Title: Cuyahoga Ohio Utilization by a REIT: Leveraging Partnership Structures for Five Development Projects Introduction: In Cuyahoga County, Ohio, Real Estate Investment Trusts (Rests) play a crucial role in financing and executing various development projects. These Rests strategically utilize partnership structures to secure capital, pool resources, and mitigate risks for their ventures. This article aims to provide a detailed description of Cuyahoga Ohio Utilization by a REIT of partnership structures in financing five development projects, highlighting their significance and exploring different types. Keywords: Cuyahoga Ohio, REIT, partnership structures, financing, development projects 1. Joint Ventures: Rests in Cuyahoga Ohio often engage in joint ventures with external partners, such as other Rests, developers, or financial institutions. Through this partnership structure, the REIT shares both financial resources and expertise to maximize returns and manage risks associated with the development projects. 2. Limited Partnerships: Another common form of partnerships utilized by Rests in Cuyahoga Ohio is through limited partnerships (LPs). In LPs, the REIT acts as the general partner, responsible for management and decision-making, while limited partners contribute capital but have limited liability. This structure allows Rests to access additional funding and share project-specific risks with diverse investors. 3. Mezzanine Financing: Utilizing mezzanine financing, Rests in Cuyahoga Ohio partner with lenders or other investors to secure funds for development projects. Mezzanine financing involves a combination of debt and equity, giving the REIT greater flexibility in project financing and often providing attractive returns to partnering entities. 4. Public-Private Partnerships (PPP): Cuyahoga Ohio Rests frequently collaborate with government entities through PPP to develop public infrastructure and revitalization projects. This partnership structure leverages private investment while accessing public resources, allowing the REIT to benefit from governmental incentives, tax credits, and reduced development risks. 5. Master Limited Partnerships (Maps): Some Cuyahoga Ohio Rests utilize Maps, which are publicly traded partnerships, for financing their development projects. Maps combine the tax advantages of limited partnerships with the liquidity and accessibility of publicly traded securities, attracting a broad range of investors and facilitating larger-scale investments. Conclusion: In Cuyahoga Ohio, Rests rely on partnership structures to finance and execute development projects efficiently. Through diverse arrangements such as joint ventures, limited partnerships, mezzanine financing, public-private partnerships, and master limited partnerships, Rests can secure capital, pool resources, and manage risks effectively. These strategic partnerships not only fuel economic growth and development in Cuyahoga Ohio but also offer attractive investment opportunities while ensuring successful project outcomes. Keywords: Cuyahoga Ohio, REIT, partnership structures, financing, development projects

Cuyahoga Ohio Utilization by a REIT of partnership structures in financing five development projects

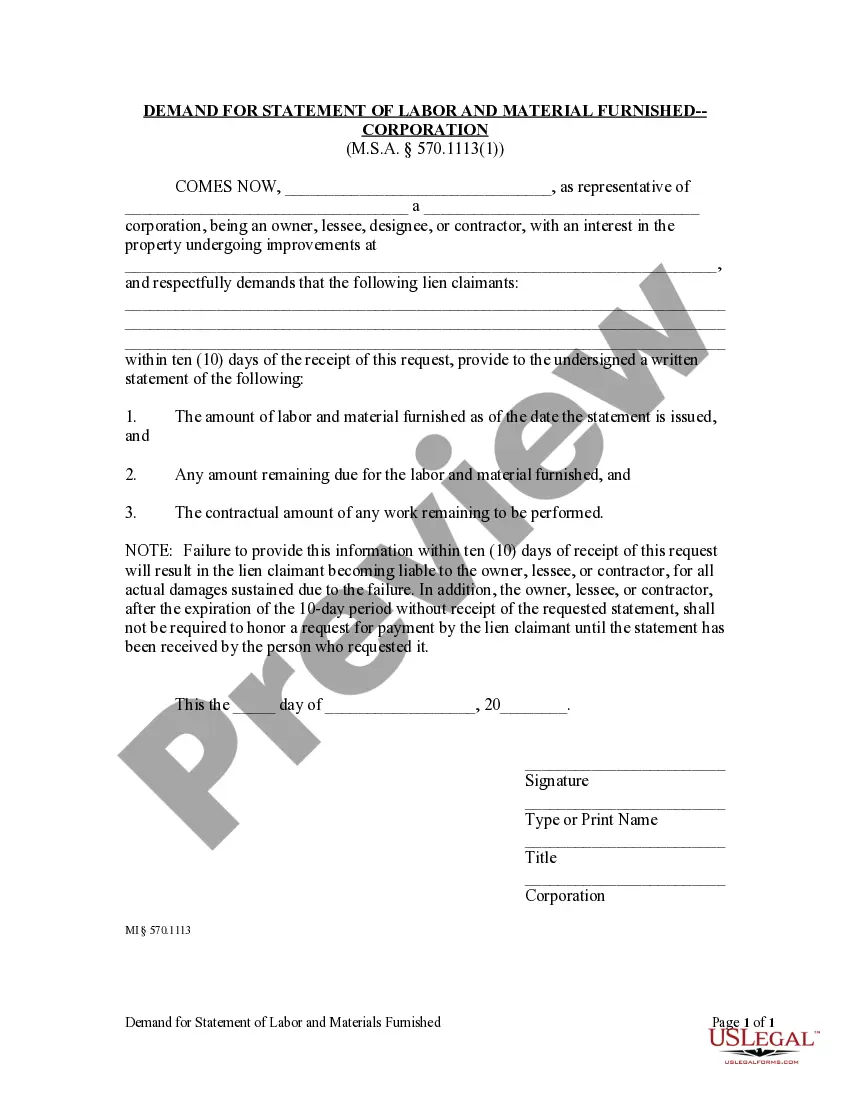

Description

How to fill out Cuyahoga Ohio Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

Dealing with legal forms is a must in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Cuyahoga Utilization by a REIT of partnership structures in financing five development projects, with a service like US Legal Forms.

US Legal Forms has more than 85,000 templates to choose from in various categories varying from living wills to real estate papers to divorce documents. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how to locate and download Cuyahoga Utilization by a REIT of partnership structures in financing five development projects.

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the form.

- Ensure that the template of your choosing is specific to your state/county/area since state laws can affect the validity of some documents.

- Examine the related forms or start the search over to locate the appropriate document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and purchase Cuyahoga Utilization by a REIT of partnership structures in financing five development projects.

- Select to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Cuyahoga Utilization by a REIT of partnership structures in financing five development projects, log in to your account, and download it. Needless to say, our platform can’t take the place of a legal professional completely. If you have to deal with an extremely challenging situation, we recommend using the services of an attorney to examine your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of customers. Become one of them today and get your state-specific documents with ease!