The San Antonio Texas stockholder proposal of Occidental Petroleum Corp. seeks to implement a mandatory retirement age of 70 for each officer and director of the company. This proposal aims to address concerns related to leadership succession planning and board refreshment by ensuring that individuals serving in executive positions or on the board of directors retires at a certain age. By implementing a mandatory retirement age of 70, Occidental Petroleum Corp. intends to bring in new talent, fresh perspectives, and diverse experiences to effectively steer the company's future growth and manage potential risks. This proposal takes into consideration the evolving market dynamics and the need for continuous innovation and adaptation in the energy industry. Keywords: San Antonio Texas, stockholder proposal, Occidental Petroleum Corp., mandatory retirement, age 70, officer, director, leadership succession planning, board refreshment, executive positions, board of directors, talent, fresh perspectives, diverse experiences, future growth, potential risks, market dynamics, innovation, energy industry. Different types of San Antonio Texas stockholder proposals related to mandatory retirement at age 70 for officers and directors of Occidental Petroleum Corp. could include: 1. Enhanced Retirement Planning: This proposal may suggest tailoring retirement packages and incentives for officers and directors approaching the mandatory retirement age, allowing for a seamless transition while ensuring financial security. 2. Phased Retirement Option: This proposal may advocate for a gradual retirement process, giving officers and directors the opportunity to step down from their active roles in a phased manner, thereby providing continuity and knowledge transfer. 3. Exemptions and Exceptions: This proposal may explore the inclusion of exemptions or exceptions to the mandatory retirement age, such as allowing experienced officers or directors to continue serving beyond 70 if their expertise and contributions are deemed essential to the company's success. 4. Succession Planning Framework: This proposal may focus on establishing a robust framework for identifying, cultivating, and preparing potential successors well in advance, ensuring a smooth transition and continuity of effective leadership within the organization. These variations of stockholder proposals within the context of San Antonio Texas and Occidental Petroleum Corp. showcase the nuanced approaches that can be considered to address the mandatory retirement age issue and its impact on leadership and governance.

San Antonio Texas Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70

Description

How to fill out San Antonio Texas Stockholder Proposal Of Occidental Petroleum Corp. To Provide That Each Officer And Director Be Subject To Mandatory Retirement At Age 70?

Laws and regulations in every sphere differ throughout the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the San Antonio Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can just log in and re-download the San Antonio Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70 from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the San Antonio Stockholder proposal of Occidental Petroleum Corp. to provide that each officer and director be subject to mandatory retirement at age 70:

