The San Antonio Texas Proposal to Increase Common Stock: Pursuing Acquisitions for Profit and Growth San Antonio Texas is a vibrant city located in the south-central part of the state. Known for its rich history, diverse culture, and thriving economy, San Antonio offers a variety of opportunities for individuals and businesses alike. This proposal aims to present a detailed plan for increasing common stock to fund acquisitions that would bring significant profit and foster growth for our organization within the San Antonio market. 1. Market Analysis: To begin, a comprehensive market analysis has been conducted to identify potential acquisition targets and understand the competitive landscape in San Antonio. This analysis includes studying market trends, consumer behavior, industry forecasts, and competitor assessments. It also focuses on identifying new market segments and untapped opportunities that align with our corporate objectives. 2. Acquisition Strategy: We propose pursuing strategic acquisitions as a means to expand our market presence and revenue streams in San Antonio. These acquisitions would serve as a platform for growth and enable us to leverage existing synergies and resources effectively. Potential acquisition targets may include thriving local businesses, emerging startups, or complementary companies within our industry. 3. Financial Plan: To support this acquisition strategy, an increase in our common stock is proposed. This infusion of capital will strengthen our financial position and provide the necessary resources to execute successful transactions. The potential benefits of increasing common stock include improved liquidity, enhanced corporate valuation, and increased ability to attract investors and funding partners. 4. Due Diligence: Thorough due diligence is a critical component of any acquisition process. Our proposal includes a detailed plan for conducting extensive due diligence on targeted companies, which will involve analyzing financial statements, assessing legal and regulatory compliance, evaluating intellectual property rights, and reviewing operational efficiencies. This diligent approach will mitigate risks and ensure that potential acquisitions align with our growth objectives. 5. Integration and Synergies: Post-acquisition, a comprehensive integration plan will be implemented to capitalize on synergies between our organization and the acquired entities. This includes integrating operational systems, optimizing supply chains, leveraging combined customer bases, and streamlining processes to maximize efficiency and profitability. The goal is to create a seamless transition that minimizes disruptions and achieves a harmonized business structure. In summary, the San Antonio Texas Proposal to Increase Common Stock is designed to strategically pursue acquisitions in the region, leveraging the city's thriving market, diverse economy, and potential growth opportunities. By increasing our common stock and implementing a well-defined acquisition strategy, we aim to achieve profitable transactions, fuel business growth, and ultimately strengthen our position within the San Antonio market.

San Antonio Texas Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth

Description

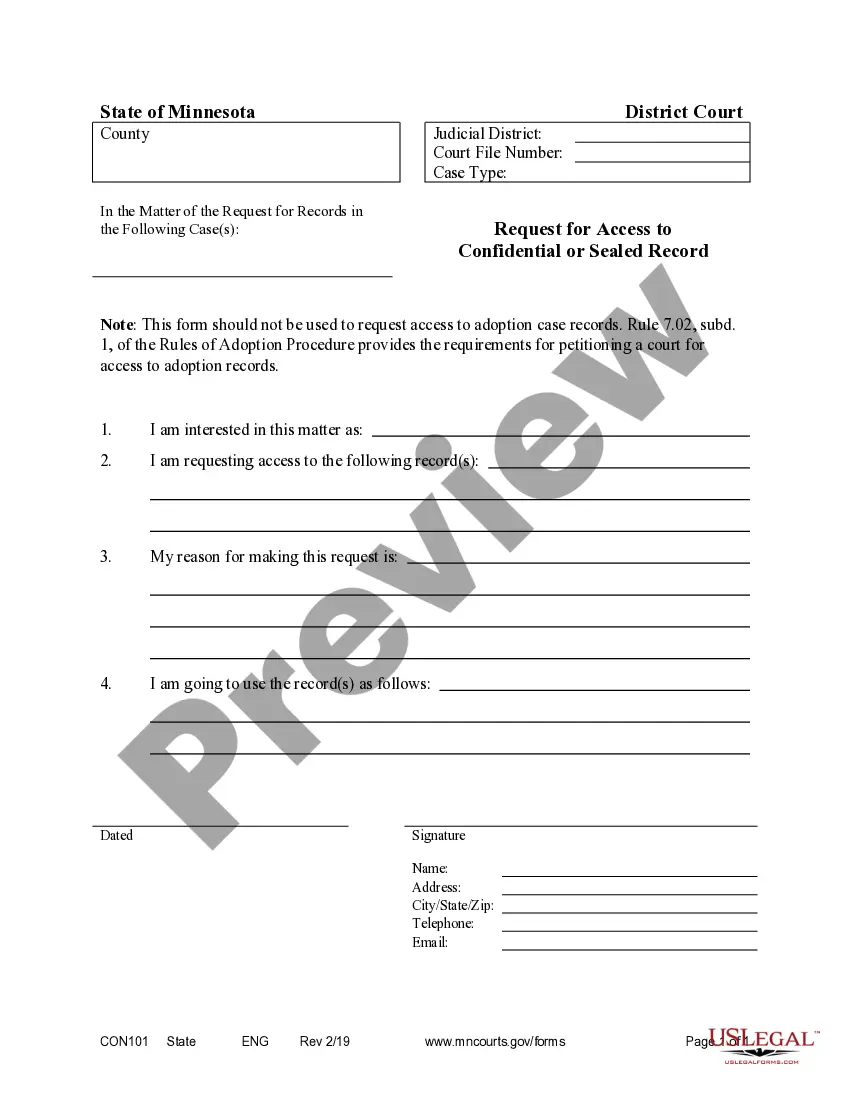

How to fill out San Antonio Texas Proposal To Increase Common Stock Regarding To Pursue Acquisitions - Transactions Providing Profit And Growth?

Drafting paperwork for the business or personal needs is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to create San Antonio Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth without professional assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid San Antonio Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the San Antonio Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth:

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that fits your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any situation with just a couple of clicks!