Salt Lake City, Utah, Proposed Amendment to Article 4 of Certificate of Incorporation to Authorize Issuance of Preferred Stock with Copy of Amendment Salt Lake City, also commonly referred to as Salt Lake or SLC, is the capital and the largest city of the state of Utah, located in the United States. It is situated in Salt Lake County, nestled in a beautiful valley surrounded by picturesque mountains. With a rich history, diverse culture, and a thriving economy, Salt Lake City offers a plethora of opportunities for residents and visitors alike. A proposed amendment to Article 4 of a certificate of incorporation in Salt Lake City seeks to authorize the issuance of preferred stock by a corporation. This proposed revision to the certificate represents a significant change in the corporate structure, allowing the company to sell preferred shares to investors, typically offering certain advantages over common stock. Preferred stockholders enjoy priority in receiving dividends and distributions of assets in the event of liquidation. Moreover, they often have a fixed dividend yield and may have higher voting rights than common stockholders. This proposed amendment holds significant implications for the corporation, potentially providing it with additional financial flexibility and attracting a broader base of investors. The proposed amendment, which will be presented to the shareholders for approval, contains specific language outlining the changes to Article 4 of the certificate of incorporation. It is essential for the shareholders to fully comprehend the text of the amendment in order to make an informed decision regarding its acceptance or rejection. In Salt Lake City, the proposed amendment to Article 4 of the certificate of incorporation to authorize issuance of preferred stock may vary in the level of preferential treatment provided to the stockholders. Some variations could include cumulative or non-cumulative dividends, convertible or non-convertible features, and different levels of voting rights. Additionally, the amendment might specify the maximum number of preferred shares that can be issued or any restrictions on their transferability. It is crucial for the corporation and its shareholders to carefully review the proposed amendment, consulting legal experts if necessary, to ensure a thorough understanding of its implications. This will enable them to make an informed decision based on the best interests of the company and its stakeholders. In conclusion, the proposed amendment to Article 4 of the certificate of incorporation in Salt Lake City, Utah, concerning the authorization of preferred stock issuance, aims to enhance the financial flexibility and attract potential investors for the corporation. Careful examination of the amendment's provisions, along with consideration of varying types of preferred stock, will enable shareholders to make an educated decision that aligns with their interests and the future growth of the company.

