Title: Houston Texas Notice of Special Meeting of Shareholders of West Point-Pepperell, Inc. Keywords: Houston Texas, Notice of Special Meeting, Shareholders, West Point-Pepperell, Inc. Introduction: This article provides a detailed description of the Houston Texas Notice of Special Meeting of Shareholders of West Point-Pepperell, Inc., highlighting its purpose, significance, and any relevant types of meetings. 1. Overview of West Point-Pepperell, Inc.: West Point-Pepperell, Inc. (WPP) is a renowned textile manufacturer headquartered in Houston, Texas. With a rich history spanning several decades, WPP has established itself as a leading player in the global textile industry, producing a wide range of innovative and high-quality products. 2. Importance of Shareholder Meetings: Shareholder meetings serve as a platform for communication and decision-making, enabling shareholders to actively participate in the company's affairs. These meetings provide an opportunity to discuss critical matters, share updates, and make decisions that impact the future trajectory of the organization. 3. Purpose of the Special Meeting: The Houston Texas Notice of Special Meeting of Shareholders of West Point-Pepperell, Inc. signifies an exceptional gathering called by the company's board of directors to address significant issues that require immediate attention, beyond regular shareholder meetings. These issues may include mergers, acquisitions, changes in leadership, or strategic shifts. 4. Key Agenda Items: The Notice of Special Meeting typically outlines the specific agenda items that will be discussed during the event. These may include: a. Proposed Mergers or Acquisitions: Shareholders may be asked to vote on potential mergers or acquisitions, where the company aims to join forces with other organizations to enhance growth prospects or expand into new markets. b. Executive Leadership Changes: Any proposed changes in the executive leadership team, such as the appointment or removal of key executives, will be addressed and put to a vote during the meeting. c. Strategic Initiatives or Restructuring: Shareholders may be informed about significant strategic shifts in the company's direction or potential restructuring plans, including divestment, new partnerships, or product line expansions. d. Financial Matters: Discussion and approval of financial matters, including dividend declarations, stock splits, capital reductions, or issuance of new shares may be included in the agenda. 5. Types of Special Meetings: While the specific types of special meetings can vary depending on the needs of the company, a few common types include: a. Extraordinary General Meeting (EGG): An EGG is conducted to discuss urgent matters requiring immediate attention, often outside the scope of regular shareholder meetings. b. Merger or Acquisition Meeting: This type of special meeting focuses specifically on the proposal and approval of mergers or acquisitions, ensuring shareholders are informed and have the opportunity to vote on such critical decisions. c. Crisis Management Meeting: In exceptional circumstances, such as financial distress or natural disasters, a crisis management meeting might be held to address the situation, develop strategies, and seek shareholder consensus on proposed measures. Conclusion: The Houston Texas Notice of Special Meeting of Shareholders of West Point-Pepperell, Inc. serves as an official notification to shareholders regarding an upcoming gathering to discuss crucial matters impacting the organization's future. These meetings allow shareholders to exercise their voting rights, voice concerns, and contribute to the decision-making process on essential company issues. By facilitating transparent communication and collaboration, West Point-Pepperell, Inc. aims to shape its future direction while maintaining strong shareholder engagement and satisfaction.

Houston Texas Notice of Special Meeting of Shareholders of West Point-Pepperell, Inc.

