Franklin Ohio Proposal to Amend Restated Certificate of Incorporation Regarding Increasing Authorized Number of Shares of Common Stock The Franklin Ohio proposal aims to amend the restated certificate of incorporation to increase the authorized number of shares of common stock. This proposal is put forth to address the growing needs and demands of the company and its shareholders. By increasing the authorized number of shares of common stock, the company seeks to have more flexibility in raising capital, facilitating future growth, and attracting potential investors. Several types of proposals can be made under the Franklin Ohio company to amend the restated certificate of incorporation regarding increasing authorized shares of common stock. These may include: 1. Primary Offering: This type of proposal is made to increase the overall number of authorized shares of common stock for future primary offerings. By doing so, the company can issue new shares to raise additional capital, which can be used for various purposes like expanding operations, funding research and development, or acquiring new assets. 2. Employee Stock Ownership Plan (ESOP): In some cases, the proposal may specifically focus on increasing the authorized shares of common stock to be allocated for an employee stock ownership plan. This allows employees to become shareholders and have an ownership stake in the company, providing them with incentives and aligning their interests with the company's success. 3. Stock Split: Another approach could be a proposal to increase the authorized shares of common stock to implement a stock split. A stock split involves dividing each existing share into multiple shares, effectively increasing the number of shares outstanding. This can make the stock more affordable and appealing to a broader range of investors, potentially increasing liquidity and market participation. 4. Anti-Dilution Measures: The proposal may also seek to increase the authorized shares of common stock to counter dilution caused by convertible securities such as stock options, warrants, or convertible debt. By having a higher number of authorized shares, the company can maintain control and avoid significant dilution of the ownership percentage held by existing shareholders when these securities are exercised or converted into common stock. 5. Strategic Partnerships or Acquisitions: In some cases, the increase in authorized shares of common stock may be proposed to facilitate strategic partnerships or acquisitions. By having a larger number of shares available, the company can negotiate favorable terms for such deals and have the flexibility to issue shares as part of the transaction. In conclusion, the Franklin Ohio proposal to amend the restated certificate of incorporation regarding increasing authorized shares of common stock aims to enhance the company's financial flexibility, attract potential investors, and support its future growth. Different types of proposals, including primary offerings, ESOP allocations, stock splits, anti-dilution measures, and strategic partnerships or acquisitions, can be made under this proposal to suit the specific needs and goals of the company.

Franklin Ohio Proposal to amend restated certificate of incorporation regarding increasing authorized number of shares of common stock

Description

How to fill out Franklin Ohio Proposal To Amend Restated Certificate Of Incorporation Regarding Increasing Authorized Number Of Shares Of Common Stock?

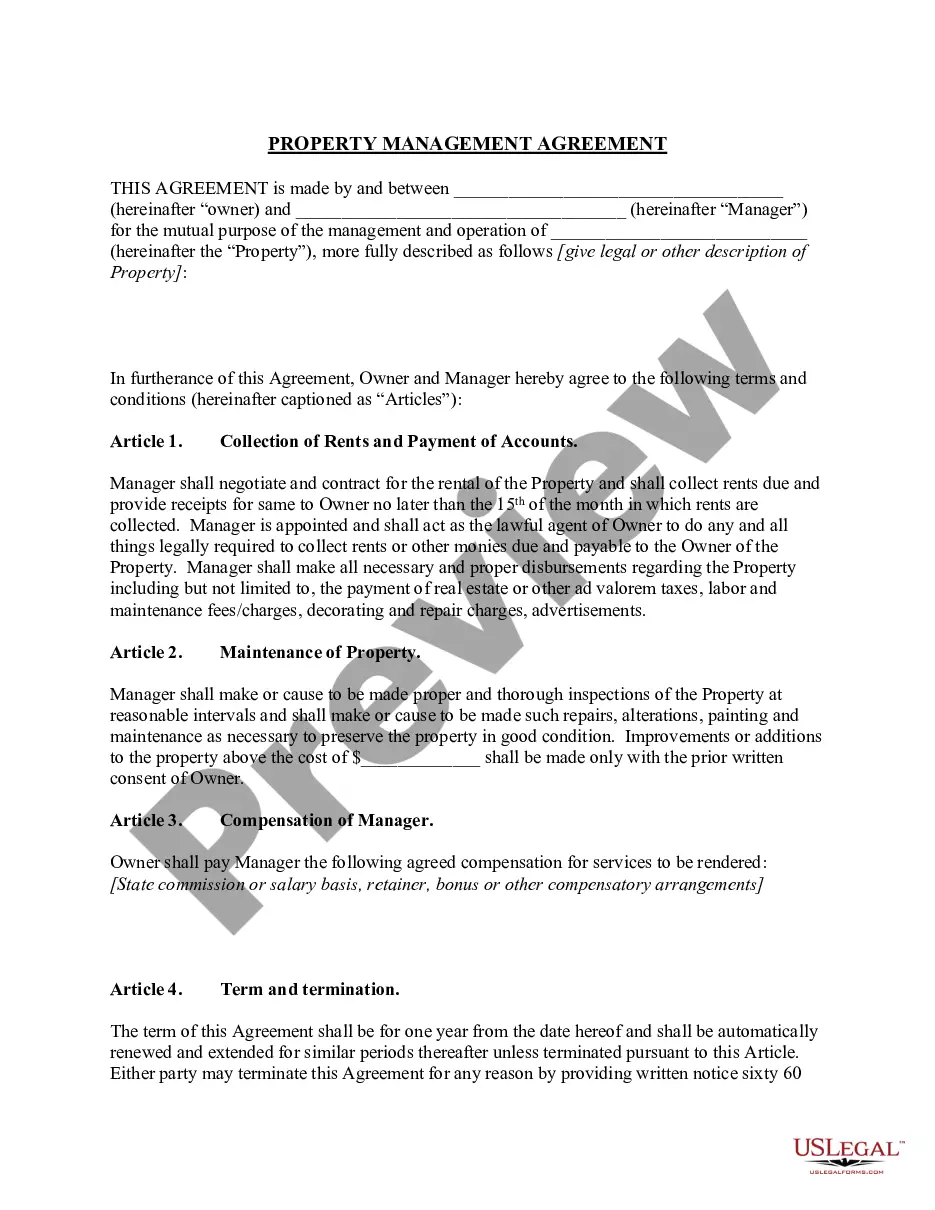

Do you need to quickly create a legally-binding Franklin Proposal to amend restated certificate of incorporation regarding increasing authorized number of shares of common stock or maybe any other form to handle your own or corporate affairs? You can go with two options: hire a legal advisor to draft a valid paper for you or draft it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable prices for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant form templates, including Franklin Proposal to amend restated certificate of incorporation regarding increasing authorized number of shares of common stock and form packages. We offer documents for a myriad of use cases: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- To start with, double-check if the Franklin Proposal to amend restated certificate of incorporation regarding increasing authorized number of shares of common stock is tailored to your state's or county's regulations.

- If the document has a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were looking for by utilizing the search box in the header.

- Select the plan that is best suited for your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Franklin Proposal to amend restated certificate of incorporation regarding increasing authorized number of shares of common stock template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our catalog. Additionally, the documents we provide are updated by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!