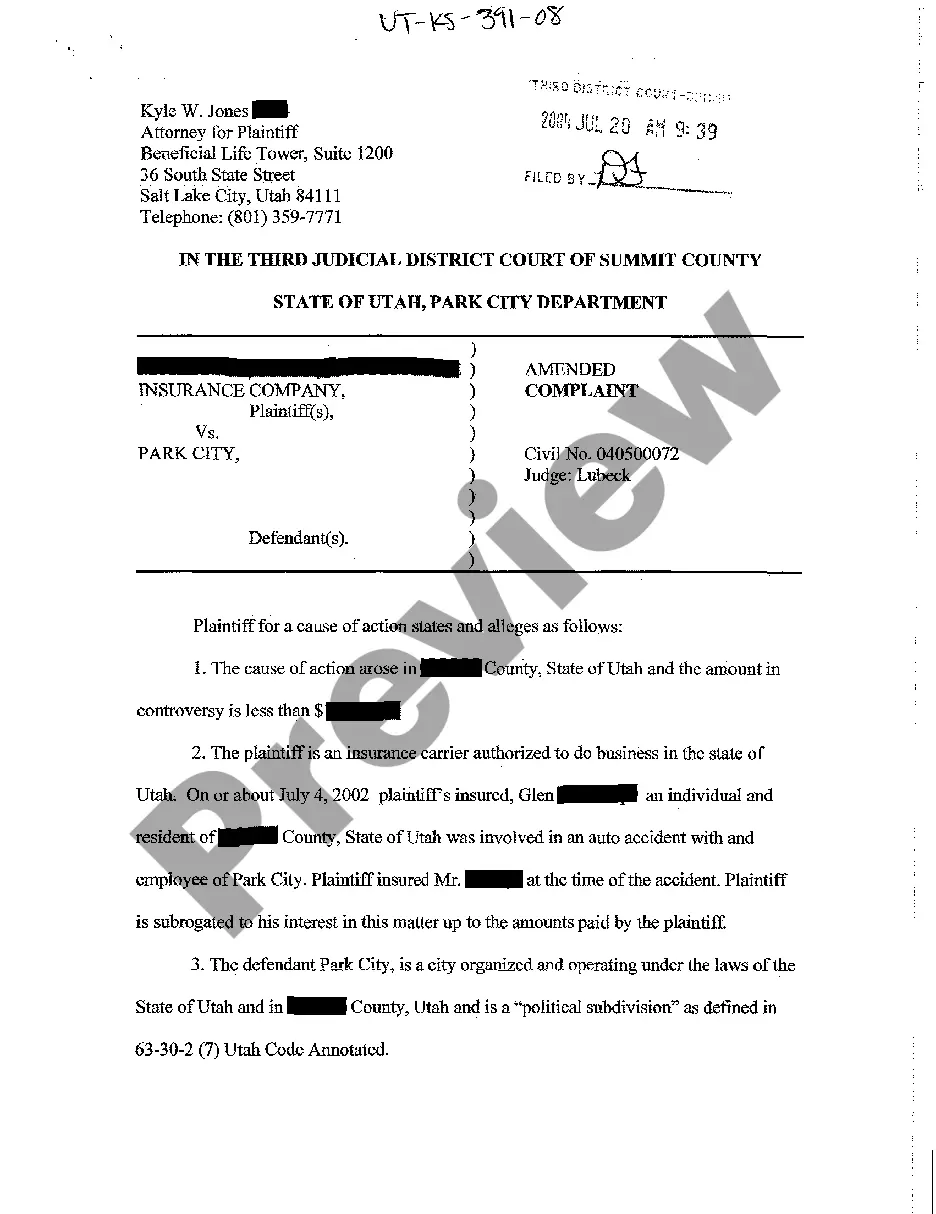

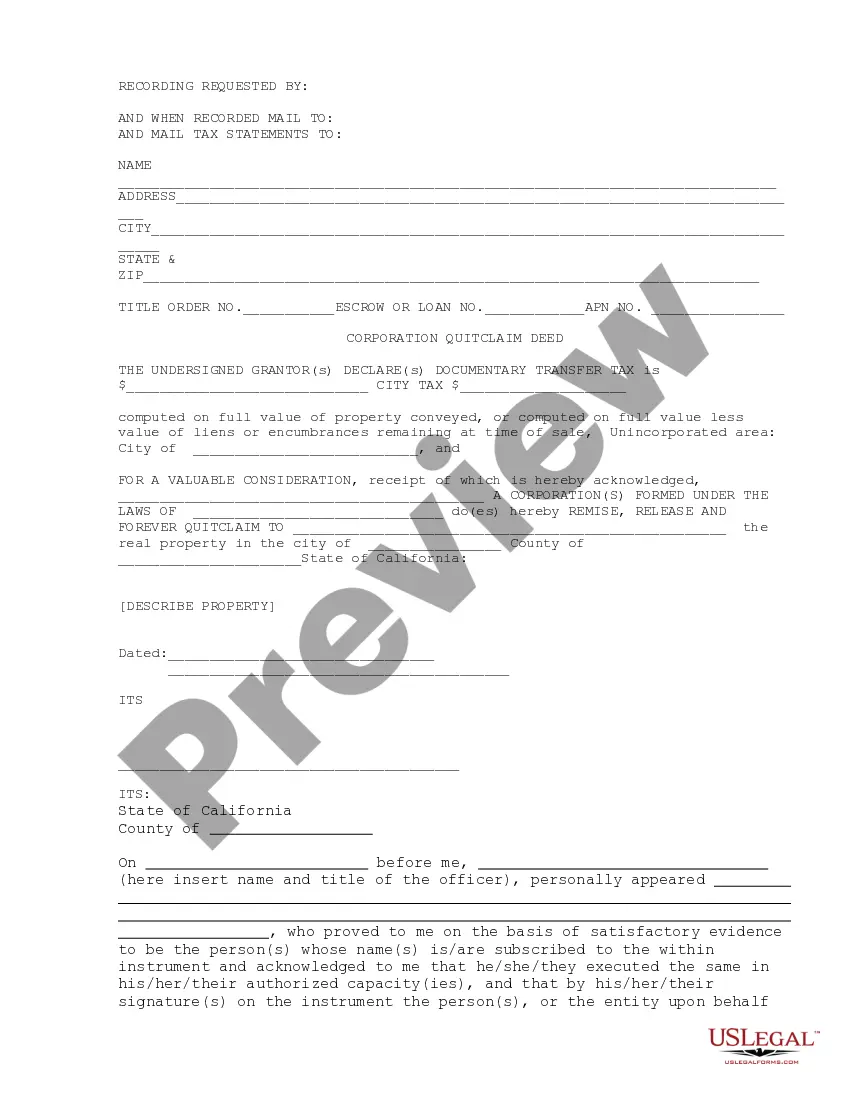

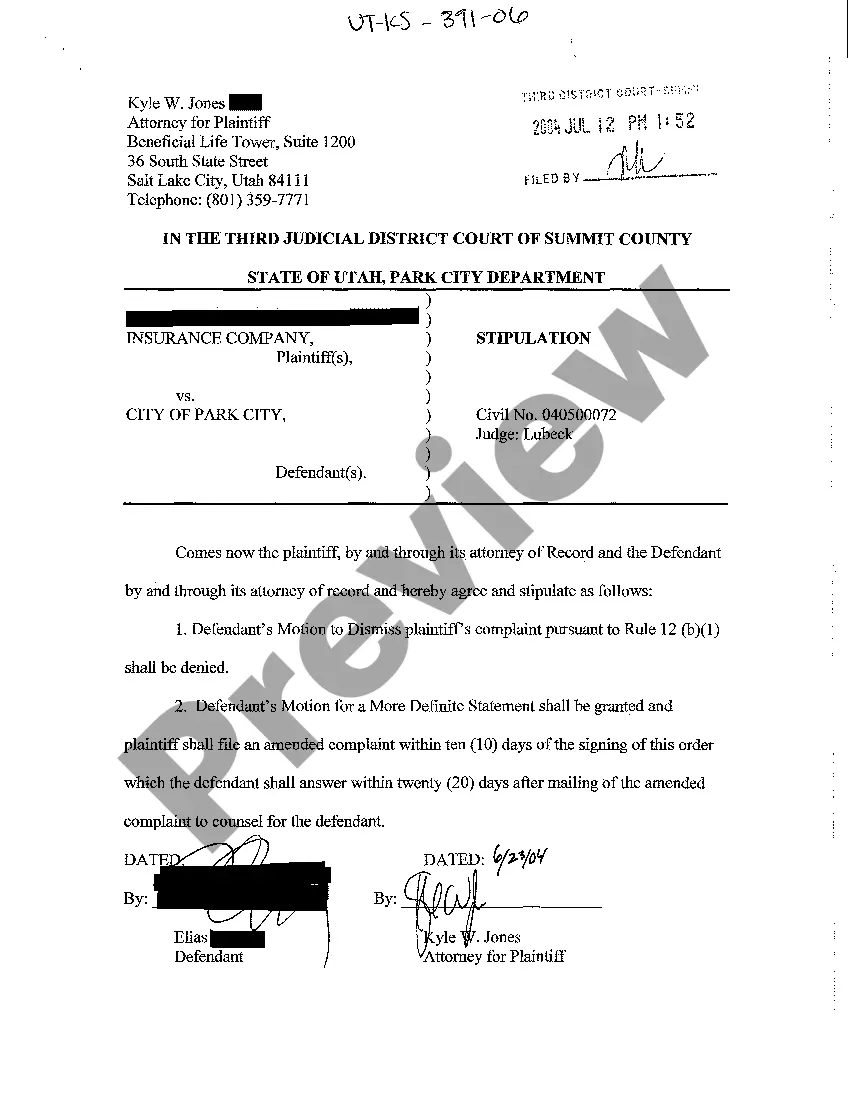

Salt Lake Utah Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment

Description

How to fill out Salt Lake Utah Proposed Amendment To Article 4 Of Certificate Of Incorporation To Authorize Issuance Of Preferred Stock With Copy Of Amendment?

Creating legal forms is a must in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Salt Lake Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less frustrating. You can also find detailed materials and tutorials on the website to make any tasks related to document execution straightforward.

Here's how you can purchase and download Salt Lake Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment.

- Take a look at the document's preview and description (if available) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can affect the validity of some documents.

- Examine the similar document templates or start the search over to locate the correct document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Salt Lake Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment.

- Choose to save the form template in any offered format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Salt Lake Proposed amendment to Article 4 of certificate of incorporation to authorize issuance of preferred stock with copy of amendment, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to cope with an extremely difficult situation, we advise using the services of a lawyer to check your document before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Become one of them today and purchase your state-compliant documents with ease!