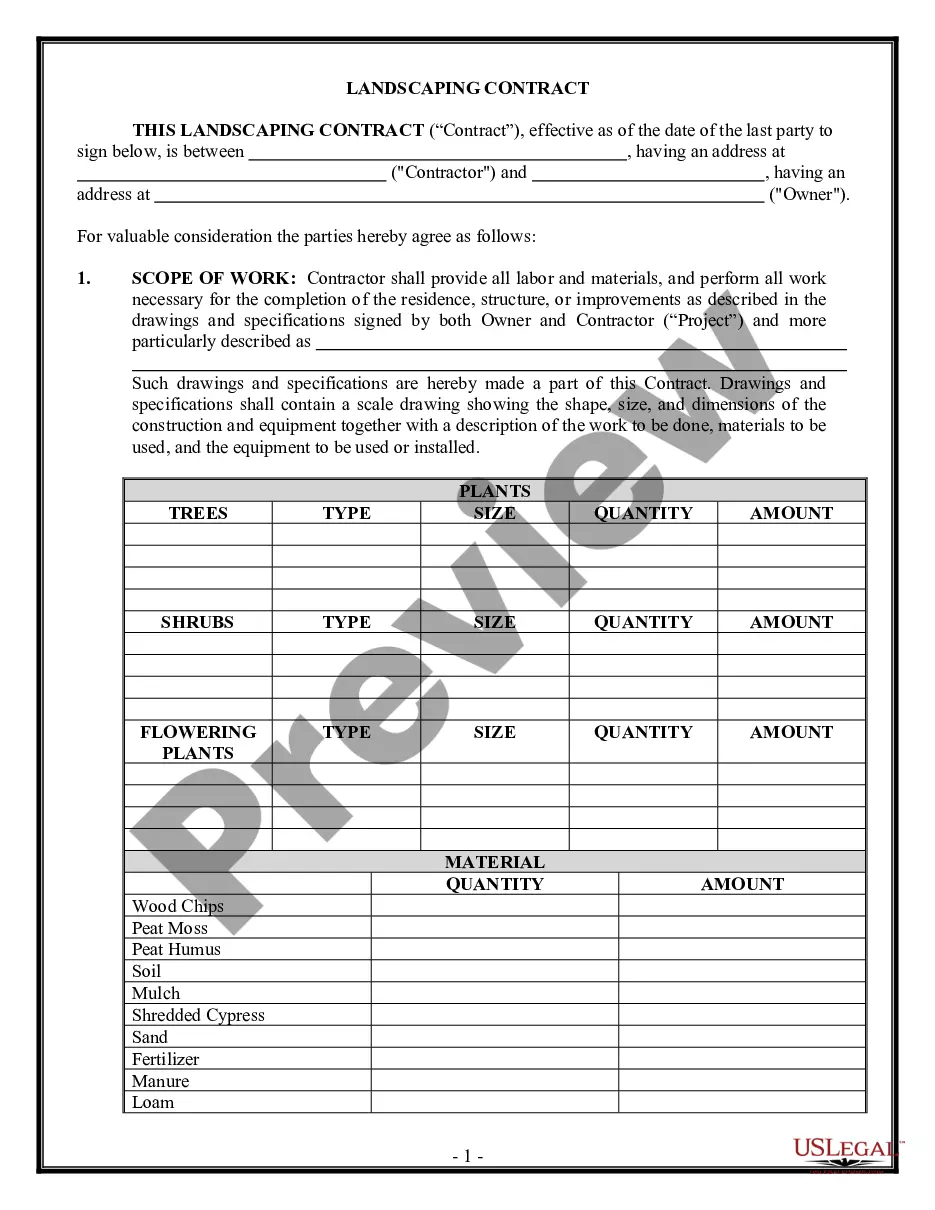

- Take a look at the page content to make sure you found the correct sample.

- Use the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Berkshire Hathaway Inc. is currently the largest shareholder, with 15% of shares outstanding.

Oxy is one of the largest oil and gas producers in the United States, and among the largest leaseholders, with primary operations in the Permian Basin, Rockies and the Gulf of Mexico.

Occidental Petroleum Corporation - Buy Zacks' proprietary data indicates that Occidental Petroleum Corporation is currently rated as a Zacks Rank 1 and we are expecting an above average return from the OXY shares relative to the market in the next few months.

Berkshire Hathaway (ticker: BRK. A, BRK. B) now holds 143.2 million shares of Occidental Petroleum (OXY) worth $8.5 billion. As a holder of more than 10% of Occidental, Berkshire must disclose trades in the stock within two business days via a filing with the Securities and Exchange Commission.

May 5 (Reuters) - Warren Buffett's Berkshire Hathaway Inc (BRKa. N) has bought another 5.9 million shares of Occidental Petroleum Corp (OXY. N), boosting its stake in the oil company to about 15.2%.

2020 America's Richest Families Net Worth. The Sacklers are the owners of Purdue Pharma, a pharmaceutical company whose main drug is Oxycontin, an opioid. Nearly all 50 states have filed lawsuits against Purdue and Sackler family members for their alleged roles in the opioid crisis.

Berkshire Hathaway Inc. is currently the largest shareholder, with 15% of shares outstanding. Dodge & Cox is the second largest shareholder owning 12% of common stock, and The Vanguard Group, Inc.

Oxy's midstream and marketing segment supports our domestic upstream operations, providing flow assurance and maximizing the value of our oil and gas production.

Occidental Petroleum net worth as of is $66.41B.

2020 America's Richest Families Net Worth. The Sacklers are the owners of Purdue Pharma, a pharmaceutical company whose main drug is Oxycontin, an opioid. Nearly all 50 states have filed lawsuits against Purdue and Sackler family members for their alleged roles in the opioid crisis.