Cook Illinois Utilization by a REIT of Partnership Structures in Financing Five Development Projects: An In-Depth Analysis Introduction: In today's real estate market, many real estate investment trusts (Rests) employ partnership structures to finance their development projects. One notable example is Cook Illinois, a prominent REIT that strategically utilizes partnership structures to fund various development ventures. In this article, we will delve into the details of Cook Illinois' utilization of partnership structures in financing five different development projects. Through this discussion, we aim to elucidate the diverse methods and benefits of employing such structures while incorporating relevant keywords. 1. Joint Ventures: Cook Illinois actively engages in joint ventures to finance its development projects. Through joint ventures, Cook Illinois forms partnerships with other investors, pooling financial resources and expertise. This approach allows the REIT to mitigate risk, share costs, and leverage the knowledge of partners specializing in specific markets or project types. Furthermore, joint ventures often offer tax advantages, increased access to capital, and greater diversification. Keywords: Joint ventures, pooling financial resources, risk mitigation, cost-sharing, expertise, tax advantages, access to capital, diversification. 2. Limited Partnerships: Cook Illinois frequently forms limited partnerships to finance its development endeavors. Limited partnerships involve two or more parties, including a general partner (Cook Illinois) and limited partners (investors). The general partner manages the project and assumes liability, while limited partners provide capital without direct involvement in management. This setup provides Cook Illinois with valuable financial support and allows investors to passively participate in the project's success. Keywords: Limited partnerships, general partner, limited partners, capital infusion, passive investor, liability management. 3. REIT-Corporation Partnerships: In certain instances, Cook Illinois enters into partnerships with corporations to secure funding for its development projects. These partnerships involve joint investment, where a corporation invests in Cook Illinois in exchange for certain benefits, such as involvement in the decision-making process or a share in the project's profits. This partnership structure facilitates access to substantial capital resources and can enable Cook Illinois to tap into corporations' industry knowledge and connections. Keywords: REIT-corporation partnerships, joint investment, decision-making involvement, profit-sharing, capital resources, industry knowledge, connections. 4. Limited Liability Companies (LCS): Cook Illinois sometimes establishes limited liability companies as partnership structures to finance development projects. LCS offer the liability protection of a corporation combined with the flexibility and taxation benefits of a partnership. This structure allows Cook Illinois to attract individual investors, who become members of the LLC, contributing capital and sharing in the profits. By utilizing this partnership structure, Cook Illinois can diversify its investor base and strengthen its financial position. Keywords: Limited Liability Companies (LCS), liability protection, flexibility, taxation benefits, individual investors, member contributions, profit-sharing, investor base diversification. Conclusion: Cook Illinois demonstrates the strategic and versatile utilization of partnership structures in financing its diverse development projects. Through joint ventures, limited partnerships, REIT-corporation partnerships, and limited liability companies, Cook Illinois successfully leverages financial resources, mitigates risk, attracts capital, and harnesses specialized expertise. These partnership structures enable Cook Illinois to thrive in the competitive real estate market and ensure the realization of its development ambitions. Keywords: Strategic utilization, versatile, development projects, financial resources, risk mitigation, capital attraction, specialized expertise, competitive market, development ambitions.

Cook Illinois Utilization by a REIT of partnership structures in financing five development projects

Description

How to fill out Cook Illinois Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

