The Kings New York Certificate of Designation, Preferences, and Rights of Series B Junior Cumulative Convertible Preference Stock of Onyx Energy Company is a legal document that outlines the specific terms and conditions associated with the Series B preference stock issued by Onyx Energy Company. This certificate is important for shareholders as it defines their rights, preferences, and privileges in relation to their investment in the company. The Series B preference stock holds certain distinctive features, providing its holders with certain advantages and benefits. It is categorized as junior cumulative convertible preference stock, meaning it ranks lower in priority compared to other senior stocks in the event of liquidation or bankruptcy. However, it offers cumulative dividends, implying that if the company fails to pay dividends in a given period, they will accumulate and become payable in the future if the company's financial situation improves. Furthermore, the Series B preference stock is convertible, providing the option to convert the stock into common shares of Onyx Energy Company. Conversion can occur either at the discretion of the shareholders or automatically triggered when specific conditions are met, such as a predetermined conversion ratio or the stock trading above a certain price for a set period. The certificate of designation elaborates on the rights and preferences associated with the Series B junior cumulative convertible preference stock. This may include details about dividend rates, voting rights, liquidation preferences, redemption provisions, and other relevant terms specific to this class of stock. It is essential to note that there might be multiple types of Kings New York Certificate of Designation, Preferences, and Rights of Series B Junior Cumulative Convertible Preference Stock of Onyx Energy Company. The certificate can be distinguished based on different series or classes of preference stock issued by the company, each having its distinct terms, conditions, and characteristics. The various types could have designations such as Series B-1, Series B-2, etc., to differentiate them from one another. These designations contribute to distinguishing the specific rights and preferences associated with each series or class of preferred stock. Overall, the Kings New York Certificate of Designation, Preferences, and Rights of Series B Junior Cumulative Convertible Preference Stock of Onyx Energy Company serve as a comprehensive legal document outlining the unique features and benefits of the Series B preferred stock and the associated rights and privileges granted to its shareholders.

