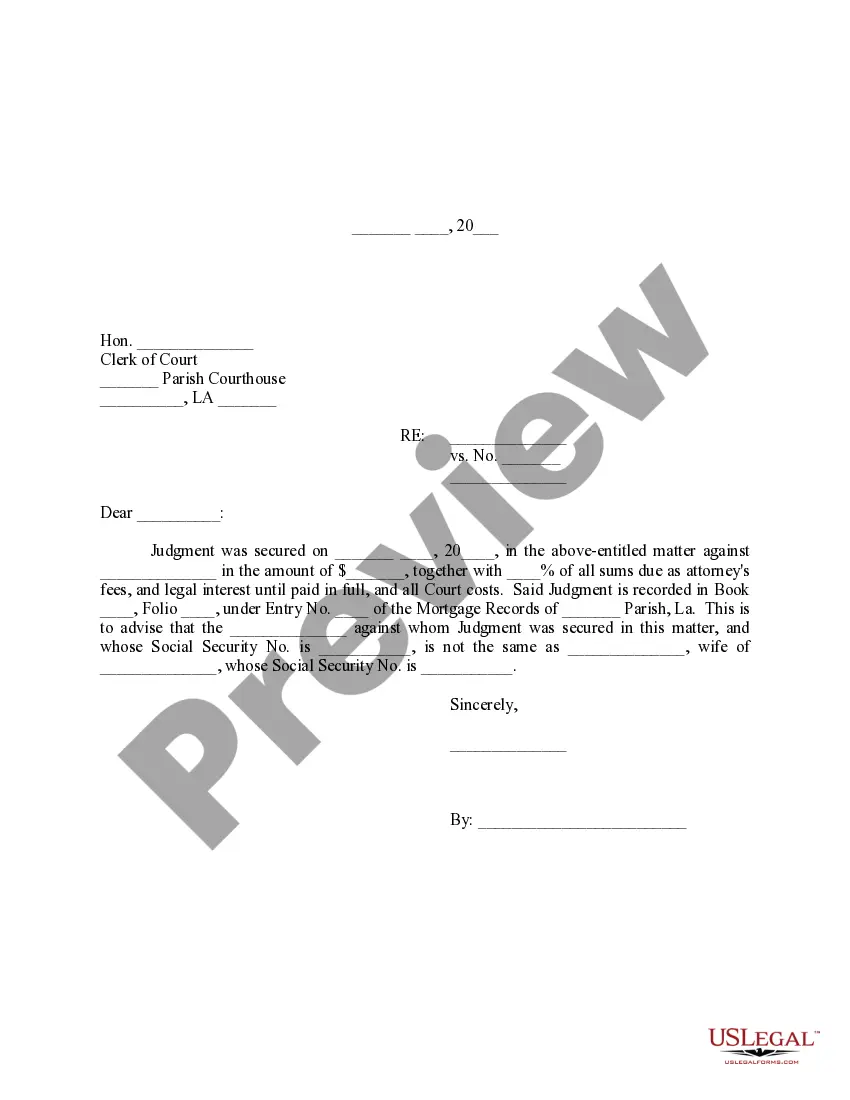

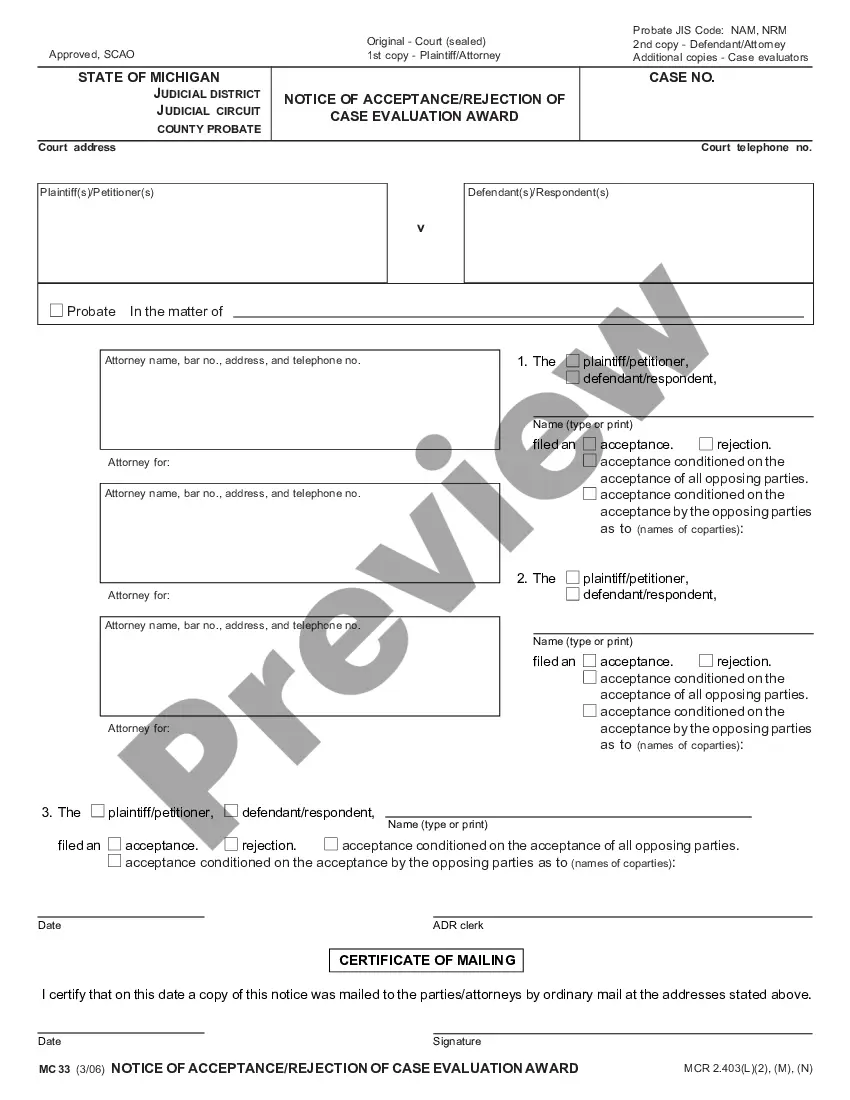

Creating documents, like Maricopa Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company, to manage your legal affairs is a challenging and time-consumming task. A lot of circumstances require an attorney’s involvement, which also makes this task expensive. However, you can get your legal matters into your own hands and handle them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal documents intended for various cases and life circumstances. We make sure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how effortless it is to get the Maricopa Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company form. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before getting Maricopa Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company:

- Make sure that your form is compliant with your state/county since the regulations for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Maricopa Standstill Agreement of Grossmans, Inc. - Internal agreement regarding shareholders of single company isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin utilizing our website and download the document.

- Everything looks great on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!