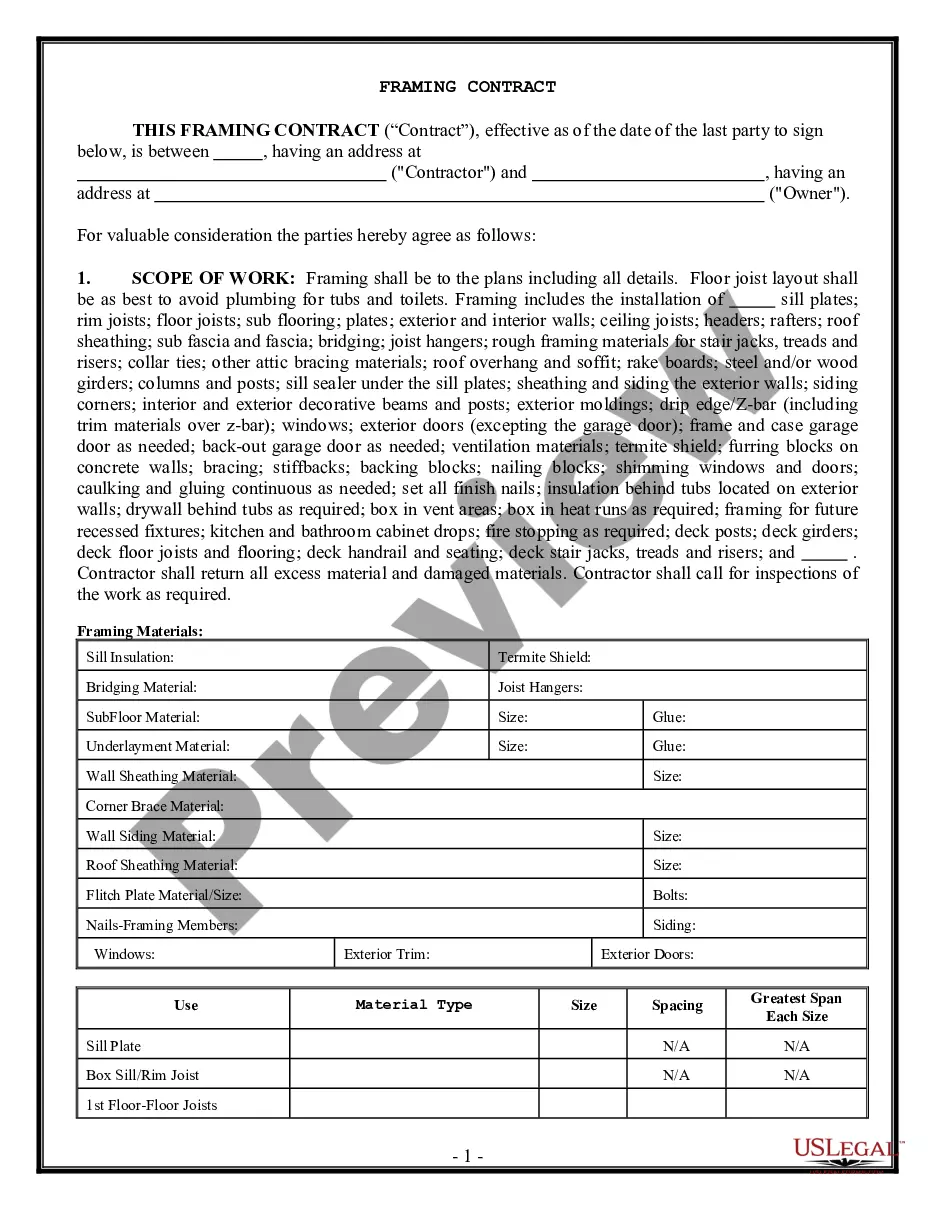

If you need to find a trustworthy legal paperwork supplier to get the Cook Utilization by a REIT of partnership structures in financing five development projects, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can select from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of learning materials, and dedicated support make it easy to locate and execute different papers.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply type to search or browse Cook Utilization by a REIT of partnership structures in financing five development projects, either by a keyword or by the state/county the form is intended for. After locating needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply locate the Cook Utilization by a REIT of partnership structures in financing five development projects template and take a look at the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Handling your law-related affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes these tasks less pricey and more affordable. Set up your first company, arrange your advance care planning, draft a real estate agreement, or complete the Cook Utilization by a REIT of partnership structures in financing five development projects - all from the convenience of your home.

Join US Legal Forms now!