Suffolk New York proposes to increase its common stock in order to pursue acquisitions and transactions that will not only generate profit but also fuel growth for the company. This move showcases Suffolk New York's strategic approach to expanding its business operations and maximizing shareholder value. By increasing its common stock, Suffolk New York aims to have additional capital on hand that can be utilized to acquire companies or assets that align with its growth objectives. These acquisitions can be in various sectors and industries, depending on the specific market trends and investment opportunities available. With an increased common stock capacity, Suffolk New York can ambitiously pursue mergers, takeovers, or strategic investments that are expected to result in substantial financial gains. This proposal signifies Suffolk New York's intent to actively explore and evaluate potential acquisition targets and transactions. The company understands the importance of a comprehensive due diligence process to identify opportunities that have the potential to create long-term value for its shareholders. By embarking on these ventures, Suffolk New York aims to diversify its business, enter new markets, and strengthen its competitive position. Apart from increasing common stock, Suffolk New York may consider alternative approaches to fund its acquisitions and growth initiatives. This could involve issuing preferred stock, convertible debt, or seeking external funding options like debt financing or strategic partnerships. Each option brings unique advantages and considerations that would be meticulously evaluated based on the specific circumstances and goals of the proposed transaction. Overall, Suffolk New York's proposal to increase common stock with the aim of pursuing acquisitions and transactions for profit and growth demonstrates the company's proactive and visionary approach. The success of such endeavors will depend on the company's ability to identify lucrative opportunities, conduct thorough due diligence, execute efficient integration strategies, and leverage synergies across its expanded portfolio. Through these efforts, Suffolk New York aims to enhance its market presence, drive sustainable growth, and deliver enhanced shareholder value.

Suffolk New York Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth

Description

How to fill out Suffolk New York Proposal To Increase Common Stock Regarding To Pursue Acquisitions - Transactions Providing Profit And Growth?

Whether you plan to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal concerns, you need to prepare specific paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occasion. All files are collected by state and area of use, so opting for a copy like Suffolk Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you several more steps to obtain the Suffolk Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth. Follow the guidelines below:

- Make certain the sample meets your personal needs and state law regulations.

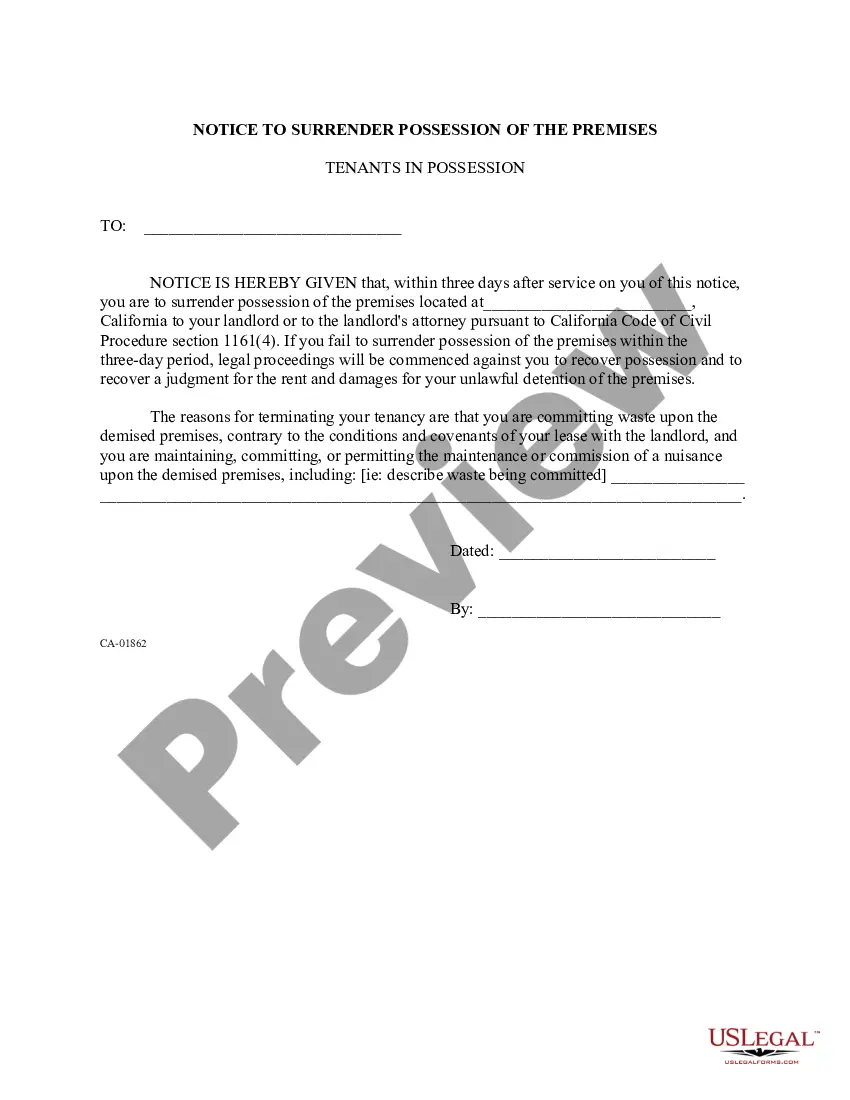

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to get the sample when you find the proper one.

- Choose the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Proposal to increase common stock regarding to pursue acquisitions - transactions providing profit and growth in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are reusable. Having an active subscription, you are able to access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!