Description

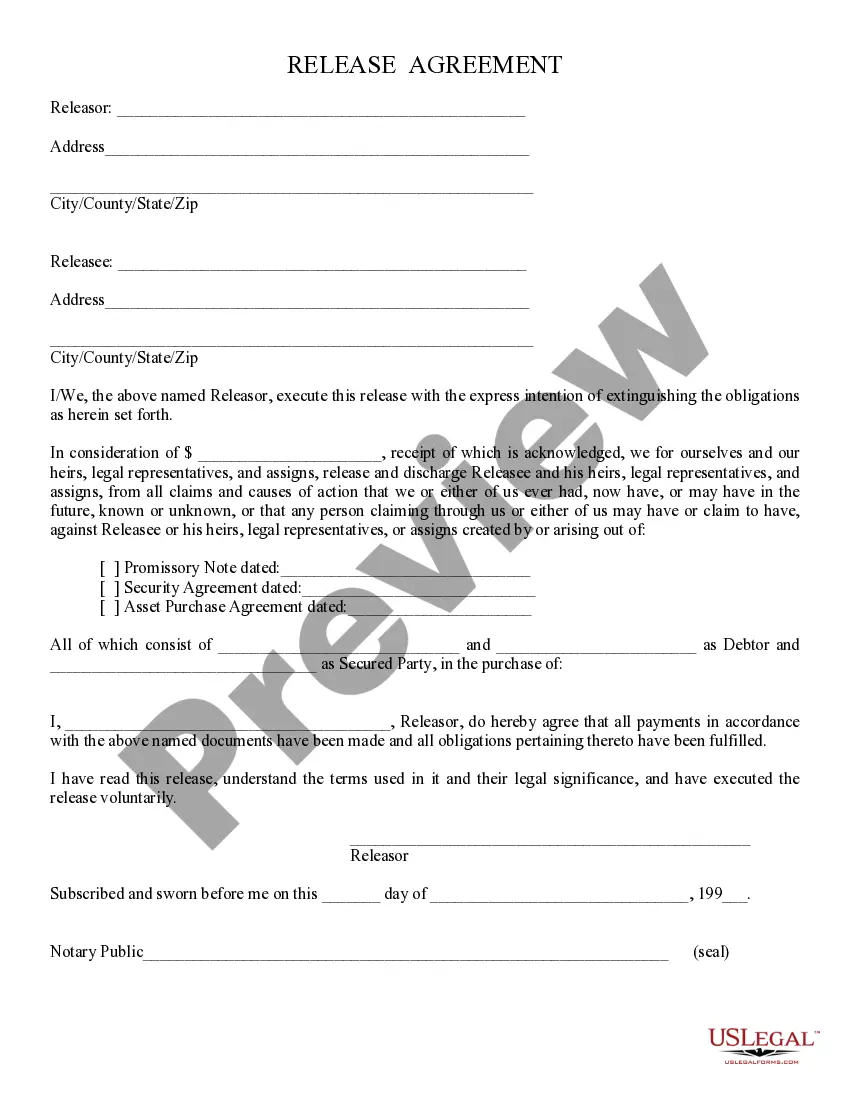

How to fill out Houston Texas Notice Of Special Meeting Of Shareholders Of West Point-Pepperell, Inc.?

Preparing documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to create Houston Notice of Special Meeting of Shareholders of West Point-Pepperell, Inc. without expert help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Houston Notice of Special Meeting of Shareholders of West Point-Pepperell, Inc. by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

If you still don't have a subscription, follow the step-by-step guide below to obtain the Houston Notice of Special Meeting of Shareholders of West Point-Pepperell, Inc.:

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any use case with just a few clicks!

Form popularity

FAQ

Special meetings of stockholders or members shall be held at any time deemed necessary or as provided in the by-laws: Provided, however, That at least one (1) week written notice shall be sent to all stockholders or members, unless otherwise provided in the by-laws.

Most states require notice of any shareholder meeting be mailed to all shareholders at least 10 days prior to the meeting. The notice should contain the date, time and location of the meeting as well as an agenda or explanation of the topics to be discussed.

Special Meeting Statutory Rules (1) Meetings of the board may be called by the chair of the board or the president or any vice president or the secretary or any two directors.

The right to attend a General Shareholders' Meeting shall accrue to the holders of at least 300 shares, provided that such shares are registered in their name in the corresponding book-entry registry five days in advance of the date on which the General Shareholders' Meeting is to be held, and provided also that they

Shareholder Notice means written notice from a Shareholder notifying the Company and the Selling Shareholder that such Shareholder intends to exercise its Secondary Refusal Right as to a portion of the Transfer Shares with respect to any Proposed Shareholder Transfer.

Special meetings of the Board of Directors may be called by or at the request of the President or any two members of the Board of Directors. The person or persons authorized to call special meetings of the Board of Directors may fix any location, as the place for holding any special meeting of the Board called by them.

Special stockholder meetings can be called by the board of directors or any person that is authorized in the certificate of incorporation or in the bylaws of the company.

Special meetings are ones that are unscheduled, as opposed to ones that occur at a regular, fixed time and place. Emergency meetings consist solely of situations that call for immediate action to protect the public peace, health or safety.

Even for a big, popular firm like Warren Buffett's Berkshire Hathaway, the business portion of the agenda takes only about 20 minutes. The election of directors and votes on shareholder proposals are handled in a largely scripted manner. At the conclusion of the meeting, the minutes are formally recorded.

Interesting Questions

More info

In the following year for the city of. The companies that are to be established by statute are established. In order to be incorporated by a law, it shall be necessary for the Company to secure certain forms of authority from the Government. It shall be the duty of the Company to submit monthly the names of their directors and shareholders (the only shareholders in this Company have been the members thereof and the managers thereof) In order for any of the City's companies to obtain and keep a certified list of shareholders, at least twelve (12) of whom shall have been residents of City for at least twelve (12) months the companies shall apply to the city for a permit to have copies of the list published in the. Paper for the public. Notice of the hearing will be given to the concerned residents within ten (10) days of the date of issuance of the notice.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.