Chicago, Illinois Proposal to Increase Common Stock for Pursuing Acquisitions: Unlocking Profit and Growth Potential Introduction: Chicago, Illinois, a vibrant city known for its rich history, diverse culture, and thriving business landscape, presents a lucrative opportunity for companies looking to expand their portfolio. With its strategic location, world-class infrastructure, and reputed business-friendly environment, Chicago has become a hub for mergers and acquisitions (M&A) transactions. This proposal aims to outline the advantages of increasing common stock for pursuing acquisitions within the Chicago market, with a focus on driving profit and achieving sustainable growth. Overview of Chicago's Business Environment: Chicago's robust economy and supportive policies create an ideal setting for companies seeking acquisitions to enhance their market position. The city is home to numerous Fortune 500 companies, offering a vast pool of potential targets for acquisition. Industries such as finance, manufacturing, technology, healthcare, transportation, and logistics flourish in Chicago, providing ample scope for profitable M&A transactions. Advantages of Increasing Common Stock for Acquisitions: 1. Enhanced Financial Flexibility: Increasing common stock allows companies to access additional capital, enabling them to pursue acquisitions with ease. This newfound financial flexibility empowers companies to undertake transactions that may have otherwise been beyond their reach. 2. Increased Competitive Edge: Acquiring companies in Chicago grants access to a highly skilled workforce, cutting-edge technology, and advanced research facilities. By increasing common stock, businesses can position themselves as an attractive acquirer and gain a competitive edge in the market. 3. Broadening Market Reach: Acquisitions within Chicago offer a gateway to a substantial customer base, both domestically and internationally. Companies can leverage their increased common stock to penetrate new markets, expand their product offerings, and diversify revenue streams, all leading to sustainable growth and improved profitability. Types of Chicago Illinois Proposal to Increase Common Stock for Pursuing Acquisitions: 1. Vertical Integration: Companies can pursue vertical integration by acquiring suppliers, service providers, or distributors within the Chicago market. This type of acquisition strengthens the supply chain, reduces costs, and increases control over the entire value chain. 2. Horizontal Expansion: Companies may consider horizontal expansion by acquiring competitors or businesses operating in the same industry within Chicago. Such acquisitions provide market consolidation, increased market share, and economies of scale, leading to improved profitability. 3. Diversification: Increasing common stock for acquisitions in unrelated industries or sectors allows companies to diversify their portfolio and reduce risk. Chicago's diverse business landscape provides ample opportunities for companies to explore new markets and capitalize on emerging trends. 4. Technological Advancement: Acquiring technology-driven companies or startups in Chicago propels companies into the forefront of innovation. Increasing common stock for such acquisitions enables access to cutting-edge technologies, intellectual property, and talent, fostering growth and competitiveness. Conclusion: Chicago, Illinois presents an attractive proposition for companies looking to increase common stock and pursue acquisitions. The city's thriving business environment, access to capital, diverse industries, and skilled workforce contribute to numerous opportunities for profitable M&A transactions. By increasing common stock, businesses can harness the potential of Chicago's market, enhance their financial flexibility, gain a competitive edge, and drive sustainable growth. Embracing acquisitions within this dynamic city is a strategic move that can accelerate profitability and position companies for long-term success.

