Riverside California, located in the Inland Empire region, is a vibrant and economically thriving city known for its diverse business sectors, rich cultural heritage, and picturesque landscapes. As the city continues to grow, real estate investment trusts (Rests) have recognized the immense potential for development projects in Riverside and have utilized partnership structures to finance various ventures. One type of partnership structure commonly employed by Rests is the limited partnership (LP). In this arrangement, the REIT acts as the general partner, responsible for managing the day-to-day operations and decision-making, while limited partners contribute capital but have little involvement in the project. This structure allows Rests to raise funds from multiple investors, spreading the risk and increasing the chances of success. Another partnership structure utilized in Riverside by Rests is the limited liability partnership (LLP). This type of partnership offers similar benefits to the LP structure but also provides liability protection to the partners. This is particularly attractive to Rests engaging in larger-scale projects, as it shields individual partners from personal liability and ensures potential losses are limited to the partnership assets. The third type of partnership structure is the master limited partnership (MLP). Although more commonly associated with energy companies, Maps have also found their way into real estate investments. This structure provides Rests with the ability to trade partnership units on public stock exchanges, offering potential liquidity to investors and potentially attracting larger capital investments from institutional investors. By utilizing partnership structures in Riverside, Rests can benefit from pooled resources, shared expertise, and increased access to capital markets. This approach allows them to finance and carry out multiple development projects simultaneously to meet the growing demands of the city. Riverside's development projects encompass various sectors, including commercial, residential, industrial, and mixed-use developments. Some keywords relevant to these projects and their financing through partnership structures could include: 1. Riverside California development projects 2. Real estate investment trusts (Rests) 3. Partnership structures in financing 4. Limited partnership (LP) 5. Limited liability partnership (LLP) 6. Master limited partnership (MLP) 7. Commercial developments in Riverside 8. Residential projects in Riverside 9. Industrial development opportunities 10. Mixed-use projects in Riverside 11. Riverside's economic growth 12. Investment potential in Riverside 13. Partnership financing models 14. Risk diversification in REIT projects 15. Riverside's cultural heritage and tourism potential In conclusion, Riverside California presents a flourishing landscape for real estate development, attracting Rests to utilize partnership structures to finance and execute a diverse range of projects. Through effective partnerships, Rests can leverage resources, expertise, and capital to contribute to Riverside's sustained growth and enhance the city's overall economy and appeal.

Riverside California Utilization by a REIT of partnership structures in financing five development projects

Description

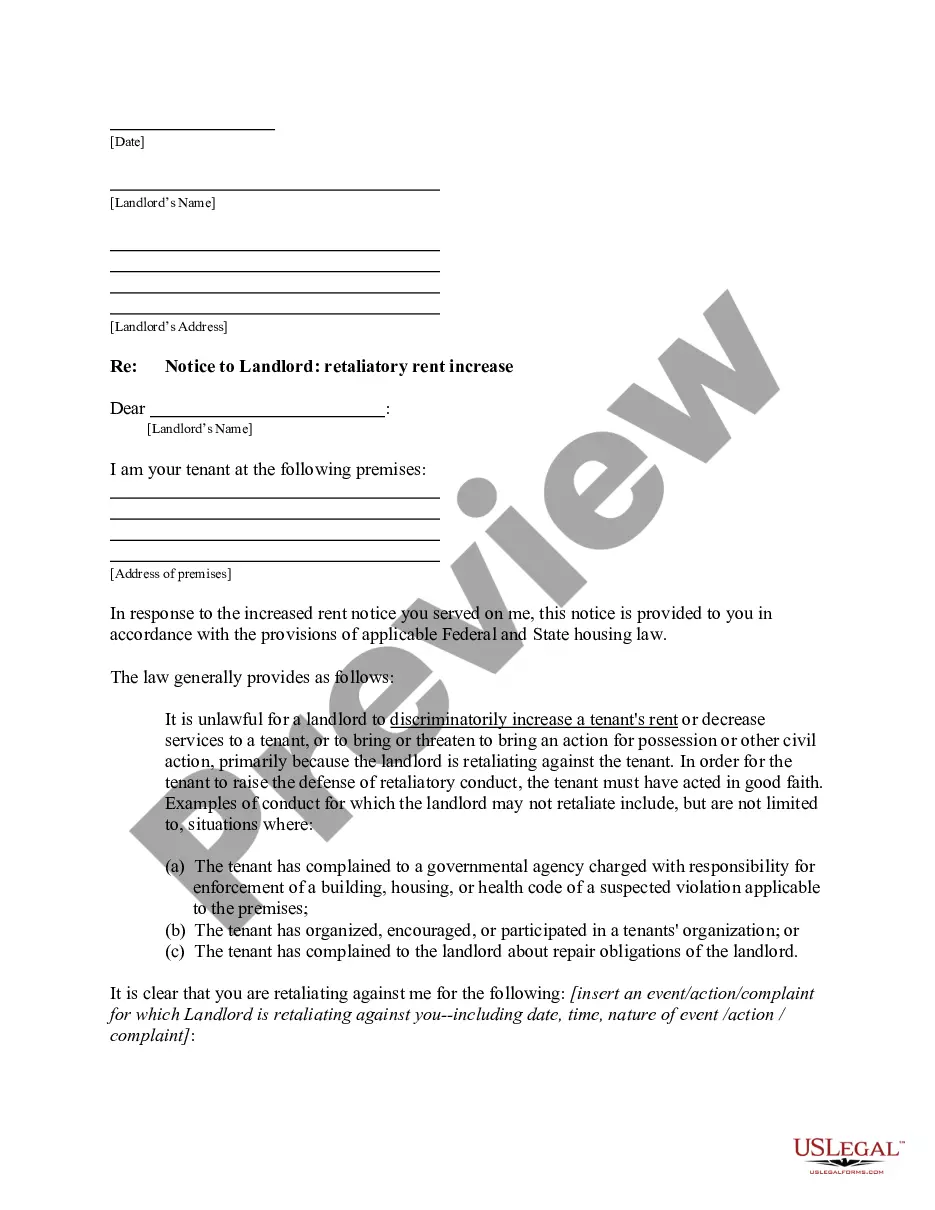

How to fill out Riverside California Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

Preparing paperwork for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Riverside Utilization by a REIT of partnership structures in financing five development projects without expert help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Riverside Utilization by a REIT of partnership structures in financing five development projects by yourself, using the US Legal Forms web library. It is the largest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Riverside Utilization by a REIT of partnership structures in financing five development projects:

- Examine the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To find the one that fits your requirements, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal forms for any use case with just a few clicks!