Kings New York Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company

Description

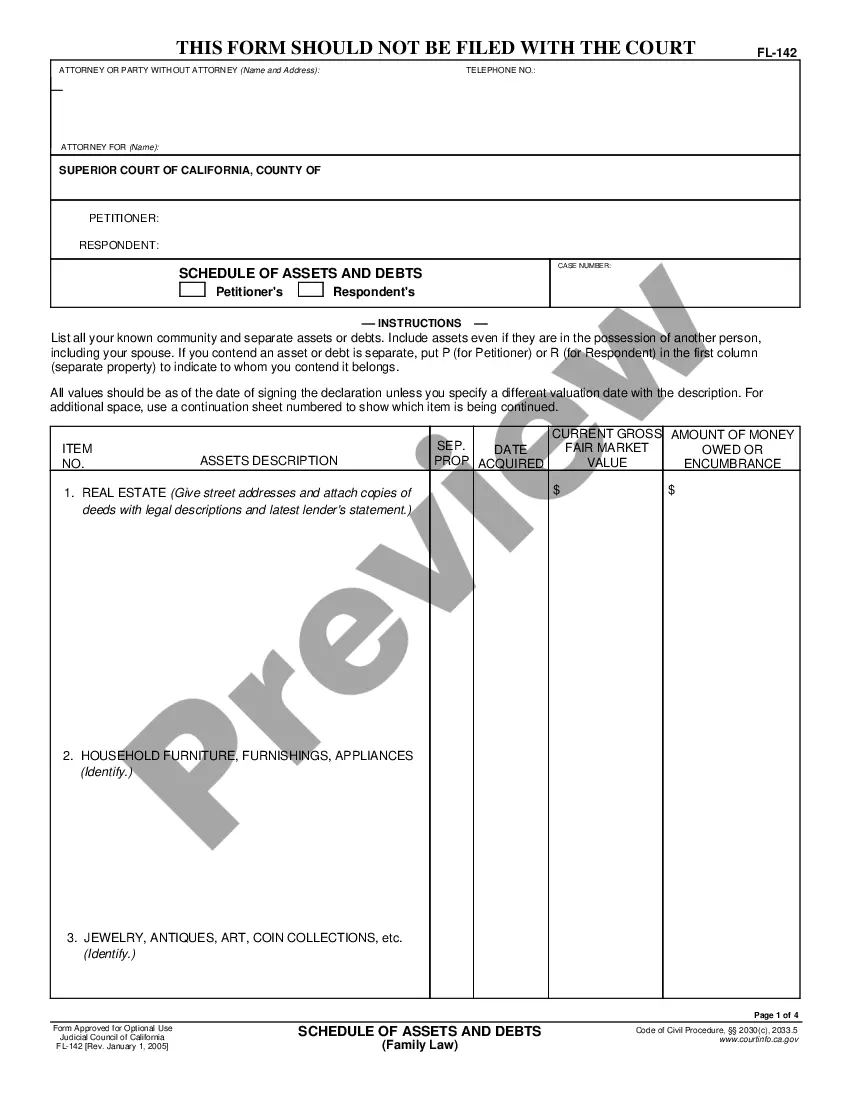

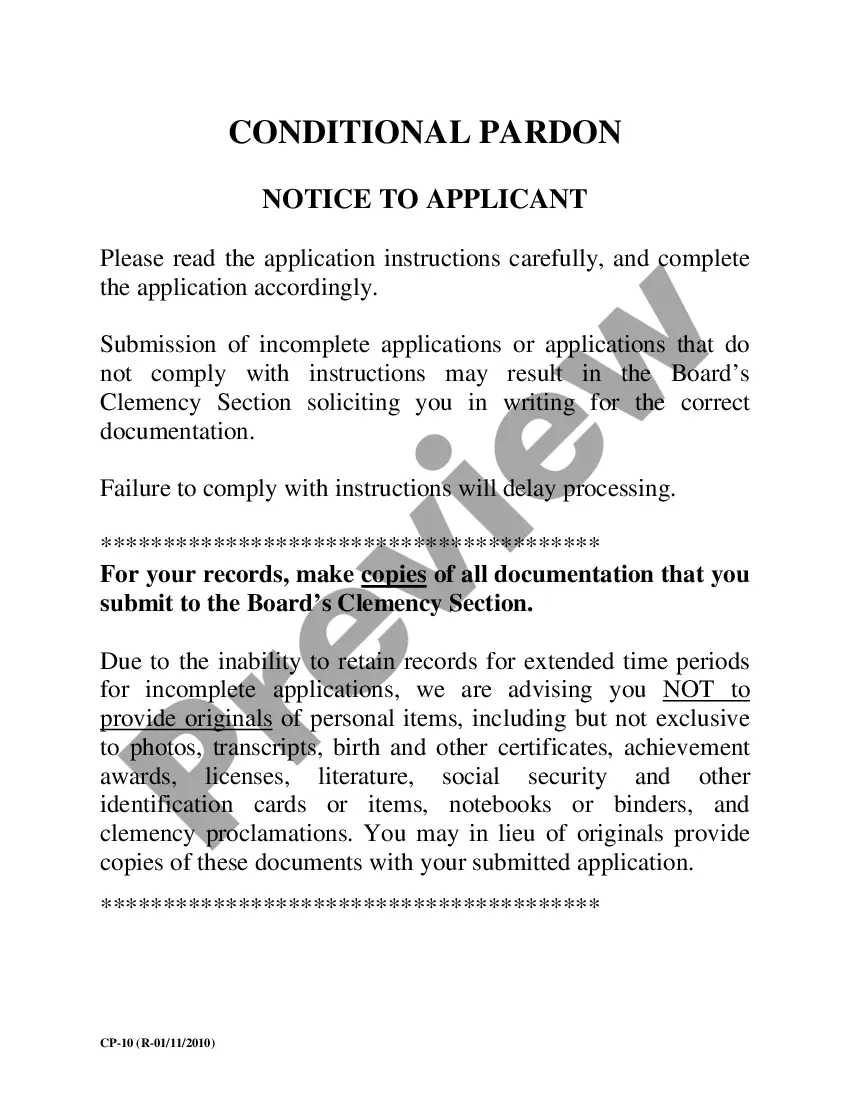

How to fill out Kings New York Certificate Of Designation, Preferences And Rights Of Series B Junior Cumulative Convertible Preference Stock Of Oryx Energy Company?

How much time does it typically take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, locating a Kings Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company meeting all regional requirements can be tiring, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific templates for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. Apart from the Kings Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation correctly.

Using the service is fairly straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the needed sample, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Kings Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Kings Certificate of designation, preferences and rights of Series B junior cumulative convertible preference stock of Oryx Energy Company.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!