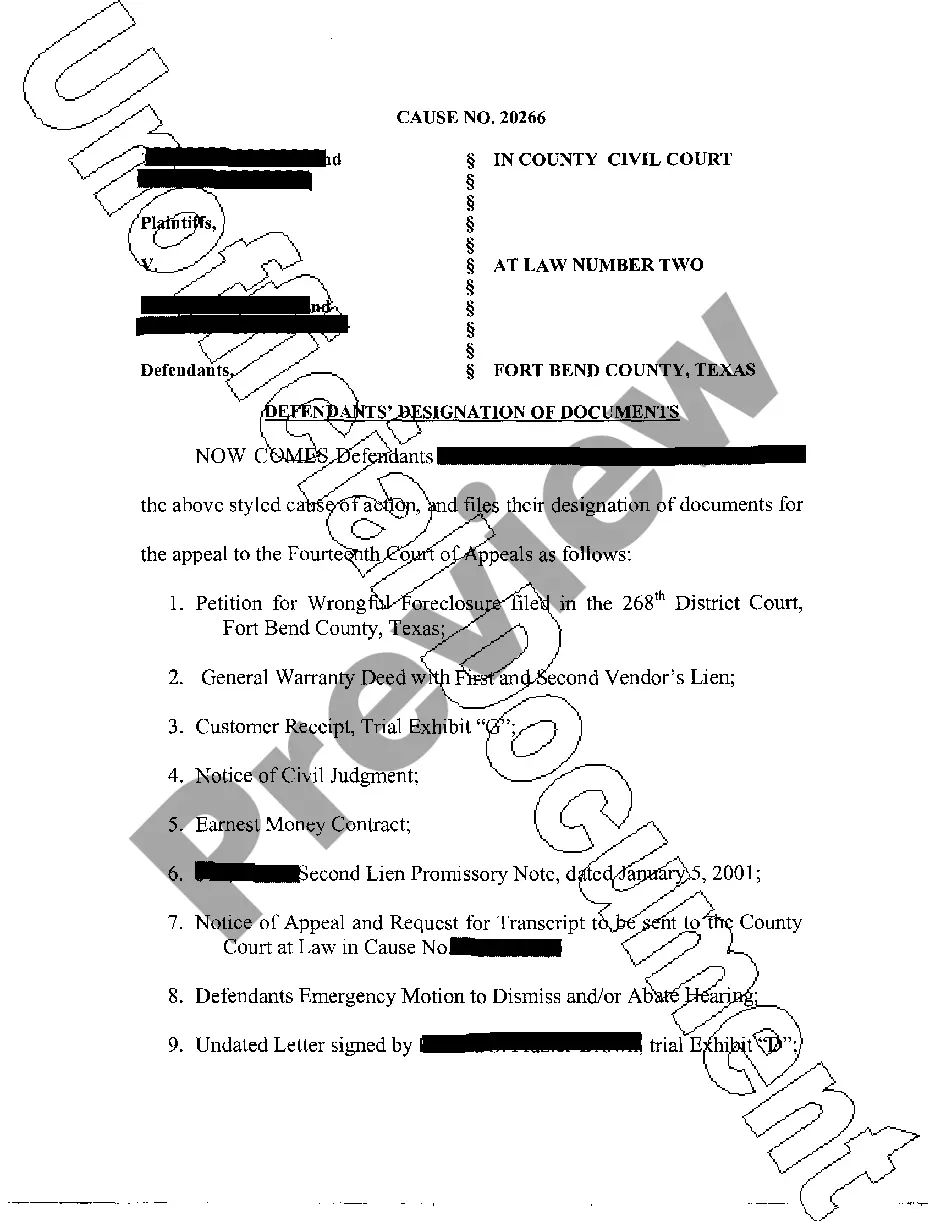

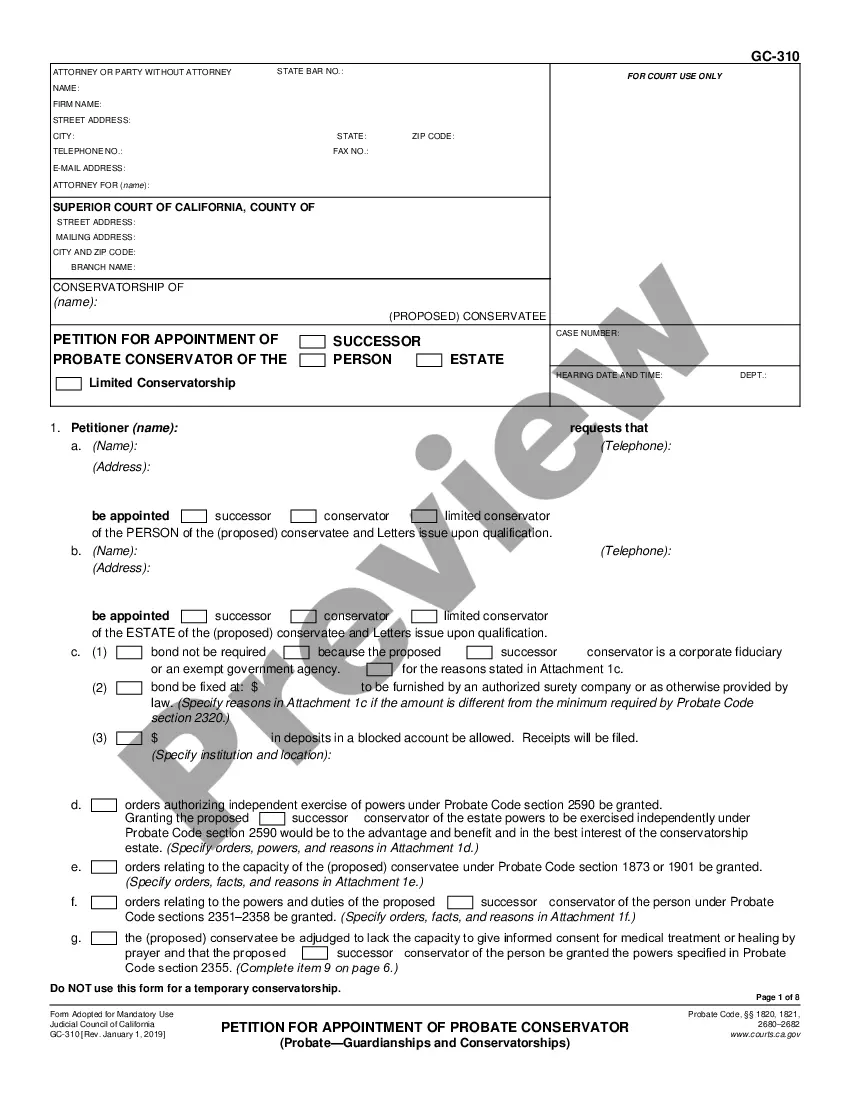

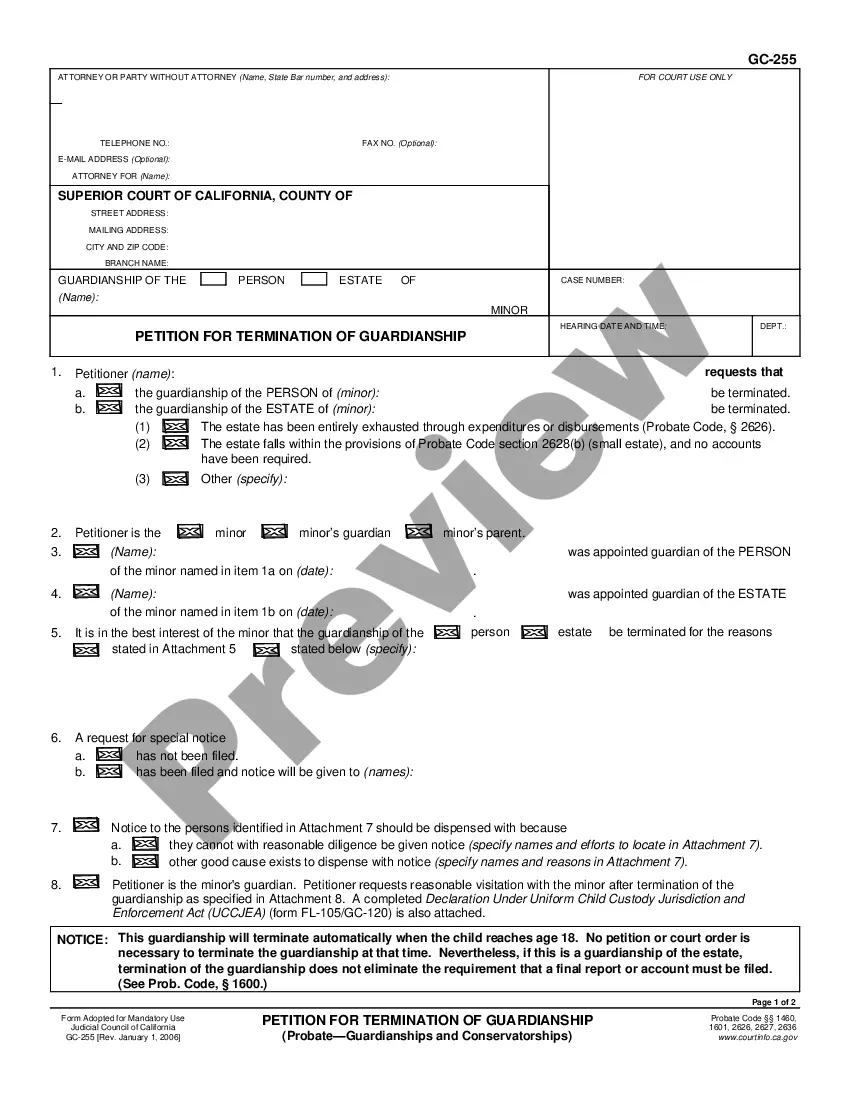

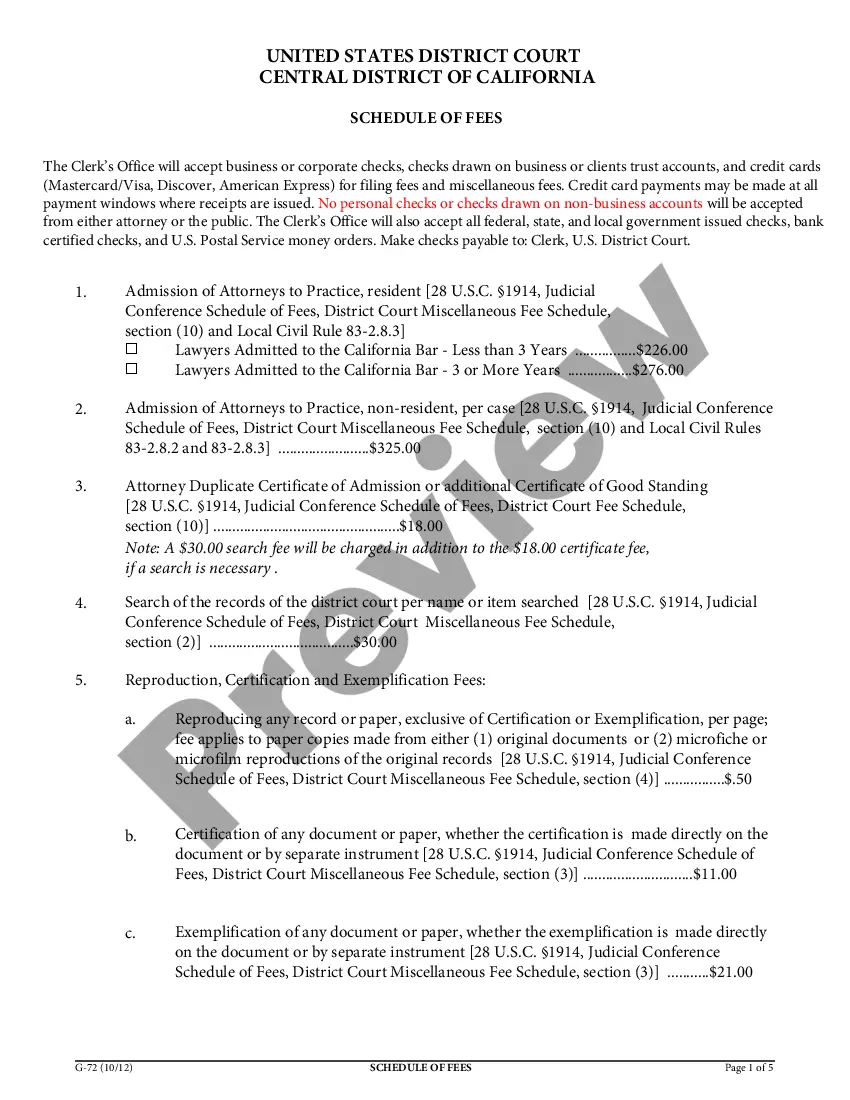

Chicago Illinois Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth

Description

How to fill out Chicago Illinois Proposal To Increase Common Stock Regarding To Pursue Acquisitions - Transactions Providing Profit And Growth?

Whether you plan to open your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any individual or business occurrence. All files are grouped by state and area of use, so opting for a copy like Chicago Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth is fast and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Chicago Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth. Adhere to the instructions below:

- Make sure the sample meets your individual needs and state law regulations.

- Look through the form description and check the Preview if available on the page.

- Use the search tab providing your state above to locate another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!